Alternative capital to be bigger proportion of reinsurance: Flandro, Howden Tiger

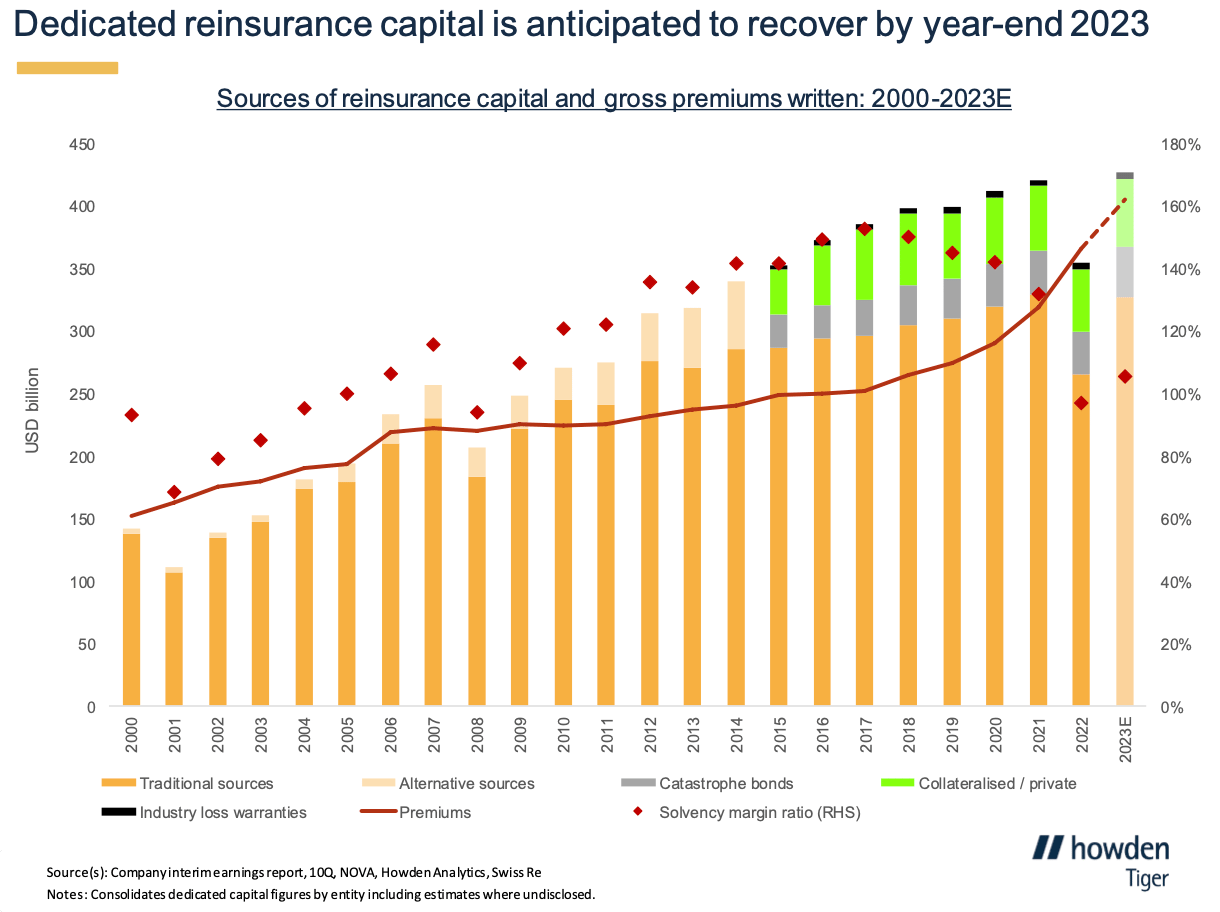

Alternative capital, so that backing catastrophe bonds, insurance-linked securities (ILS) and other collateralized reinsurance structures, is set to make up a bigger proportion of dedicated reinsurance capital, according to Howden Tiger’s David Flandro

Discussing the state of the reinsurance market after the mid-year and projecting ahead to reinsurance capital levels at year-end, David Flandro, at risk capital and reinsurance brokerage Howden Tiger, implies that the ILS market is growing faster than traditional reinsurance at this time.

Overall, the presentation given with Michelle To, Executive Director and Head of Business Intelligence at Howden Tiger, suggests a more optimistic outlook for the global reinsurance market, in the firm’s view.

If the remainder of the year proceeds as anticipated, with no undue surprises or capital impacting events, then Howden Tiger believes both traditional and alternative sides of the market can grow further.

The broking group explained in a statement that, “Capital is recovering from the low levels of 2022; global underwriting performance improved slightly in the first half of this year in spite of significant catastrophe losses and unfavourable experience in US personal lines. Outperformance was driven mainly by premium growth, the culmination of positive pricing trends.”

The upshot of the improved environment is that, “Reinsurers as a whole are set to exceed their cost of capital for the first time in this cycle.”

Flandro explained, “If you remember, 2022 was the year in which the insurance sector suffered its largest capital impairment since the financial crisis”, adding that first-half 2022 capital movements were “almost universally negative” for reinsurers.

“By contrast in the first half of 2023, most carriers experienced capital increases. This wasn’t just due to capital raising it was also due to realise gains on investment portfolios where previously there had been losses,” Flandro added.

He noted that, on the traditional reinsurer side, “There has been a marginal increase in capital here as well, driven by underwriting, by unrealized gains and then offset by dividends and share repurchases.

“Still, capital is slowly returning to its previous levels.”

Flandro then points to the chart (seen below) that specifically breaks out dedicated reinsurance capital and tries to estimate capital levels at year end, saying that the chart assumes a normal second-half.

“In this exhibit, you can see that alternative capital makes up a bigger proportion of dedicated capital than previously,” Flandro said.

Adding that, “Notably the solvency margin ratio, that’s capital divided by premiums, is around the same level as it was after the financial crisis. All of this should inform renewal discussions going into 1/1.”

“It’s clear that insurers and reinsurers can create economic value in this environment, if they use reinsurance effectively and allocate portfolios strategically. Capital levels are recovering and should have stabilised back to previous levels, if we have a normal second-half,” Flandro said.

Adding that, “A large portion of the second-half really depends on catastrophe losses in hurricane season, which are in turn a function of climate change and the El Nino cycle.”