5 Star Insurance Innovations, Products, and Leaders in Asia | 5-Star Insurance Innovators 2023

Jump to winners | Jump to methodology

Agents of transformation

Insurance Business Asia recognises the 5-Star Insurance Innovators of 2023, trailblazing organisations modernising and transforming insurance practices.

Underlining how vital the winners are to pushing boundaries is industry expert Bernhard Kotanko, senior partner at McKinsey.

“Most insurers fare not particularly well on innovation. The endowment legacy of the book, the complexity of the balance sheet and economics, and a focus on short-term economics all impede fresh thinking.”

And he adds, “Innovation is foremost a mindset – it requires the encouragement of fresh ideas, of challenge, of experimentation and of a ‘fail fast’ allowance. Innovation also needs resources and capabilities beyond business as usual.”

Further illustrating this, Insurance Business Asia’s data shows:

Kotanko explains, “It is important to remind ourselves that the purpose of insurance is to tackle the biggest emotions of humanity – the fears, dreams, and promises we have – and mobilise pooling and capital markets mechanisms to provide safety and peace of mind. With all this innovation coming, the overall purpose for the industry needs to be reinvigorated to stimulate growth and wider penetration.”

Nanoinsure Technology (Hong Kong ) Limited

Insurance innovations winner ensures customers thrive

The no-code and low-code platform is a game-changing product that offers its life insurance company customers a self-configuration capability, enabling them to leverage the company’s groundbreaking “Excel to API” technology to create any insurance products they can imagine.

The 5-Star Insurance Innovator’s platform differentiates itself by accepting any format of actuarial Excel, unlike other vendors who are limited to proprietary Excel format. This allows insurance carriers to innovate quickly and cost-effectively by utilising their existing resources, giving them a competitive edge.

“Our team’s expertise, dedication, and collaborative approach have been instrumental in achieving this recognition,” chief commercial officer Terence Ho remarks. “Our unique value proposition lies in our ability to provide comprehensive and tailored solutions that empower insurance companies to thrive in the digital era.”

The factors that set Nanoinsure apart in the highly competitive landscape include:

relentless focus on innovation to be at the forefront of technological advancements in the insurance industry

continuously striving to develop groundbreaking solutions addressing the evolving needs of clients and the market

a commitment to exceptional client experiences and building long-term partnerships

Nanoinsure’s holistic suite of innovative products and services enables insurance companies to:

The organisation is also leading the way with its deep industry knowledge, cutting-edge technology stack, and agility to adapt its solutions to meet specific client requirements.

“We prioritise customisation, scalability, and seamless integration to deliver a superior client experience that surpasses industry standards,” adds Ho.

For 5-Star Insurance Innovators such as Nanoinsure, one of the most significant challenges in the insurance industry is the resistance to change and adopting new technologies. Many traditional processes and systems are deeply ingrained, making it challenging to introduce innovative solutions.

To address this, Nanoinsure employs a multifaceted approach:

actively engaging industry stakeholders, including insurers, regulators, and industry associations, to drive awareness and advocate for innovation

focusing on delivering tangible value, showcasing the benefits and ROI its solutions provide

prioritising education and knowledge sharing, organising industry events, webinars, and thought leadership initiatives to promote a culture of innovation and facilitate industry-wide digital transformation

In addition, the company emphasises building strong client relationships as crucial drivers of its support and service approach. Nanoinsure’s team provides hands-on support, comprehensive onboarding, training, and ongoing assistance throughout the implementation process.

“We believe in fostering open communication channels, proactive problem-solving, and continuous improvement to ensure our clients achieve maximum value from our solutions,” Ho states.

Ho notes Nanoinsure’s unwavering commitment to build upon and sustain its status as an insurance innovator through:

continuing investment in research and development

expanding its solution portfolio

enhancing existing products and exploring new growth avenues

strengthening partnerships and collaboration with industry leaders, insurtech startups, and academic institutions to foster innovation ecosystems and drive co-creation

“As an Asian market-focused company, we are committed to supporting our clients locally,” he notes. “In the short term, we will open an office in Tokyo to fuel the digital transformation in this global third-largest market.”

“Our products are localised in seven languages across 10 Asian markets, and we believe we can ignite the digital transformation for the insurance industry”

Terence HoNanoinsure Technology (Hong Kong ) Limited

Entsia

5-Star Insurance Innovator’s digital-first philosophy

In a highly regulated, complex environment, 5-Star Insurance Innovators need to be agile, reactive, flexible, and customer-focused.

Long considered a game changer in the digital transformation space, the Entsia digital distribution platform rises to those challenges by enabling insurance companies to expand their product offerings cost-effectively and reach new markets.

The award-winning platform was designed to allow a seamless and straightforward distribution-focused policy and claims solution, enabling insurers to conduct digital interactions with customers, partners, and suppliers.

“We set out to develop a single platform to cover all the unique policy distribution and claims needs of every kind of insurance provider,” explains founder and CEO Alistair McElligott. “The more complex the insurance product, the better.”

Entsia’s stellar reputation and customer satisfaction allow it to stand out, along with the following:

technology that is secure, proven, scalable and flexible, ensuring customers and the industry’s evolving needs are met

speed and cost to market

ability to handle the most complex insurance products

team expertise and insurance knowledge

technology partnerships with marketplace operators and international brokers/large broker groups

“Entsia is passionate about solving key operational and technological challenges with a digital-first philosophy,” McElligott adds. “While traditional insurance solutions are typically focused on the back office, Entsia focuses on end-customer and distribution, removing the need for complex, bespoke development for implementation of modern digital distribution channels.”

Client service and support take centre stage, as the 5-Star Insurance Innovator’s dedicated team partners with customers to ensure a successful outcome.

They strive to add value by bringing significant insurance technology experience to solve problems collaboratively, as well as:

“Digital transformation is more than just adopting digital technology; for many, it also requires a revamp of their entire operating model and an opportunity to look at more innovative ways of doing insurance,” notes McElligott. “Digital transformation and insurance transformation are critical for organisations to compete, survive, and thrive.”

Entsia plans to continue transforming the insurance industry via its research and development by delivering for its underwriter customers:

cost-effective, low-risk technology that can meet their complex distribution requirements

technology solutions that are continually enhanced and expanded

service providers that add value by bringing significant insurance technology experience

technology that accelerates their ability to innovate and differentiate in the market

products and services promptly accessible through a variety of channels

Continuing evolution

This year’s 5-Star winners and their innovations are shaping the future of the insurance industry. The trend is set to continue with McKinsey’s Kotanko highlighting three main areas for upcoming innovation in the Asian market:

Distribution and customer experience reimagined – “including digital generative AI-powered ‘co-pilots’ for advisors, personalisation, and curated content and services”

Proposition innovation – “in health centred around integrating provision services mainly in the predict-and-prevent stage as well as in care management, while in wealth and investments focused on innovative asset structuring for a higher interest-rate environment in many geographies”

Operations and services innovation – “Many Asian insurers face rising expense ratios and stagnating economic productivity, despite material technology investments. We see the link between technology and ways of working as critical to unlock this productivity potential.”

“We view our clients as our partners in success; our commitment extends beyond the initial implementation to provide ongoing support for long-term satisfaction”

Alistair McElligottEntsia

AIA Group

Blackpanda

bolttech

EAB Systems

Entsia

Finology Group

Great Eastern Life Assurance Company

Igloo

Income Insurance Limited

JA Secure

Nanoinsure Technology (Hong Kong) Limited

Sun Life Assurance Company of Canada, Singapore Branch

Surer

ZA Tech

Insurance Business Asia’s third annual 5-Star Insurance Innovators report recognises the companies that are moving the insurance industry forward, whether by introducing new technology or rolling out a groundbreaking product or distribution channel strategy.

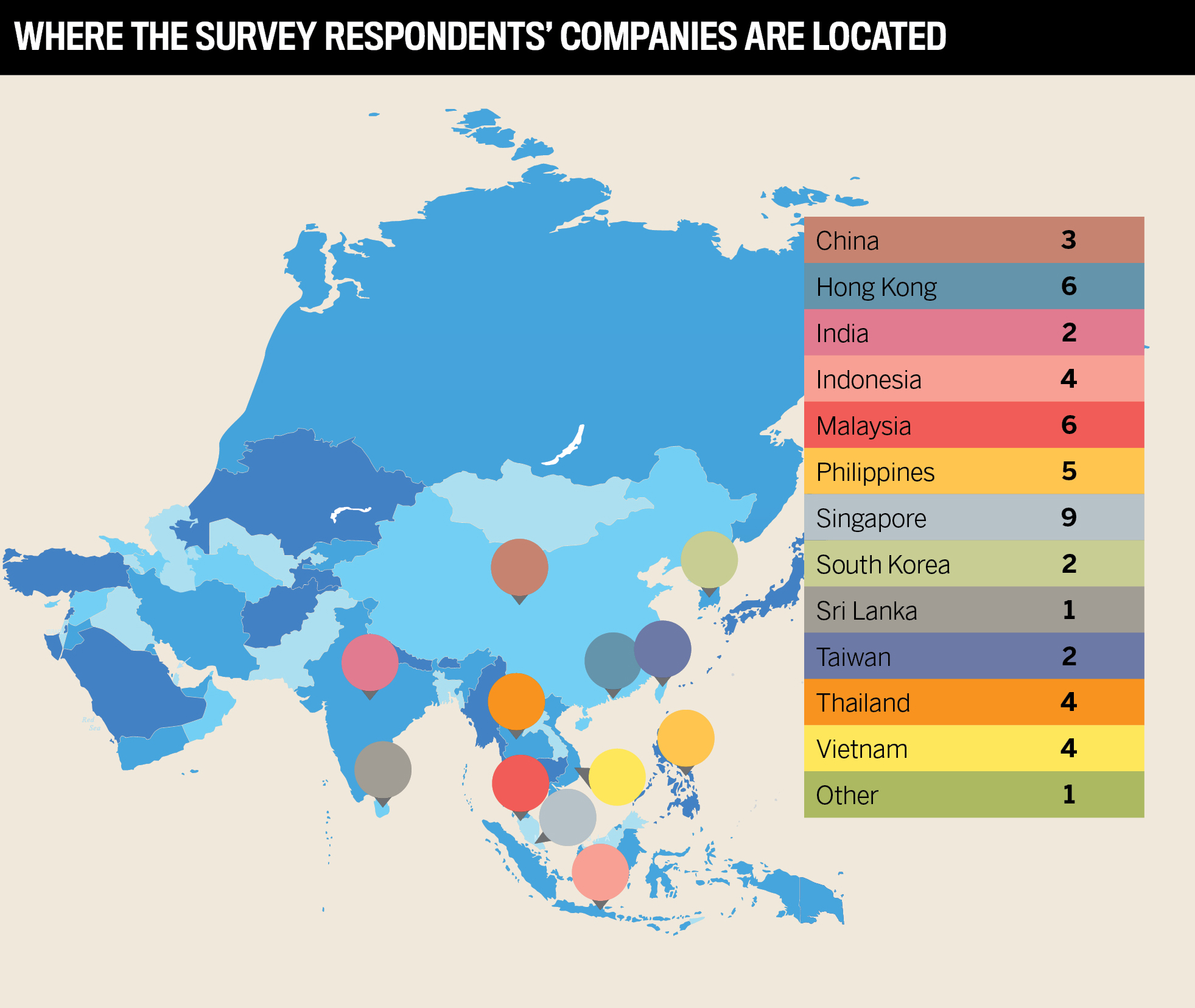

Starting in August, IB Asia invited insurers, brokerages and service providers from across the region to submit a nomination, detailing the steps they had taken to introduce new innovations to the insurance industry. Companies were encouraged to focus on initiatives launched and results achieved over the last 12 months.

The IB Asia team objectively assessed each entry for detailed information, true innovation and proven success – along with benchmarking against the other entries – to determine the 14 5-Star Insurance Innovators.