5-Star MGAs 2022

Jump to winners | Jump to methodology

Mining the gap

“Traditionally, the MGA space is like an accordion,” HDI Global Specialty SE general manager and chief agent Derek Spafford recently told Insurance Business Canada. “As insurers restrict capacity, risks flood to the MGA space.”

Meanwhile, Brett Graham, president of Agile Underwriting Solutions, one of this year’s 5-Star MGAs, explains the situation directly, from the inside out. “If you’re not growing in the MGA space, there’s something wrong,” he says.

With hard market conditions in commercial lines, some primary carriers have unloaded difficult or unprofitable lines of business. MGAs have embraced this deluge of new business and leveraged their finely tuned niche underwriting skills to turn a profit, while offering brokers more opportunities.

“There’s been a huge space for MGAs with strong technical underwriting expertise to help brokers who maybe had not seen a hard market”

Meagan Woensdregt, Lions Gate Underwriting Agency

There are over 80 MGAs in Canada. Of those, 65 manage over $3 billion in premium transactions and are members of the trade group CAMGA.

Despite the stabilization of the commercial markets, many believe MGAs are here to stay, having established themselves as a legitimate and efficient distribution channel in recent years.

To recognize the best in the industry, IBC queried hundreds of brokers across Canada and asked them to rate the MGAs in 10 criteria such as pricing, responsiveness, and product range. Twenty-five excelled in one or more criteria, gaining the 5-Star distinction.

The IBC team spoke to a few of them to get their exclusive insight into the Canadian MGA sector.

What the results reveal

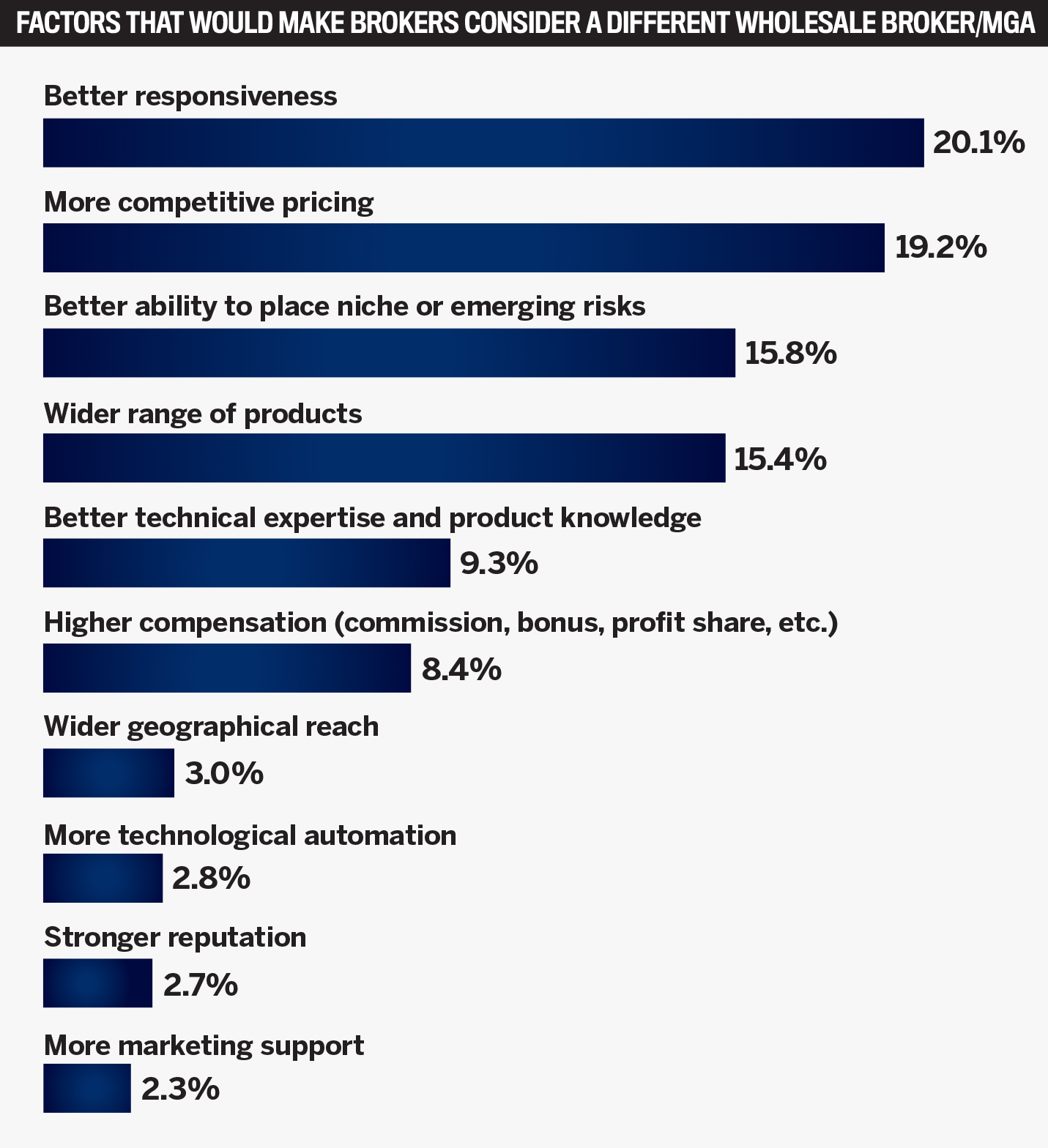

One may attribute the success of the 5-Star MGAs to meeting the demands of their broker customers. However, it’s a more detailed picture than that. According to IBC’s survey, brokers seek out MGAs according to four criteria; (1) responsiveness, (2) pricing, (3) ability to place niche risks, and (4) product range.

“These findings align with our business strategies,” says Meagan Woensdregt, managing director of Lions Gate Underwriting Agency. “We built Lions Gate up over the last seven years with this combination of building efficiency and building technology while allowing for scalability and without losing an eye for human capital or the underwriter who truly understands risk.”

That means having sharp people who can think quickly and have the technical ability to make good decisions, based on the top three most important elements of risk. Woensdregt also underscores the importance of leveraging technology to keep the price point low to the broker.

“Our vision and our values are service, human capital and technology playing together to build out Lions Gate,” she says. Currently, they have three offices (Ottawa, Vancouver and Toronto) throughout Canada.

Neither is Rodney Spurrell, managing director of fellow winners Unique Risks, surprised by IBC’s survey findings. “By the time an MGA sees an account, it’s probably been around a little bit,” he says. “So, responsiveness tends to be a concern of theirs because they’re three days away from renewal and they don’t have a quote.”

A casualty shop for tough-to-place risks, such as trampoline parks and axe-throwing venues, Unique Risks prides itself on turning around quotes in 24 hours and constantly tweaking operations to keep costs competitive.

Meanwhile, Graham says responsiveness, pricing, ability to place niche risks, and product range are always top of mind and have been for years.

He adds that brokers also want long-term partners. “They want people who are going to be there through the market cycles to support them and also be agile, and look at things from a different perspective than some of our competitors and be there to find a solution.”

“We’ve built this platform for under $200,000, and it’s just spectacular”

Rodney Spurrell, Unique Risks

Standing out from the crowd

Performing well in a survey is one thing, but there are other metrics including revenue and creating a vibrant workplace culture, that help explain what differentiates the winners.

Lions Gate is on pace to achieve 30% year-over-year growth in gross written premium (GWP) and has its biggest ever month in June. Three key elements are behind that performance. For Woensdregt, culture is number one.

“We really stress the value of owning and knowing your portfolio and operating almost as a little entrepreneur within your book of business,” she says.

“Second, we have dedicated staff that want to utilize that combination of technology and human abilities. Lastly, we have really great market relationships. We’ve not lost a contract. Our contracts are very solid, very stable. We have this long-standing trust with our London and domestic markets, which has seen us survive this period of contract culling and pullback of capacity. So, it’s going to project us into the next round of a slightly softer market having those great stable market relationships.”

Only three years old, Unique Risks has enjoyed 300% growth annually since it launched – going from $4 million to $12 million to $36 million, while expecting to hit $50 million or $60 million this year.

“It’s a great work culture here,” enthuses Spurrell. “We have great compensation and a lot of freedom for the staff.

“Our responsiveness is fantastic. It’s probably under 24 hours. Our underwriting, we can tailor a product and write it so the customer is happy. At the end of the day, it runs fairly clean and smooth. Finally, there’s technology. We’ve built this platform for under $200,000, and it’s just spectacular. We’re able to push policies out, we’re able to manage the money as it comes in. That really gives us a leg up.”

Agile Underwriting Solutions mirror their peers’ success and expect double-digit growth in 2022.

“Technical capabilities and our team’s solutions mindset [are our strengths],” says Graham. “We operate our MGA like we are an insurer… a focus on governance, strong relationships, profitability, and a strong engaged team are critical to our success.

“The key aspect for us is our broad reach [in terms of] product offering, market-leading capacity, and our ability to source solutions for challenging risks and programs for our broker partners.”

“Traditionally, the MGA space is like an accordion. As insurers restrict capacity, risks flood to the MGA space”

Derek Spafford, HDI Global Specialty SE

Capitalizing on hard conditions

“There’s been a huge space for MGAs with strong technical underwriting expertise to help brokers who maybe had not seen a hard market,” explains Woensdregt. “Perhaps they haven’t seen some difficult placements or cancellations due to claims, where in a softer market maybe they would have maintained that type of insurance.”

Still, she says, the MGAs that have done well are the ones that have been smart about maintaining underwriting integrity and standards and put profitable growth into their carriers and London syndicates. In the future, the ones who will carry the day are those who can continue to meet brokers’ needs.

Spurrell echoes Woensdregt’s assessment and adds that one way his firm has taken advantage of market conditions is by using domestic capacity instead of London capacity.

“The beauty of domestic capacity is that it tends to be a little bit more stable than London capacity,” he says. “And anytime there’s a withdrawal – either by Lloyd’s or others – you need to be poised to jump.”

In the near future, Spurrell expects to see more MGAs enter the Canadian market and some restructuring at Lloyd’s.

Meanwhile, Graham is impressed with the progress the MGA market has made in Canada. “The last few years, maybe even longer, have helped educate brokers and our insurer partners in the standard markets about the MGA space,” he says. “We’ve made strides in Canada to go from a position of ‘MGA is kind of bottom of the barrel’ versus on par with insurer partners, which is kind of where things are around the world and in the US. Canada tends to be 10 years behind everybody else.

“Long term? We have capacity in the standard market and London as well. We’re able to put up some substantial numbers given the deterioration in the standard market over the last couple years.”

ABEX

Agile Underwriting Solutions

AM Fredericks

Angus Miller

APOLLO

APRIL CANADA

Burns & Wilcox

Cansure

CFC Underwriting

CHES Special Risk

Chutter Underwriting

Forward Insurance

i3 Underwriting

InsureBC Underwriting

Lions Gate Underwriting

Milnco

Stewart Specialty Risk

Strategic Underwriting Managers

Totten Insurance

Trans Canada Insurance Marketing

Vailo Insurance

Victor Canada

Pricing

ABEX

Agile Underwriting Solutions

APOLLO

CFC Underwriting

Chutter Underwriting

Forward Insurance

i3 Underwriting

InsureBC Underwriting

Lions Gate Underwriting

Stewart Specialty Risk Underwriting

Vailo Insurance

Victor Canada

Technical Expertise and Product Knowledge

AM Fredericks

ABEX

Agile Underwriting Solutions

Angus Miller

APOLLO

Burns & Wilcox

Cansure

CFC Underwriting

CHES Special Risk

Chutter Underwriting

Forward Insurance

i3 Underwriting

InsureBC Underwriting

Lions Gate Underwriting

Stewart Specialty Risk Underwriting

Strategic Underwriting Managers

Totten Insurance

Trans Canada Insurance Marketing

Vailo Insurance

Victor Canada

Ability to Place Niche or Emerging Risks

CHES Special Risk

i3 Underwriting

Lions Gate Underwriting

Stewart Specialty Risk Underwriting

Strategic Underwriting Managers

Totten Insurance

Vailo Insurance

Range of Products

Agile Underwriting Solutions

APOLLO

APRIL CANADA

Burns & Wilcox

Cansure

i3 Underwriting

InsureBC Underwriting

Lions Gate Underwriting

Strategic Underwriting Managers

Vailo Insurance

Victor Canada

Compensation

Overall Responsiveness

ABEX

APOLLO

Chutter Underwriting

Forward Insurance

InsureBC Underwriting

Lions Gate Underwriting

Milnco

Stewart Specialty Risk Underwriting

Trans Canada Insurance Marketing

Vailo Insurance

Reputation

ABEX

APOLLO

Burns & Wilcox

Cansure

CFC Underwriting

CHES Special Risk

Chutter Underwriting

i3 Underwriting

InsureBC Underwriting

Lions Gate Underwriting

Strategic Underwriting Managers

Totten Insurance

Vailo Insurance

Victor Canada

Marketing Support

Lions Gate Underwriting

Vailo Insurance

Technology/Automation

ABEX

APOLLO

CFC Underwriting

Forward Insurance

Lions Gate Underwriting

Geographical Reach

AM Fredericks

APOLLO

Forward Insurance

i3 Underwriting

Lions Gate Underwriting

To determine the outstanding MGAs in Canada, IBC surveyed hundreds of brokers across the country, asking them to rate the quality of service they’ve received from their MGAs over the last 12 months. Brokers rated MGAs on a scale of 1 (poor) to 5 (excellent) in 10 criteria including pricing, overall responsiveness, product range, technical expertise product knowledge, and more. Brokers were also asked to rate the importance of each criterion when choosing an MGA partner.

The MGAs that earned an average score of 4 or higher in at least one criterion were awarded a 5-Star rating for it. In total, 25 MGAs earned a 5-Star rating this year. Of those, only one achieved All-Star status by earning 5-Star ratings across all 10 criteria.