144A catastrophe bond issuance surpasses $4bn, setting new Q1 record

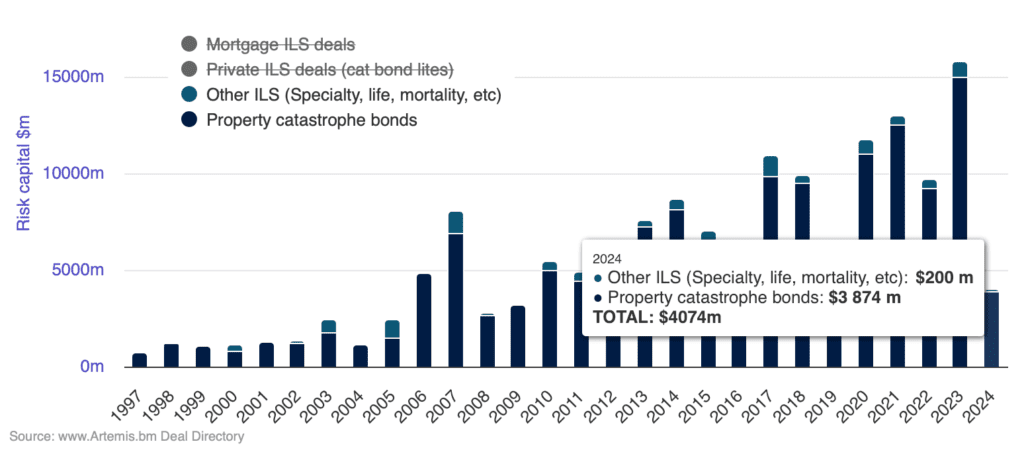

The first-quarter of 2024 has seen records fall in the catastrophe bond market and the period is the first time that the starting months of the year have ever seen over $4 billion of 144A catastrophe bond issuance, according to Artemis’ data.

Our new quarterly catastrophe bond market report will be published next week and it will review all of the quarter’s key cat bond issuance data points. Watch out for our announcement next week when it is released, or you can always find all of our quarterly cat bond market reports here.

But, our catastrophe bond market charts and visualisations are kept up to date as every new deal settles or old cat bonds mature, so you can keep up with issuance as it progresses throughout the year.

Now, with the last two new catastrophe bonds of the first-quarter settling today, it’s clear from the data that Q1 2024 has set new records, a notable one of which we thought we’d highlight today.

It is the first first-quarter of any year where 144A catastrophe bond issuance has reached above $4 billion.

The previous record was 2020, when 144A issuance reached $3.96 billion, so it’s only just a record, but still a notable one we feel.

This year, January 2024 saw the second highest level of new cat bond issuance on record for the month, but it is really March that has driven the records.

March 2024 saw almost $2.3 billion of 144A catastrophe bonds issued, setting a new record for the month.

It’s an exceptional start to the year and now the market pipeline already has $1.84 billion of issuance scheduled for April, some of which is almost guaranteed to upsize, some perhaps significantly.

The record for April issuance was set in 2023 with just over $2 billion of issuance, so we could easily see another record month this year.

2024 is on-track to be a very strong issuance year and with a number of larger deals also anticipated and demand for reinsurance rising in general, there is every reason to be optimistic that a new annual record will be set.

Just last week, we polled our readers for their opinions as to how high 2024 catastrophe bond issuance could rise and more than 35% of respondents said they expect it will be above $17 billion, while 16% expect $20 billion will be surpassed in 2024.

There is a long way to go before we reach that stage and we have a whole hurricane season ahead of the industry.

But, the foundations have been set and with returns still considerably more attractive than a few years ago and the cost of risk transfer in the cat bond market compelling for sponsors and offering real value through risk capital diversification, there is every chance we hit those levels and see a new record set this year.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.