Worried About Medicare Scams: A Medicare Question

What You Need to Know

Efforts to bilk Medicare beneficiaries are common.

You can help by warning clients about the red flags.

To do that, you need to recognize the red flags.

In an age when technology has opened up new avenues for fraudsters to exploit vulnerable people, it’s crucial for us to learn how to protect senior customers who are signing up for Medicare or who are already enrolled in Medicare.

Recent reports show a concerning increase in the number of Medicare scams, emphasizing the urgency of this issue.

One way advisors can help is to learn how to handle conversations with Medicare beneficiaries who are worried about being scammed.

The Question:

How worried should clients be about Medicare scams, and how can financial professionals address clients’ concerns?

The Answer:

Very worried.

A quick internet search will reveal a slew of ongoing Medicare scams.

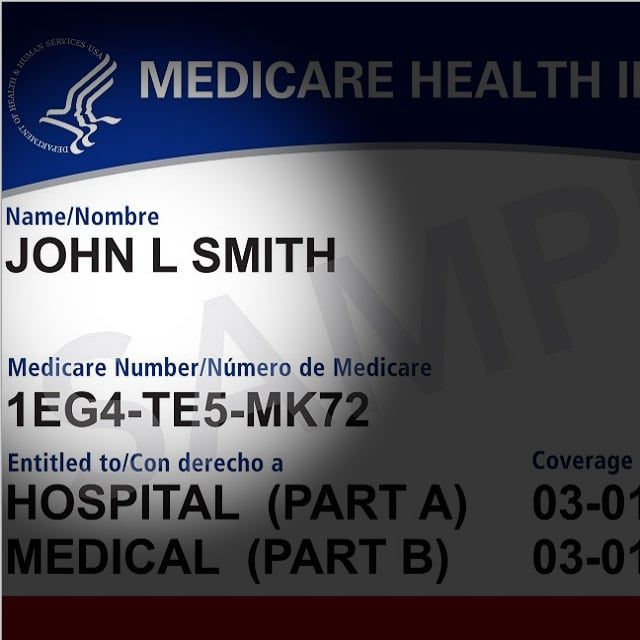

One common scam involves fraudulent phone calls from people claiming to represent Medicare or other health coverage providers.

These scammers often ask for personal information or money. They pose a significant threat to seniors’ financial and personal well-being.

Building Trust and Credibility

Building trust and credibility with Medicare recipients is critical for ensuring their peace of mind and confidence.

Stay current on Medicare regulations, practices, and precautions to establish yourself as a competent and trustworthy provider.

By demonstrating a thorough understanding of the Medicare system, you can effectively address any issues or queries your clients may have.

Addressing Medicare recipients’ scam concerns requires engaging and educating them in a way that fosters a safe and trusting environment.

Show clients that they can share their fears and concerns without fear of being judged. Try to understand their point of view and the emotions surrounding the situation.

Once you’ve figured out what the clients’ unique worries are, give them clear and straightforward information about fraud prevention, stressing practical steps they can take to protect themselves.

Educating About Red Flags

To protect Medicare recipients against scammers, warn them about “red flags,” or potential fraud indications.