Alternative capital hits record $103bn, delivers best performance ever: Aon

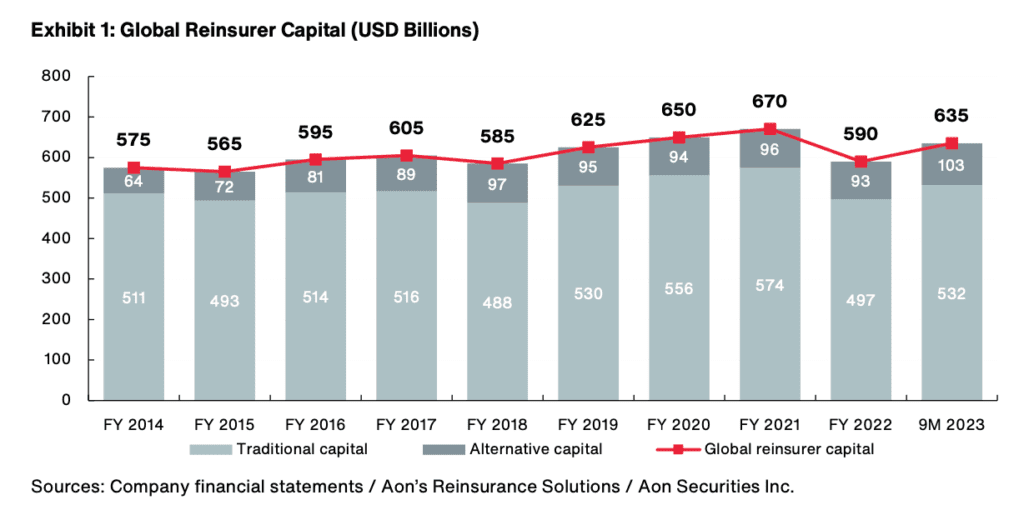

Alternative reinsurance capital, largely deployed in insurance-linked securities (ILS) formats, saw strong growth in the third-quarter of 2023 to end that period at a record high of $103 billion, while for the full-year ILS structures have delivered the best performance in their 20+ year history, broker Aon has said.

The last data from the insurance and reinsurance broker, up to the mid-year of 2023, had shown alternative reinsurance capital as flat at $100 billion.

Now, the latest analysis of global reinsurance capital from Aon’s Reinsurance Solutions division, shows that strong outright growth in the ILS and alternative capital space through the third-quarter of last year.

Over the first nine-months of 2023, traditional reinsurance capital grew by 7% to reach $532 billion, but alternative and ILS capital outpaced that, to grow by 11% over the period, reaching a new high of $103 billion at 9-month 2023.

Which works out as 8% overall growth for Aon’s estimate of global reinsurance capital in the period, which the broker said was driven by retained reinsurer earnings, recovering asset values for reinsurers and new inflows to the catastrophe bond market.

Aon noted that, in 2023, insurers and reinsurers have utilised alternative reinsurance capital “more than any year in the history of re/insurance market.”

With property reinsurance pricing reaching levels not seen for years, Aon notes that ceding insurers and reinsurers have been “grateful” for the opportunity to be able to “diversify their purchase with insurance-linked securities” in 2023.

The catastrophe bond market was the main source of insurance-linked securities (ILS) to have experienced growth, with more new alternative reinsurance capital flowing to cat bond assets than any other, it appears.

Aon counts the growth of the cat bond market as being $7 billion over the course of 2023, which is 21% by its measure of the cat bond deals it includes.

Artemis’ data also shows just over $7 billion of outright catastrophe bond market growth in 2023, although our year started from a higher baseline figure given the inclusion of private cat bond deals.

Joe Monaghan, Global Growth Leader at Aon’s Reinsurance Solutions, is positive on the outlook, saying, “Demand for property catastrophe reinsurance remains strong at the start of 2024, supported by inflation and exposure trends.”

While, positively for the cat bond market and alternative capital provides, he also highlighted that, “As capacity continues to build, there will be opportunities for insurers to buy additional limit at the top of programs, and for reinsurers to work with brokers and clients to share the burden of secondary perils more equitably.”