2023’s ILS hard market equal to post-Katrina 2006: Lane Financial

The current hard market for insurance-linked securities (ILS) and catastrophe bonds is equally as hard as the post-Katrina year of 2006, according to new analysis from consultancy Lane Financial .

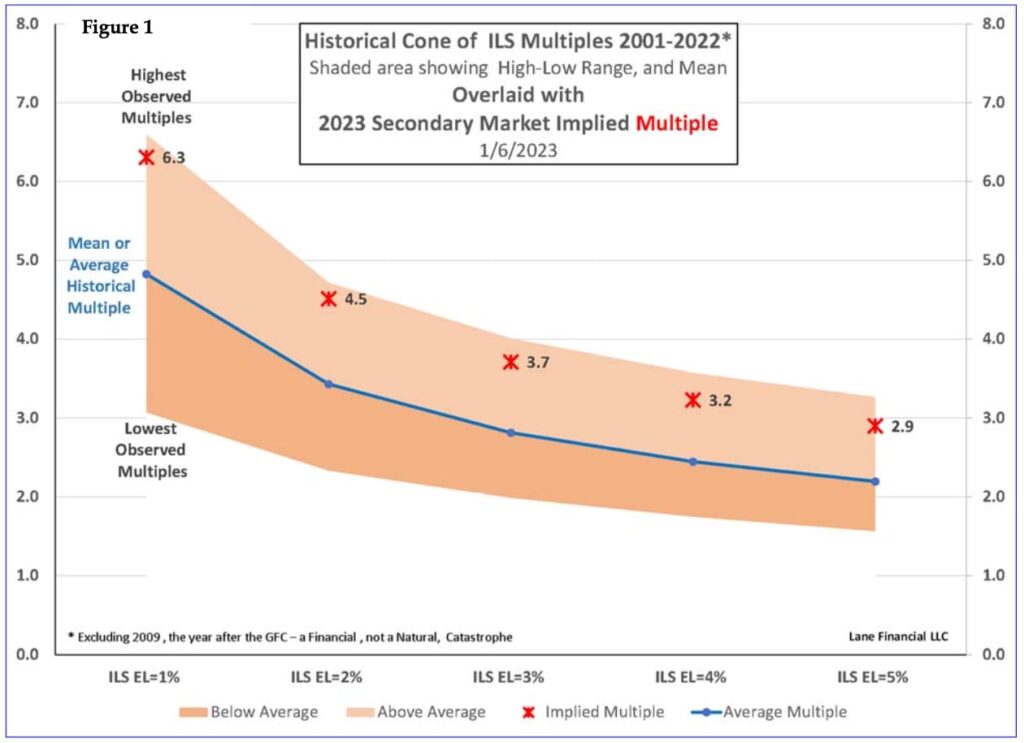

Through the analysis of standard catastrophe bond multiples across a number of different expected loss levels, at different points in time, Lane Financial can show how the pricing and returns of ILS and catastrophe bonds in 2023 compare to prior years.

By displaying multiples of theoretical ILS deals at standard expected loss levels for prior years, Lane Financial could then plot current issues against this and compare how potential cat bond market returns have moved.

“Given these caveats it is possible to comment quantitatively on the 2023 Hard Market,” Lane Financial explained.

Commenting on the chart displayed below, they add, “The forward-looking multiple derived from the secondary market prices on the unimpaired portfolio (as of 01/06/2023) is superimposed on the historical range of past multiples for each fixed EL. The (red) markers from the secondary multiples are at the highest end of the range. This is a hard market.

“Only 1 year (i.e., 5% of the time) had multiples equal to or higher than the current implied multiple. That was 2006 (the year after Katrina) which was a very hard market. Clearly 2023 looks to be equally hard.”

Lane Financial notes that, if its analysis is correct, then an investor looking at catastrophe bonds and ILS right now “might have to wait another 10 to 20 years to encounter such good conditions again.”

While there are no guarantees catastrophes won’t occur, “What is certain is that you are being paid a handsome premium for taking ILS risk.”

Lane Financial moved on to look at the current return potential of catastrophe bonds and ILS on a risk adjusted basis.

They found that the expected return of 2023’s cat bond and ILS stock beats all recent years soundly.

As of the first week of 2023, the ILS portfolio it used in its analysis shows a loss-free return potential of 9.82%.

The expected return, allowing for expected losses, is 7.40%.

But, Lane Financial explains, “The foregoing analysis speaks solely to the underwriting profit – the premium net of expected losses – that the secondary market expects or implies. The investor will also receive income from their collateral – the floating rate of the floating rate note structure. Currently this is around 4%. If this is maintained during the year, expected total returns would be in double digits.”

With reinsurance market returns now far higher than even a year ago, the ILS and catastrophe bond market return potential is significantly elevated.

The fact it falls on a rough par with 2006, the year after hurricane Katrina is important, as

The analysis goes into more detail and technicalities and we recommend you visit the Lane Financial website, where you can download all of their excellent research.