Alternative reinsurance capital grows to new $100bn high: Aon

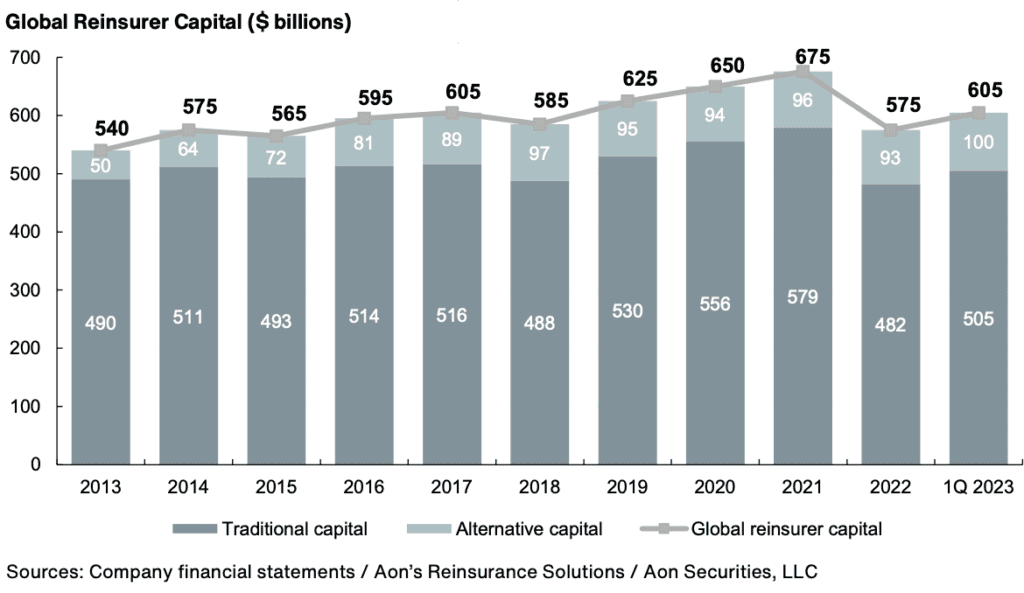

According to the latest data from insurance and reinsurance broker Aon, alternative reinsurance capital, largely deployed in insurance-linked securities (ILS) formats, has resumed growth and reached a new high of $100 billion.

The catastrophe bond market has been the main contributor to insurance-linked securities (ILS) market growth through the start of 2023, the broker explained.

With strong issuance, as Artemis has detailed on a transaction by transaction basis in our Deal Directory, growth in outstanding cat bonds is one factor that has helped overall ILS capital reach $100 billion as of March 31st 2023.

Overall global reinsurance capital reached $605 billion, with traditional reinsurance capital growing by 5% or $30 billion.

But, it is alternative reinsurance and ILS capital that grew the fastest, rising almost 8% from $93 billion at the end of 2022, to reach the new $100 billion level.

Aon said that a recovery in reinsurance capital is now in progress, after it dropped away to $575 billion last year.

The recovery in traditional reinsurance capital is seen as steady, while in alternative capital and ILS it has been a little faster, helped by the strong catastrophe bond market performance.

Given Aon’s figures are as of March 31st, we can anticipate the total rising well above the $100 billion once mid-year data is available from the broker, given the very strong cat bond issuance seen in the second-quarter and other ILS capital raises.

Joe Monaghan, Aon Reinsurance Solutions Global Growth Leader commented, “Reinsurer capital increased by five percent, or $30 billion, in the first quarter of 2023, as earnings were strong and catastrophe bond markets rebounded.

“While capacity has not returned to 2022 mid-year levels, reinsurers are showing a willingness to support current terms and grow in target areas.”