144A property cat bond issuance nears $12.8bn, hits second-highest level ever

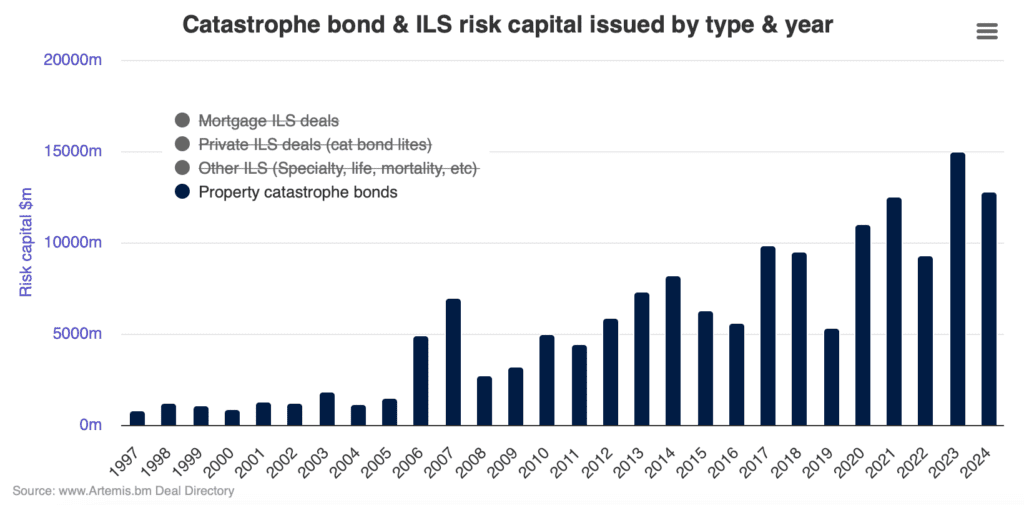

Already in 2024, the dollar amount of new Rule 144A property catastrophe bonds issued and settled has reached the second-highest level on record, with almost $12.8 billion in completed property cat bond deals tracked in the Artemis Deal Directory so far this year.

Using our charts you can analyse the mix of issuance we include in our Deal Directory, with this chart particularly useful that breaks issuance down and allows you to analyse 144A property cat bond issuance only.

As the largest component of the cat bond market, out of a total almost $13.8 billion in issuance tracked so far this year, which is already the third highest annual issuance total ever, almost $12.8 billion of that is from 144A property cat bonds, which are now at their second-highest level of annual issuance on record.

Using this chart, you can exclude the other ILS category (where cyber, specialty, life and other 144A non-cat bonds reside), the private ILS category and also the mortgage ILS we track, to simply view property catastrophe bonds.

Just click on the category name in the chart key to remove or include them from your analysis.

When showing just property catastrophe bond issuance, this is how the chart will look:

At almost $12.8 billion, 144A property cat bond issuance has now surpassed the full-year figure for 2021, which was just over $12.5 billion.

This year is now running only behind 2023 for property cat bond issuance, with some $14.97 billion issued in the full-year.

Overall issuance of catastrophe bonds, 144A property cat, private cat bonds and non-cat 144A deals, continues to run well ahead of trend, with all October issuance now accounted for in our range of cat bond and ILS market charts.

Visit our issuance by month and year chart, which includes only cat bond structures (144A cat and non-cat, plus private deals), then exclude November and December from the key to see just how far ahead of trend 2024 cat bond issuance is currently running.

With just under $13.8 billion issued by the end of October 2024, that’s well ahead (more than $2 billion ahead) of the previous record for the first ten months of the year, which was $11.6 billion in 2021.

There is another roughly $580 million in cat bonds still being marketed right now, but a pipeline that continues to build for the end of the year suggests a record remains possible in 2024.

One final tip for you, related to our range of catastrophe bond and ILS market charts. We have added a new feature that allows you to view the interactive chart in full-screen.

Just click on the three-line icon in the top-right of a specific chart and select “View in full screen”. To exit the full-screen view, click the same three-line icon, or simply hit escape on your keyboard.

We hope you find that a useful addition, as you can now put our charts up in full-screen to aid in your market analysis, as well as in furthering education of cedents and investors.

All of our catastrophe bond market charts and visualisations are up-to-date and include data on new cat bond transactions as they settle.