Alternative capital rebounds to record $97bn (again): Aon

For now the third time, alternative capital levels in reinsurance, largely in insurance-linked securities (ILS) formats, have rebounded to their previous high-level of $97 billion, according to Aon.

That came against a shrinking of traditional reinsurance capital levels, as reinsurers were impacted by unrealised losses linked to their bonds, triggered by interest rate movements.

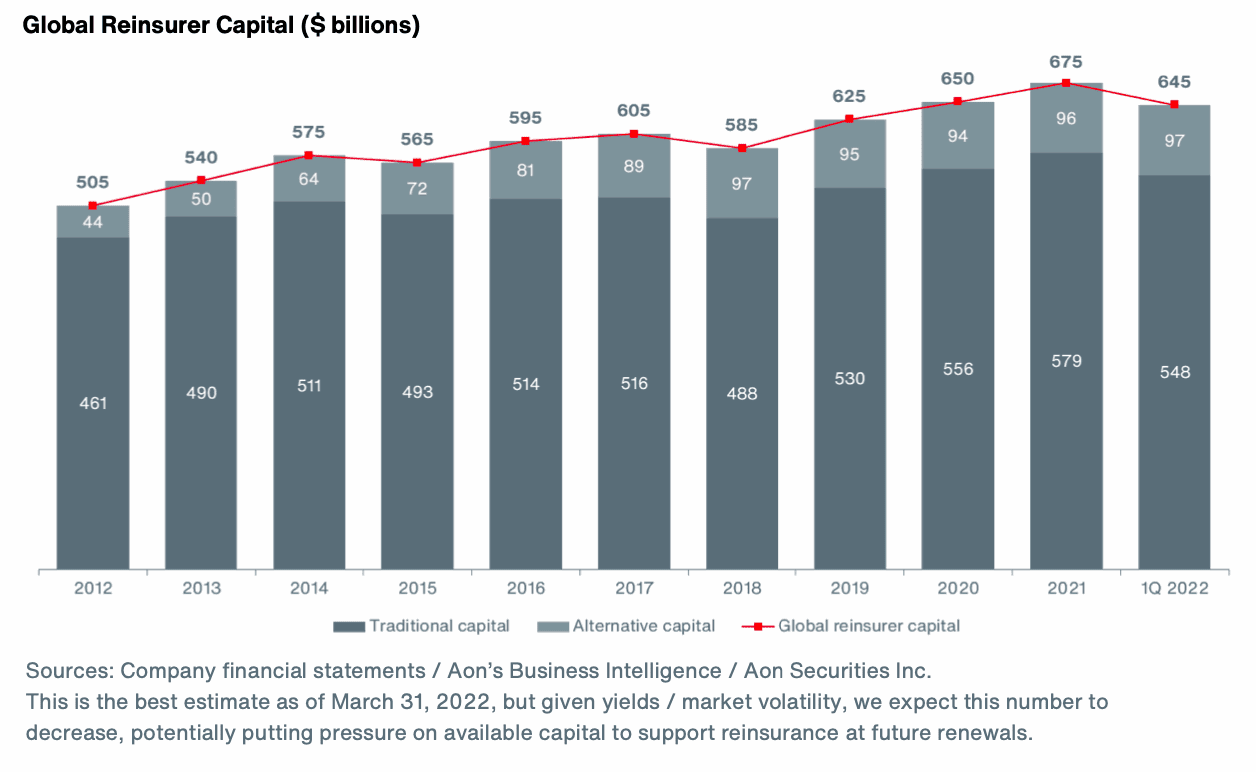

Overall, global reinsurance capital fell $30 billion to $645 billion as of March 31st 2022, according to Aon’s latest market data.

Traditional reinsurance capital declined by $31 billion over the quarter of record, to $548 billion at March 31st 2022, a roughly 5% drop, as the global volatility hit the investment side of the business.

Alternative, or ILS capital, grew by $1 billion, to end the first-quarter of 2022 back at its high of $97 billion again, as you can see in the chart below.

Aon last recorded ILS capital levels as reaching $97 billion back at the end of H1 2021, but the broker’s measure of alternative capital levels in reinsurance then shrank back to $96 billion by the end of last year.

Previously, as the chart above shows, ILS capital levels were reported as $97 billion by Aon at the end of 2018 as well.

The good news in this, is that ILS and alternative reinsurance capital levels have only fluctuated by $1 billion either way for now a full calendar year, as they were measured at $96 billion at the end of Q1 2021 as well.

Commenting on the data, Joe Monaghan, Aon Reinsurance Solutions Global Growth Leader explained, “Industry capital decreased in the first quarter of 2022, driven principally by unrealized losses on bonds, linked to rising interest rates.

“Total reinsurer capital stood at $645 billion at March 31, a $30 billion reduction relative to the end of 2021.

“Alternative capital, however, increased slightly to $97 billion, as investors recognized the value of diversification and increased margins amid more turbulent financial markets.”