Almost nowhere in US safe from severe weather in 2023 as losses surpass $26bn: BMS

Insurance industry losses from severe weather in the United States are estimated to have surpassed $26 billion year-to-date by broker BMS, with its senior meteorologist Andrew Siffert noting that “almost no place has been safe from severe weather.”

While the number of local storm reports has been about normal this year so far, Siffert says that losses are elevated for a range of reasons, not least inflationary effects that raise costs of claims.

But location also matters, a lot when it comes to weather events, which Siffert notes will be a contributing factor to the high levels of insurance market losses seen to-date.

“There was a high occurrence of severe weather during the spring leading to the likely correlation to higher loss levels. States like Texas have taken a beating this year in particular and during the month of June, which is unusual. The high levels of loss from severe weather is not just confined to the “bread basket” states: California and Florida are also experiencing high levels of unusually severe weather this season,” Siffert explained.

Adding that, “According to BMS Re and our analysis between this year and last year, almost no place has been safe from severe weather.

“This will no doubt be an area of contention as the insurance industry gears up for the all-important January 1 renewals.”

With primary insurance carriers set to retain much more of their losses in 2023, as their reinsurance attachments have largely risen, while terms of their reinsurance coverage will also have changed and result in greater loss retention, the severe weather losses may become evident in insurers second-quarter and half-year results over the next few weeks.

Siffert also noted that Texas has seen a large share of losses, amounting to $7.2 billion year-to-date and that severe weather has continued to impact the state in June, a month where it more typically slows there.

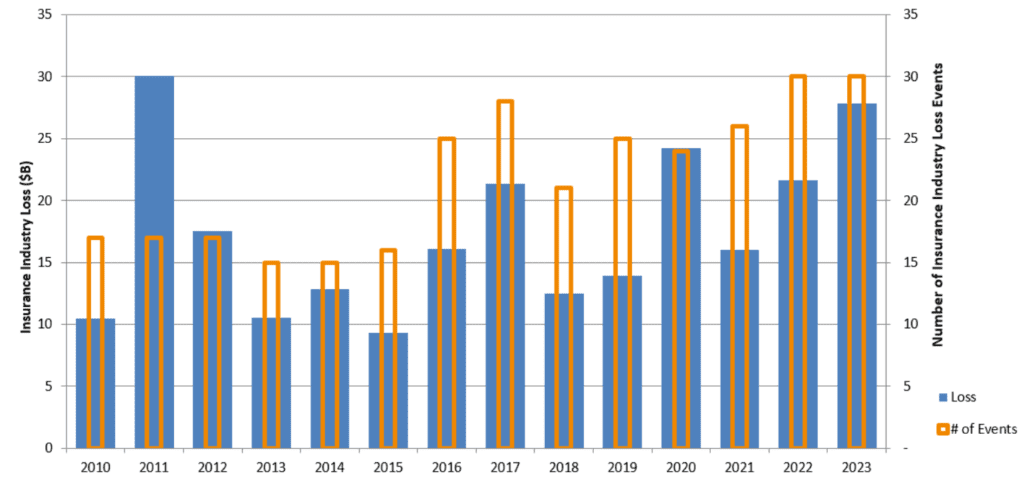

As the chart above from Siffert’s latest piece shows, losses from severe weather for the first-half of 2023 still fall behind 2011’s record, which were largely driven by the significant tornado events that spring.

But 2023 is running second and this will have an effect on carriers’ desire for reinsurance cover as well, which could help in sustaining demand running into 2024.