Allstate adds ~$600m to top of Florida tower with help of cat bonds

In completing its June 1st reinsurance renewal for 2022, US primary insurance giant Allstate has extended the top of its Florida excess-of-loss catastrophe reinsurance tower by almost $600 million.

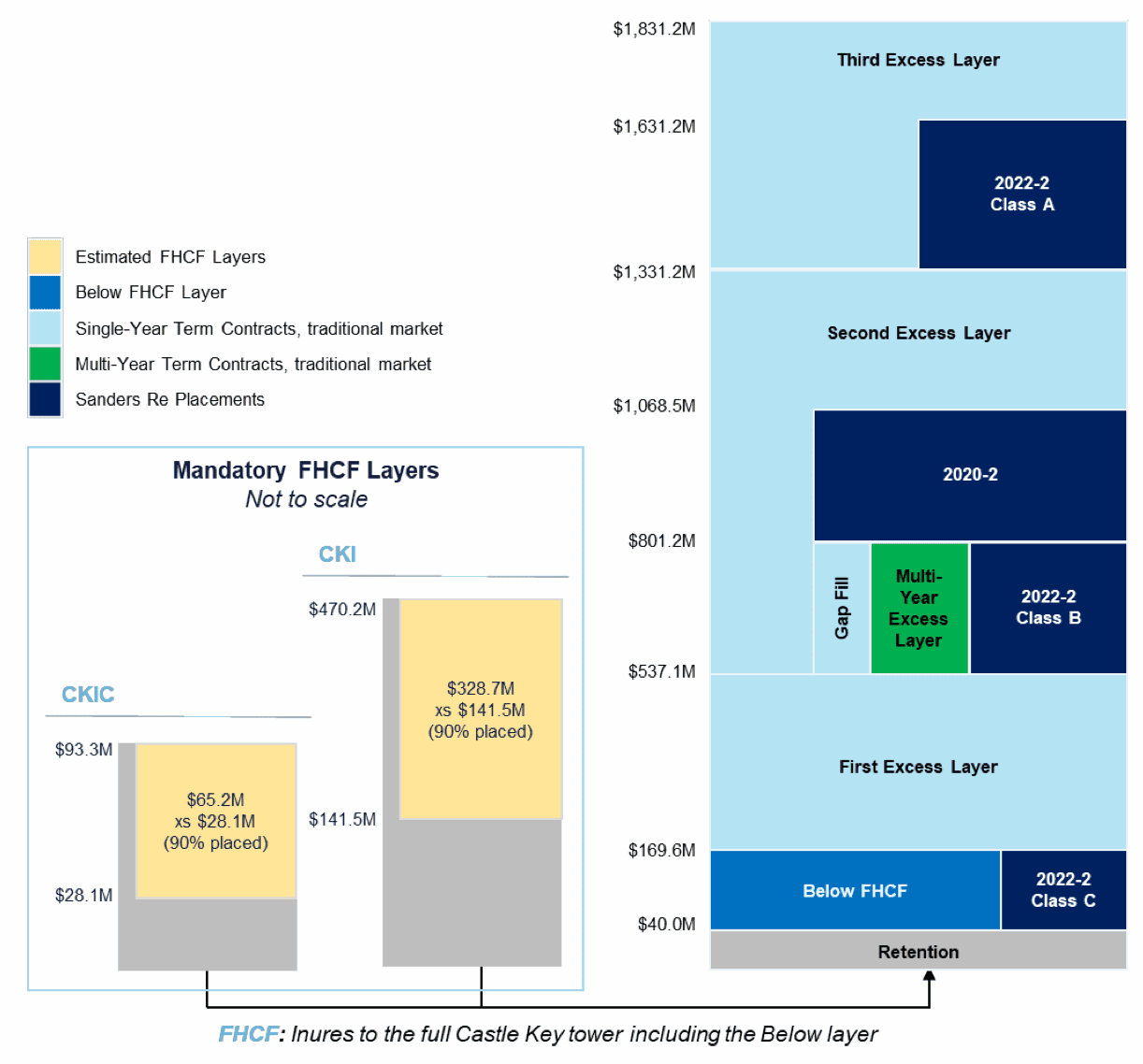

Allstate’s Florida Excess Catastrophe Reinsurance Program covers its subsidiaries that underwrite in the state, including Castle Key Insurance Company, Castle Key Indemnity Company and other affiliated entities.

The protection provided is all against losses to Allstate’s personal lines property book in Florida and the catastrophe reinsurance tower is a mix of traditional and catastrophe bond coverage.

At the June 1st 2022 reinsurance renewal, Allstate has lifted the top of its Florida catastrophe reinsurance tower by almost $600 million, with its recent Sanders Re III catastrophe bond providing a significant uplift and filling out some of the towers layers for the company.

That new cat bond has provided $287.5 million of valuable reinsurance coverage to Allstate, especially as it spans multiple layers of the reinsurance tower, including filling out the bottom below the Florida Hurricane Catastrophe Fund layer for the insurer.

Allstate’s renewed Florida catastrophe reinsurance tower now provides coverage up to $1.8312 billion of losses for the carrier, roughly $592 million more than the prior year’s $1.2391 billion tower.

Of that $1.8 billion plus Florida reinsurance tower, Allstate’s catastrophe bonds now provide $487.5 million of the limit, given its $200 million Sanders Re II 2020-2 cat bond is still in-force.

From the traditional market, which likely also includes some fronted or collateralized ILS backed reinsurance capacity, Allstate has $1.3 billion of placed limit this year, up from $939.1 million in the prior year.

There is a below FHCF layer providing 71.1% of $126.9 million in limits in excess of a $40 million retention, that sits alongside the $37.5 million riskiest layer of Allstate’s newest cat bond.

Three excess layers above provide combined limit of $1.14 billion, while a multi-year layer above provides $264.1 million in limits in excess of a $169.6 million retention, is 10% placed, and sits next to the 2022-2 Class B catastrophe bond notes.

Finally, a gap fill layer provides $50 million in limits and also sits next to the 2022-2 Class B cat bond notes.

FHCF coverage is larger than the prior year, in-line with the growth of the tower and Allstate has continued to opt for 90% participation.

View details of every catastrophe bond ever sponsored by Allstate here.