"A lot of people will be consolidated, we aren’t going to be one of them"

“A lot of people will be consolidated, we aren’t going to be one of them” | Insurance Business America

Insurance News

“A lot of people will be consolidated, we aren’t going to be one of them”

Brown & Brown CEO on firm’s acquisition strategy

Insurance News

By

Mia Wallace

“There’s going to be an enormous amount of consolidation in the next three-to-five-to-seven years, not only here [in the UK] but in the United States and Continental Europe. Some of it will work, some of it won’t. A lot of people will be consolidated, we aren’t going to be one of them.”

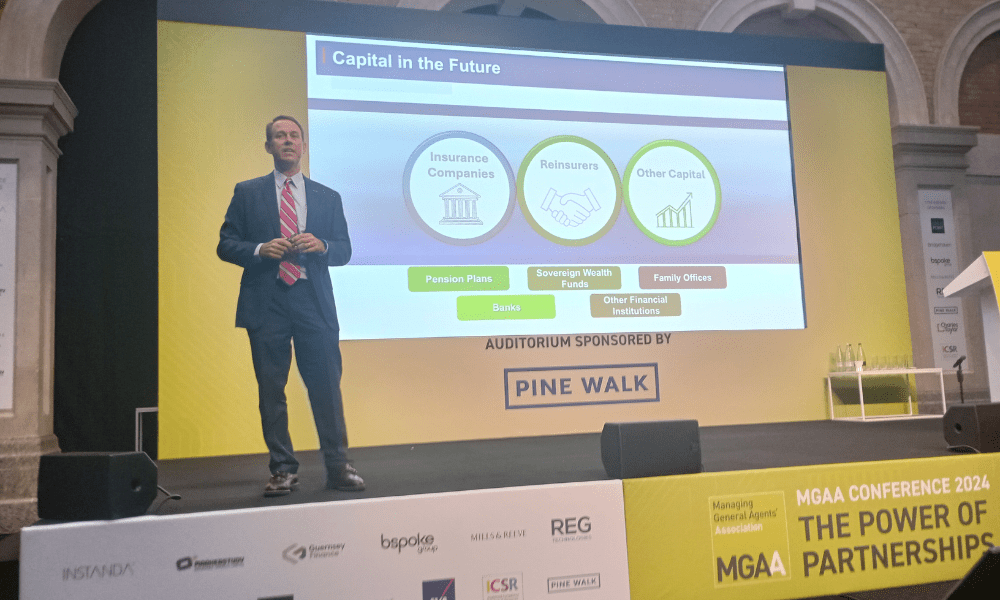

In a keynote address at the MGAA Conference 2024, J Powell Brown (pictured), president & CEO of Brown & Brown, delivered his verdict on consolidation in the insurance market and shared insights into his team’s M&A strategy. From conversations across the UK market, he said, he’s heard the sentiment echoed that there’s going to be 15 global brokers left at the end of consolidation efforts, with some people feeling the pressure to affiliate with those firms or risk getting left behind.

“Do I think that is the case? No, I don’t think that’s the case, I think it’s going to be much broader than that,” he said. “There’ll continue to be consolidation in our industry… but consolidation has been going on forever.” Contextualising his comments, Brown pointed to the largest global brokers in the world in 1972, noting that only one of those businesses now exists today – Marsh.

How M&A activity has evolved

In the United States (US), he said, consolidation really started making its mark in the banks in the late 90s, a trend that persisted through to the early 2000s when private equity started to become more actively involved. Today, in the US, there are between 35-40 private equity firms actively involved in investing in the insurance space and he doesn’t expect that to meaningfully change. Insurance is a great business, he said, and as long as people continue to grow there’s a play for investors in terms of low expense ratios and multiple expansion opportunities.

In the US, 13 of the top 20 brokers are backed by private equity, which is why Brown believes the insurance industry in the US, the UK and Continental Europe will continue to be consolidated. What sets Brown & Brown apart from this trend, he said, is that it is first and foremost a purchaser of businesses that fit culturally and make sense financially.

A culture-first approach to M&A and organic growth

“I think a lot about culture and passion,” he said. “[…] Let’s talk a little bit about us, our culture and how we think about the business because we’ve been doing it for 85 years… So, what differentiates us? You might have a perception of Brown & Brown because we’re an American public company and that may or may not be true, but I’m going to try and demystify that.”

The first defining factor is that the business has teammates rather than employees, he said. Brown shared that when he started his insurance career in 1990, he vividly remembers being introduced by a senior leader of the underwriting company he had joined as an employee. It made him feel awful, he said, and he decided on that day that any company he had influence over would have a ‘teammate’ culture, where, “we win together, we lose together.”

As somebody who enjoys football, he’s a strong believer in having the best teammates on the field all the time, supported not by managers but instead by leaders. Leaders are willing to take risks, he said, and to step forward in order to deliver for customers, carrier partners and their own teammates. Underpinning the success of Brown & Brown’s culture-first strategy is its internal ownership structure. As a publicly traded company, its teammates own 22% of the company, making it the largest shareholder collective of its type in the US.

Brown & Brown – a unique growth story

Each of these facets is key to how Brown & Brown differentiates itself and, in turn, its acquisition strategy. Having a different kind of mentality means the business isn’t run from quarter-to-quarter, he said, and growth isn’t thought about in a matter of months, but rather years. That long-term commitment to growing profitably and reinvesting that profit in the business is reflected in how the group likes to set goals.

Brown’s grandfather started the firm in 1939 in Daytona Beach, Florida and his father bought the business in 1959, staying on as CEO for 50 years and growing it to US$1 billion in revenue. Last year, Brown & Brown crossed an intermediate goal, reaching $4 billion in revenue and has since set a new goal to hit the $8 billion mark. “We don’t have a stated timeline,” he said, “it could be nine years, could be five years, or anywhere in between. It took us seven years to go from $1 billion to $2 billion, and five years to go from $2 billion to $4 billion which is a testament to all our 16,000 great teammates.”

Organic growth is at the heart of everything Brown & Brown does, he said, but it is careful not to fall into the trap of growth for growth’s sake. As the business continues to grow organically, it will continue to strategically reinvest in order to maintain long-term profitability. “We don’t budget acquisitions, acquisitions come when people would like to sell their business for a number of different reasons. And we are always looking.”

Keep up with the latest news and events

Join our mailing list, it’s free!