25 years of Artemis, over $170bn of Deal Directory transactions tracked

Artemis is now a quarter of a century old! We celebrated our 25th birthday last week with a team gathering, reflecting on more than $170 billion of catastrophe bonds and related insurance-linked securities (ILS) transactions tracked, with hundreds of billions more in assets deployed to insurance risks covered by us over the years.

On the 12th of May 1999, Artemis was launched formally to an audience of reinsurance and capital market executives at an event held in Bermuda.

We’ve been tracking activity in the catastrophe bond market, the development of insurance-linked securities (ILS), the use of alternative capital markets structures and modern risk transfer techniques, as well as the development of new and efficient global reinsurance capacity sources, since that time.

The Artemis Deal Directory was actually born as a listing of the very earliest catastrophe bonds on another website back in late 1996. Some of you might remember WIRE and its Risk Information & Services Exchange (RSX) from that time.

Enormous thanks to Rowan Douglas, the visionary behind much of what we did at WIRE and now the CEO, Climate Risk & Resilience at Howden, for putting his trust in me and being the original driving force behind my developing a passion for the convergence of risk and capital markets.

As ever, when Artemis has its birthday and I’m a little late with this quarter of a decade Silver Jubilee, I like to highlight the development of Artemis over the years and the depth of information we have analysed and tracked since its launch.

The insurance-linked securities (ILS) market captured our attention in the mid-90’s, stimulated originally by the advent of catastrophe options, weather derivatives and then the very first catastrophe bonds.

The goal, with Artemis, was to create an online heart of the emerging catastrophe bond and insurance-linked securities (ILS) sector, providing timely, relevant, accurate and thoughtful information flow for ILS and reinsurance professionals, to support their work and operations in the market.

We also wanted to provide an educational resource for investors interested in the ILS asset class and for cedents and sponsors that might find ILS a viable alternative source of risk capital and risk transfer.

The goal hasn’t changed, but the market is now much bigger, more institutional and providing a significant percentage of global reinsurance capital today, having cemented its position as a key provider.

The industry remains fascinating to us and I am proud to call so many of our readers good friends. It has been a real privilege to get to know and spend time with so many smart, innovative and insightful people.

Equally, all of us at Artemis are proud that it has become so deeply embedded within information provision and decision-making for the ILS marketplace and its constituents.

Our catastrophe bond and related insurance-linked securities Deal Directory remains central to Artemis and is the most widely used data source on the ILS market available today in any medium.

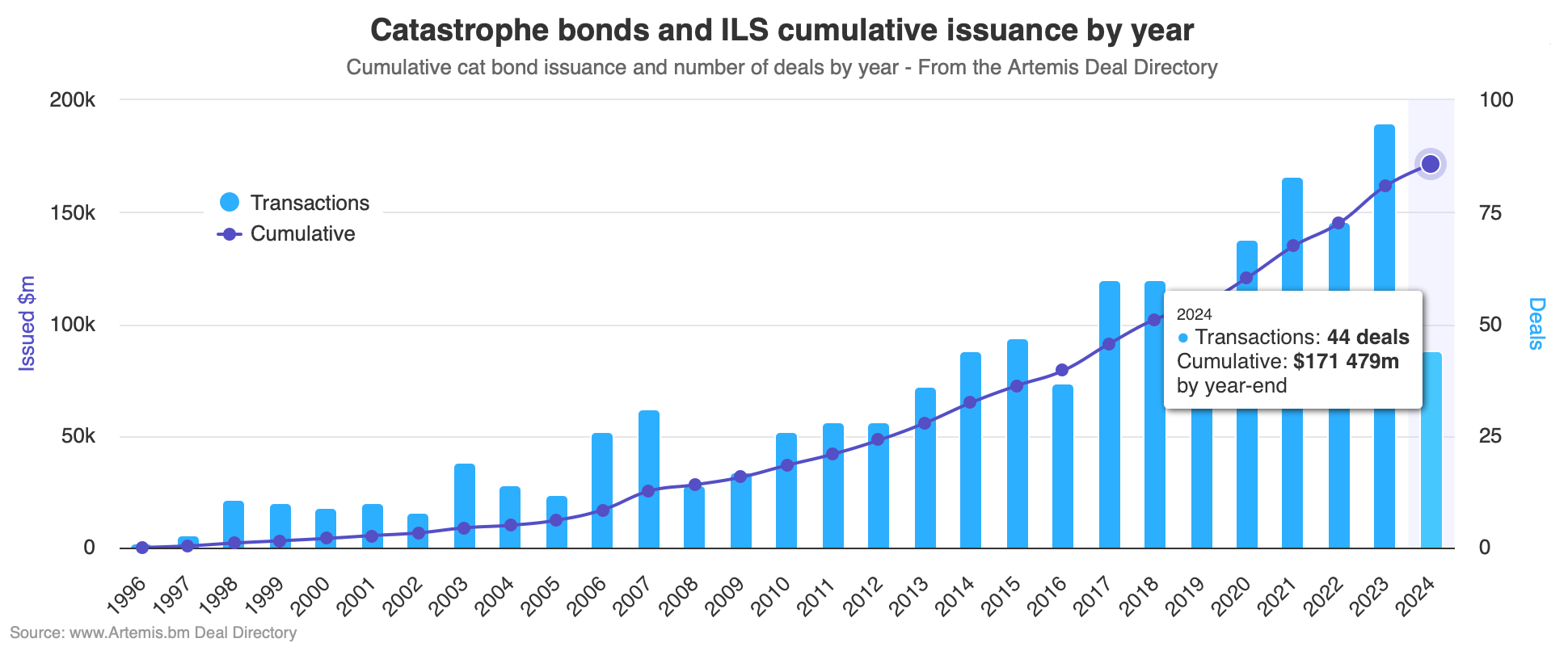

Since we started collecting the data set, we’ve now tracked an incredible 1,047 individual cat bonds and related ILS transactions in the Artemis Deal Directory.

One of our data sets that goes back that far now shows almost $171.5 billion in cumulative issued and priced 144a catastrophe bonds, private cat bonds and cat bonds covering other lines of insurance or reinsurance business tracked.

While this total, of cumulative issuance tracked by Artemis (excluding any mortgage ILS deals) is now over $171 billion, if you were to also include the new cat bond issues that have yet to price but are listed in our Deal Directory today the total rises to an even more impressive $173.7 billion.

It’s a great resource for tracking the ILS market’s development over time, as are the rest of our charts, visualisations and analytics on the market.

That’s not all, in terms of deal volume we’ve tracked.

We have tens of billions of dollars in collateralized reinsurance sidecars and longevity risk transfer arrangements that we’ve also tracked.

We’ve also tracked specialist ILS asset managers, with well over $100 billion of ILS assets detailed over-time in our ILS Fund Manager Directory.

As the insurance-linked securities (ILS) market continues to grow and the use of capital markets funding for reinsurance risk transfer expands, Artemis has been growing as well.

We’ve now surpassed 100,000 readers in a peak single month and average between 60k and 75k through the rest of the year.

With truly global readership representation, we have the largest ILS focused audience on any medium, in every single city in the world.

We also have the largest reinsurance focused audience in the world, with our other publication www.reinsurancene.ws a leading source of news and insight for those in reinsurance and those interested in it, peaking at well over 300,000 readers in a single month.

I’d like to take this opportunity to say a personal thank you to all of our readers, contributors, sponsors, advertisers, partners, conference attendees and good friends from the industry and further afield.

A further thank you to the hard-working team here at Artemis and Reinsurance News.

The relationships that have been created over the last 25 years of Artemis are truly valued by me.

I and the growing team here look forward to continuing to work closely with the industry, supporting its development and growth, while making new connections and deepening relationships.

Best wishes and I hope you continue to enjoy Artemis!

Steve Evans

Owner & Editor, Artemis.bm.

As is customary when I reflect on Artemis’ history, here are some reminders of the evolution of Artemis since its launch in 1999. A special prize, my utmost admiration for your staying power in the industry, to anyone who remembers the very first iteration of Artemis.

The first image below shows how Artemis looked around its launch on 12th May 1999, taken from an original press release about the launch event.

The fact that the top headline covered the potential for growth in cat bond issuance by corporate sponsors is particularly interesting, given that is a topic that continues to be discussed today.

This image below shows Artemis in late 2000, around 18 months after its launch. Not much had changed, but deal-flow was accelerating and things were starting to get interesting in the emerging ILS world.

This image below shows how Artemis looked in 2004.

From 2008 to late 2018 Artemis looked similar to this, but during that time our readership grew from just 1,000 readers per month to more than 50,000, over that decade.

While the look and functionality of Artemis is now different again, not least our much newer data services, charts and industry analytics, we remain open and accessible to everyone, with a singular goal to drive quality information about the ILS asset class to anyone wanting to learn more about it and track deal flow.

Stay tuned, there are more Artemis developments in our pipeline and we look forward to continuing to serve our readers for years to come!