Airmic publishes 2023 report on insurance market conditions

Trade body Airmic, which regularly conducts polls among its members, has released the “Pulse survey report: Insurance market conditions” for January 2023.

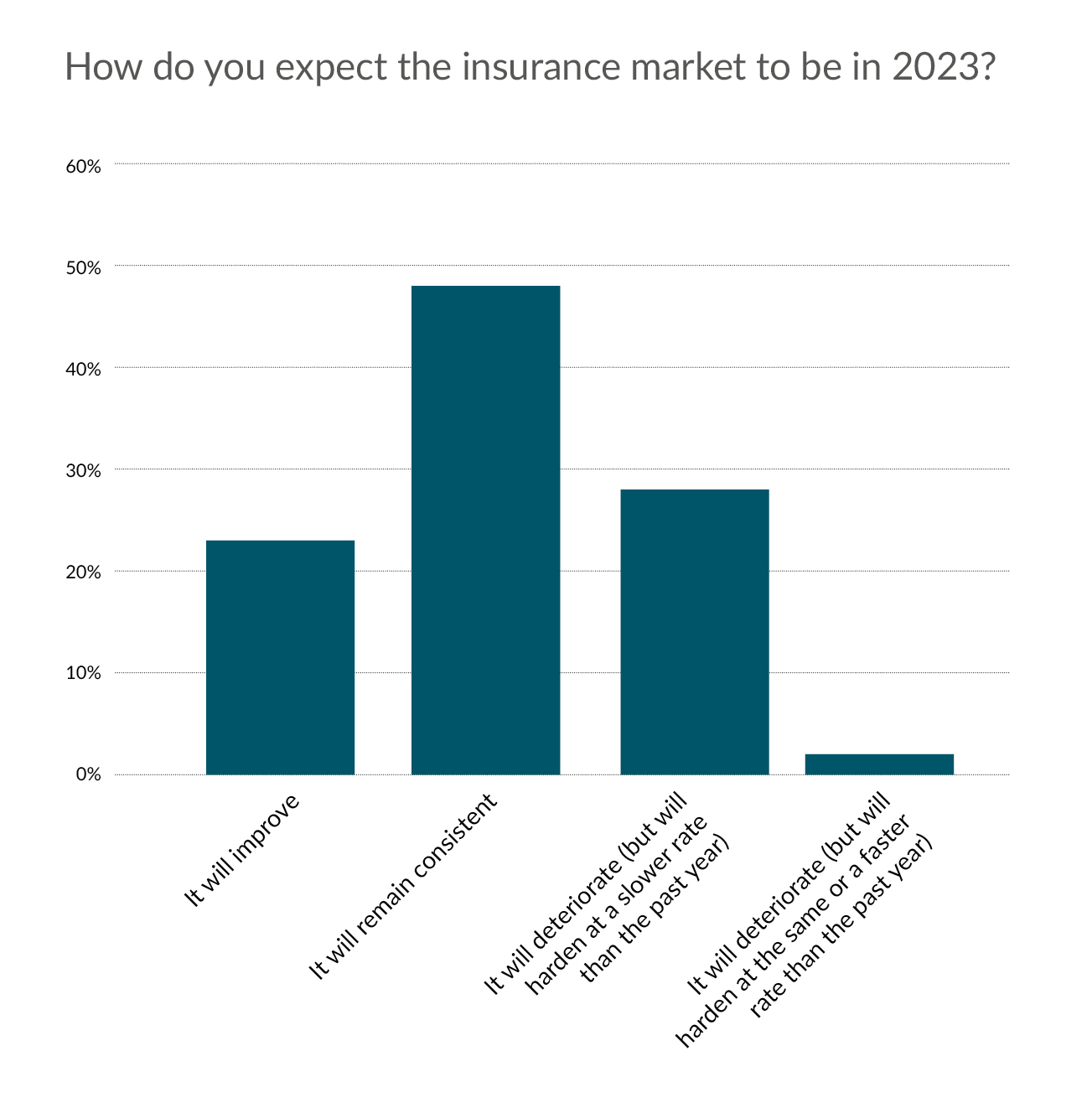

Conducted last December, the latest survey found that 30% of respondents are of the view that insurance market conditions will deteriorate this year. Nearly half believe there won’t be much change from the current state of affairs.

Airmic wrote in the report: “There are signs of ‘green shoots’ where the pace of the hardening of the insurance market is slowing. The trend since 2021 is that fewer respondents are saying that they find themselves in a hard market.”

Source: Airmic

Here are the main points, as listed by the trade body: members perceive the insurance market as softening, but a significant number believe market conditions will continue to deteriorate; there is a slowing of the pace of increase in directors’ and officers’ liability insurance premiums; high costs and limited cover persist for cyber insureds; respondents would like to see greater willingness from the market to engage with members on designing policy coverage; and there being other challenges like global instability, market volatility, and the need for better understanding and support for ESG (environmental, social, and governance) initiatives.

Airmic member Keith Jury was cited as saying: “After a period of large premium increases together with restrictions in cover, it is pleasing to see some stabilisation in certain areas.

“With global economic and political headwinds, businesses are looking for value in every dollar they spend. The value of insurance is being discussed in the boardroom. We need to work as an industry to deliver that value by meaningful cover at a fair and sustainable price together with expert, analytics, advice, and knowledge.”

The report also noted the need for improvement in the communication that insurers and brokers have with their customers.

Airmic members can access the full report here.