Allstate adds $325m of Jan 2024 catastrophe losses, may raise agg cat bond risk

US primary insurer Allstate has reported January catastrophe losses of $325 million, with the majority of this coming from just two events, suggesting the potential for further loss aggregation under its aggregate reinsurance cover from its catastrophe bonds.

When we last reported on Allstate’s Q4 2023 catastrophe losses, the insurer had added a lighter quarterly total than it had in earlier quarters last year.

Allstate had by then reported just under $3.95 billion of pre-tax catastrophe losses across its business since April 1st of last year, which is the annual risk period that aligns with the annual aggregate cover for the firm’s in-force Sanders Re catastrophe bond backed aggregate reinsurance.

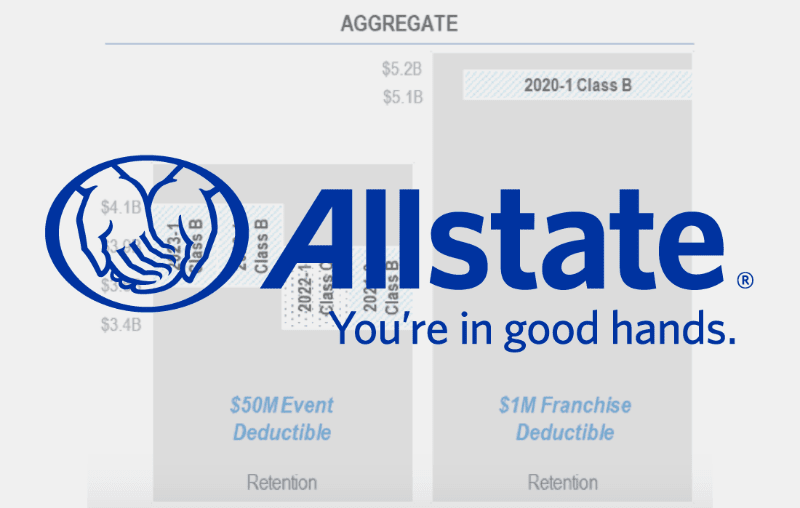

However, as we also reported, the actual qualifying loss tally under the catastrophe bonds differs that that reported pre-tax cat loss total, given the different per-event and franchise deductibles applied to the Sanders Re cat bonds that provide Allstate aggregate protection.

In that last report, we revealed that sources had told us that more than 80% of the retention for the one remaining aggregate cat bond that features a $1 million franchise deductible had been eroded, while the Sanders Re catastrophe bonds that provide aggregate reinsurance to Allstate but feature a $50 million per-event deductible had seen their retentions eroded by between 53% and 56%.

So, with $325 million of additional pre-tax catastrophe losses from the month of January 2024, further erosion of the retention seems likely, particularly for the most at-risk notes with the $1 million franchise deductible.

As a reminder, the one remaining aggregate cat bond tranche with a $1 million franchise deductible is the $100 million Sanders Re II Ltd. (Series 2020-1) Class B tranche of notes.

These notes attach at $5.1 billion of aggregated qualifying losses and after December the aggregated catastrophe loss figure reported applicable to these notes reached $4.2 billion, so some 82% of the retention beneath these cat bond notes had been eroded.

There are also four outstanding Sanders Re aggregate cat bond tranches with the $50 million event deductible and the qualifying catastrophe loss total, to the end of 2023, for those four cat bonds stood at $1.9 billion at the end of 2023.

Given 80% of the $325 million of January 2024 catastrophe losses came from two events, it seems almost certain there will have been an increase to both the franchise deductible and event deductible structured aggregate Sanders Re cat bonds qualifying loss totals.

The one factor that could minimise the increased qualifying loss total for these cat bonds is the fact Allstate also reported prior period favourable development that has reduced its reported pre-tax cat losses down from the $325 million to $276 million or $218 million, after-tax.

If that favourable development applies to previous months catastrophe losses that were relevant to the aggregate cat bonds, it could offset any January increase somewhat.

Interestingly, all four the exposed aggregate Sanders Re cat bonds that feature the $50 million event deductible actually saw their secondary market prices increase slightly, in just the last week. So it is possible that favourable development was relevant to those cat bonds, or this could just have been a slight market correction.

There is still February and March 2024 to report, before the final annual aggregate risk period catastrophe loss total will be known for the five cat bond tranches that are exposed to the aggregation of cat losses across the current term, so whether any losses of principal are faced will depend on how active a period for severe weather or other catastrophes the next weeks are for Allstate.

Details of catastrophe bonds facing losses, deemed at risk, or already paid out, can be found in our cat bond losses Deal Directory here.