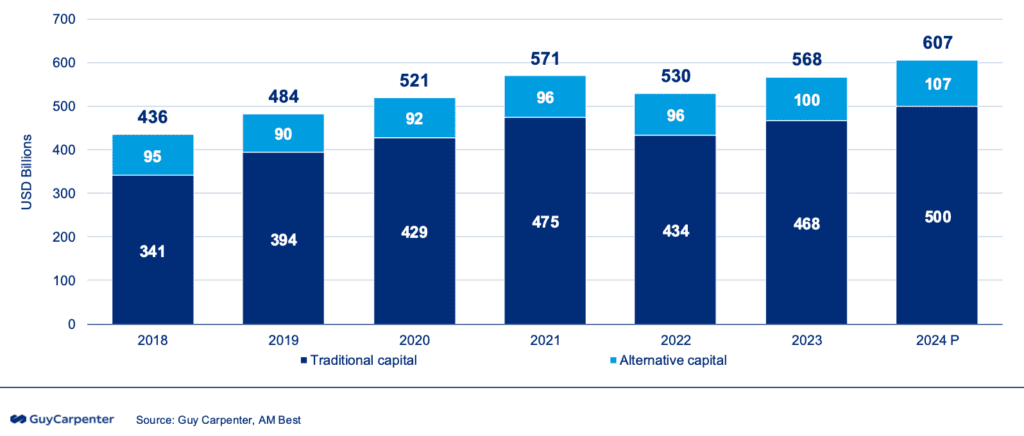

Alternative reinsurance capital grew 7% to $107bn in 2024: Guy Carpenter, AM Best

Dedicated reinsurance capital grew by 6.9% over the course of 2024, but alternative capital that largely represents the capacity deployed by insurance-linked securities (ILS) fund managers and through other ILS structures expanded slightly faster by 7% to reach $107 billion this year, according to Guy Carpenter and AM Best.

Previously, the reinsurance broker and the rating agency had made a projection that alternative and ILS capital in the reinsurance market would end the year at between $105 billion to as high as $110 billion.

Now, the pair have honed their projection and come to a conclusion that alternative capital in reinsurance will have reached $107 billion at the end of 2024, which represents 7% growth from the $100 billion level it stood at a year earlier.

It’s interesting to note that more than half of the alternative capital growth came from the catastrophe bond market in 2024.

By Artemis’ measure of 144A catastrophe bonds and the private cat bond issuances we have tracked, the outstanding market expanded by just over $4.5 billion in 2024, so making up more than half of the $7 billion growth in alternative capital that Guy Carpenter and AM Best have estimated.

The rest of the alternative capital expansion likely came through a mix of larger collateralized reinsurance sidecars, more industry-loss warranty (ILW) contracts and capital raises for collateralized reinsurance and retrocession focused ILS funds during this year.

Overall dedicated reinsurance capital is estimated to have reached $607 billion at the end of 2024 by Guy Carpenter and AM Best, which is a 6.9% increase on year-end 2023.

Traditional reinsurance capital grew from $468 billion a year ago to $500 billion by the end of this year, the pair believe, which represents 6.8% growth over the twelve months.

Alternative capital in reinsurance expanded the 7% from $100 billion at the end of 2023, to now reach $107 billion by the reinsurance broker and rating agency’s estimate.

Guy Carpenter highlighted profitability and retained earnings as key drivers of reinsurance sector capital growth, which goes for both traditional and alternative sides. Strong underwriting earnings in 2023 and 2024 are a key part of the capital growth.

But, on the alternative capital side, it seems clear (given the lack of traditional reinsurance start-ups) that more fresh capital has been raised into ILS markets than into traditional reinsurers this year, which helped the alternative capital share grow slightly faster, it seems.

As we always say, when it comes to these estimates of how much alternative capital is in the reinsurance market, the number itself is often less important than the growth being seen.

Recall that, Aon already had alternative capital in reinsurance pegged at $110 billion as of the middle of this year.

It’s worth noting these estimates do not tend to include the capital supplied by a range of institutional investors to structures dedicated to backing life and annuity reinsurance risks. Neither do they tend to include all casualty focused structures backed by investor funding.

As a result of which, depending on what you include, the total amount of capital in the reinsurance market that can be considered alternative, or from direct institutional investors supporting risk rather than equity balance-sheets, may well be higher.