Affordable health insurance: Everything you need to know

Those without company-sponsored health insurance, however, need to shop around for their own plan and pay for the full cost of coverage. This begs the question – where can they find the best affordable health insurance policies?

In this article, Insurance Business discusses the different options available for those searching for affordable health insurance. This is part of our client education series and we encourage insurance agents and brokers to share this article with customers to guide them in finding the best health plans that suit their budget.

The latest analysis by the national health non-profit Kaiser Family Foundation (KFF) pegged the average monthly cost of health insurance premiums at $456. The amount a person pays, however, can be lower or significantly higher, depending on where one lives.

New Hampshire residents, for instance, pay about $323 per person monthly for health insurance – the cheapest based on KFF’s latest benchmark premium. The amount is more than twice lower than Vermont’s average at $841, which is the most expensive monthly premium among all states.

But even if employer-sponsored coverage is not an option, there are several ways for many Americans to avail of affordable health insurance plans. Here are some of them:

1. Medicaid

Considered the most affordable option, this government-funded health program imposes certain eligibility criteria, which vary depending on the state they live in. The law requires states to provide Medicaid assistance to these groups:

For those who fall into the above categories, they may avail of free or low-cost health care if they meet the following eligibility requirements.

They are US citizens or legal aliens in good standing with immigration.

They must be a resident of the state where they are applying for coverage.

They must not currently be an inmate at an institution, although they can apply for coverage upon their release.

Currently, there are 38 states that allow income to be the sole basis of qualification. The cut-off is usually 133% of the federal poverty level (FPL), which is about $17,774 per person. A bigger household means a higher income limit. The income cut-off is the same for almost all 38 states, except Alaska and Hawaii.

The table below details the Medicaid cut-off limit for each household size.

The remaining 12 states do not offer income-only Medicaid qualification. These are:

Alabama

Florida

Georgia

Kansas

Mississippi

North Carolina

South Carolina

South Dakota

Tennessee

Texas

Wisconsin

Wyoming

In these states, the governments impose additional eligibility criteria, including child guardianship or being above 65-years old.

Medicaid plan holders have access to free emergency care, family planning, and child healthcare. Depending on their state and income levels, they may also have copays for doctor visits, inpatient hospital care, and prescription medication.

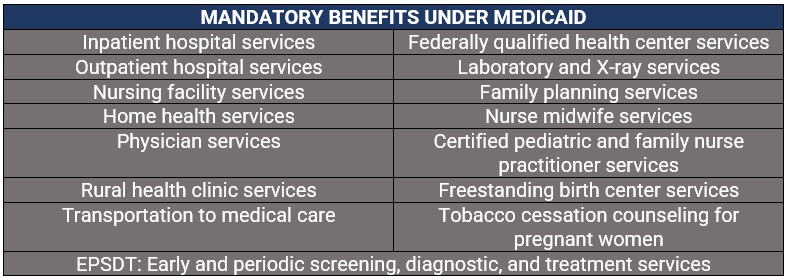

The tables below outline the mandatory benefits that federal law requires each state to provide, along with the list of optional benefits.

2. Medicare

US citizens and permanent residents aged 65 and older can avail of affordable health insurance through another government-funded program, called Medicare. The program is also accessible to younger people with certain disabilities and those with end-stage renal disease (ESRD) or permanent kidney failure that requires dialysis or a transplant.

Medicare consists of four parts:

Medicare Part A (hospital insurance): This covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Medicare Part B (medical insurance): This pays out for certain doctors’ services, outpatient care, medical supplies, and preventive services.

Medicare Part C: Now called the Medicare Advantage Plan, this combines all benefits and services under Parts A and B in one plan.

Medicare Part D (prescription drug coverage): This helps cover the cost of prescription medication, including most recommended shots or vaccines.

The first two parts are offered through the government, while the last two can be purchased through private insurance providers.

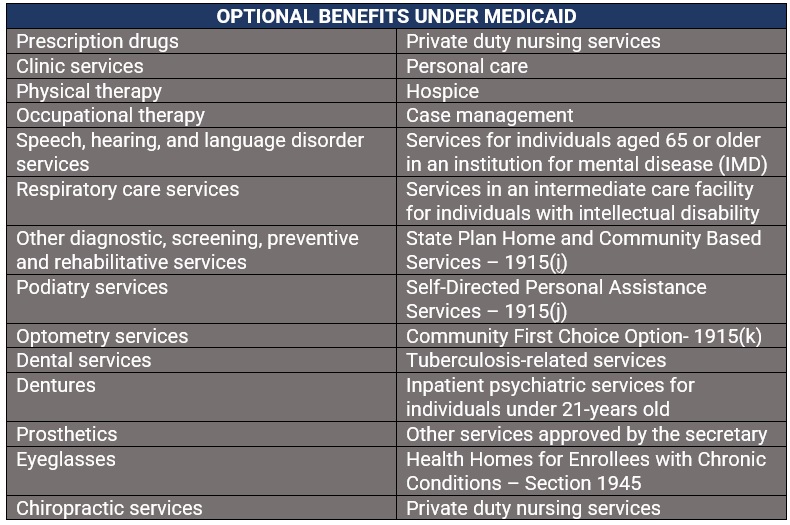

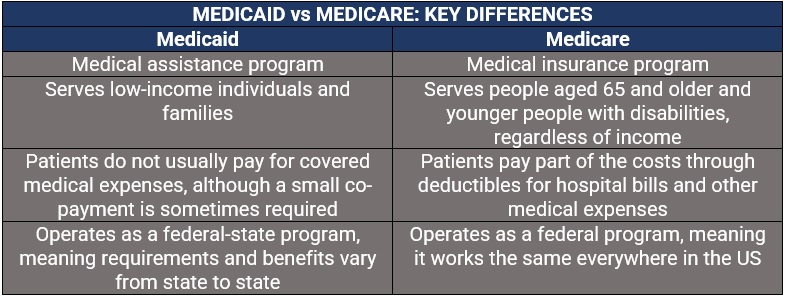

Because of their similar-sounding names, people are often confused about what Medicaid and Medicare covers. Another factor that may add to the confusion is that in certain situations, people may be able to apply for both.

To help provide some clarity, Insurance Business summarized the key differences between these two government-administered programs in the table below.

3. Health insurance marketplace

For many low-income Americans, their state’s health insurance marketplace is another good place to start searching for a policy that fits their needs. Here, they can compare plans for coverage and affordability, and get answers to any questions or clarifications they may have about healthcare insurance. This is also where they can find out if they qualify for Medicaid, tax credits, or lower premiums.

Parents can enroll their kids in the Children’s Health Insurance Program (CHIP) through the marketplace as well. This program provides low-cost health coverage to children in families whose income is too high to qualify for Medicaid, but not enough to afford private insurance. In some states, CHIP also offers coverage to pregnant women.

Individuals can sign up for a health insurance plan during an open enrollment period, which typically runs from November 1 through January 15. But even if this period has ended, they may still be able to secure coverage if they have experienced a qualifying life event, including getting married, having a baby, and losing their previous insurance. Coverage begins about two to six weeks after enrollment.

4. Short-term health insurance plans

Short-term health insurance plans are designed to fill temporary coverage gaps and provide protection for up to one year, so the benefits are not as comprehensive as policies in the marketplace. Short-term plans can also be canceled anytime without the need to pay penalty fees.

Because these are not regulated by the government, the benefits, coverage limits, exclusions, and premiums vary widely, depending on the health insurance provider. Coverage typically includes physician visits, and emergency and preventative care. Some plans may also cover prescription drugs. Pre-existing medical conditions, however, are not covered.

Applicants may also be required to complete a medical questionnaire to assist the insurance carrier in determining if they should be approved for affordable health insurance coverage.

5. Farm Bureau health plans

Some states offer health plans through the local Farm Bureau as an alternative to health coverage that complies with the Affordable Health Care Act (ACA). These states include:

Tennessee

Iowa

Kansas

Indiana

South Dakota

The affordable health insurance plans offered by these local bureaus tend to be less expensive than ACA-compliant policies. They are also exempted from state insurance laws as states do not consider Farm Bureau plans to be health insurance.

Enrollment is open year-round to Farm Bureau members. However, membership does not require active engagement in the agricultural sector and is instead based on the dues they pay. One important thing to note is that membership dues do not cover the cost of the health benefits, which are paid separately.

Farm Bureau health plans also require medical underwriting, meaning applicants can be rejected due to their medical history, unlike in ACA-compliant coverage. They likewise impose waiting periods for pre-existing conditions.

Since these plans are not considered health insurance, they are not mandated to comply with state or federal health insurance regulations. This means coverage does not have to include the 10 essential health benefits under ACA and maximum out-of-pocket limits can be much higher.

According to HealthCare.gov, insurance companies can only account for five factors when determining premiums under the healthcare law. These are:

Age: Premiums can be up to three times higher for older people than for younger ones.

Location: Differences in competition, state, local regulations, and cost of living also impact health insurance rates.

Tobacco use: Insurers can charge tobacco users up to 50% more than those who do not smoke.

Individual vs. family enrollment: Insurance providers can also charge more for a plan that also covers a spouse and dependents.

Plan category: The different plan categories – Bronze, Silver, Gold, and Platinum – also have an effect on premium prices.

The government website noted that states can limit how much impact these factors have on insurance rates but prohibited them from using medical history and gender in calculating premiums.

“Insurance companies can’t charge women and men different prices for the same plan,” HealthCare.gov explained. “They also can’t take your current health or medical history into account. All health plans must cover treatment for pre-existing conditions from the day coverage starts.”

Although the high cost of health plans can leave one feeling ill, there are several practical steps that people can take to save on health insurance costs. Here are some of them:

1. Consider your health needs.

Because healthcare costs vary depending on a person’s individual circumstances, it is often difficult to determine which policies offer the greatest savings – and sometimes premium prices are not the biggest factor. Choosing a low premium, high deductible plan, for instance, can cost the policyholder more if they tend to visit the doctor more often. In this type of situation, it may be ideal to pay higher premiums as this would also mean fewer out-of-pocket costs.

2. Avail of tax-advantaged plans.

Those looking for affordable health insurance can avail of tax-advantaged plans that can help them cut healthcare costs. These include:

Health savings account (HSA): Available to policyholders with high-deductible health plans (HDHPs), HSAs allow them to contribute funds to the account and withdraw them tax-free for qualified medical costs, including deductibles, copayments, and coinsurance.

Health reimbursement arrangement (HRA): As this is set up and funded by employers, employees will not be able to contribute to the funds, but they can withdraw from their accounts for qualified medical expenses.

Flexible spending account (FSA): Available from employers, FSAs allow workers to contribute pre-tax funds to the account and withdraw money tax-free for qualified medical costs.

HRAs and FSAs do not require a high-deductible health plan, but the funds must be used by the end of each year. These accounts are also not portable, meaning if the employee leaves their company, they also lose the account.

3. Get affordable health insurance by using a premium tax credit subsidy.

Those who have applied through the health insurance marketplace may have their rates reduced or even pay nothing for their plans if they qualify for ACA’s premium tax subsidy. Plan holders whose household income is between 100% and 400% of the federal poverty level (FDL) are eligible for subsidies on their health policies.

The subsidies work with the marketplace directly sending the credits to the insurer who will then apply these to the plan’s monthly premiums to reduce the policyholder’s out-of-pocket expenses. Plan holders must file a tax return at the end of the year to reconcile their income with the tax credit they received. In some cases, they may have to pay back some of the credit that decreased their costs if they earned more income than expected when they first applied for the health plan.

4. Make sure you understand your health plans coverage rules.

By doing so, policyholders can avoid mistakes that will cost them money later. Some managed health plans, for example, cover the costs if the plan holder chooses an in-network doctor, but pay more or the full cost if they visit an out-of-network medical professional.

5. Review your health insurance plan annually.

In preparation for open enrollment – the time of the year when they can change company-sponsored or marketplace health coverage – policyholders should reassess their health needs to see if their current policies still suit them or if they need additional coverage. By reviewing their policies every year, they may be able to secure the best affordable health insurance plan possible. Need help? Check out the ten largest health insurance providers in the USA.

What about you? Do you have any tips on how to get the most affordable health insurance plan possible that you want to share? Hit us up in the comments section below.