Why Ukraine Crisis Could Mean Even Higher Oil, Gas and Food Costs

Food, Fertilizer at Risk

A major casualty could be even higher food prices. Ukraine and Russia together are heavyweights in global wheat, corn and sunflower oil trade, leaving buyers from Asia to Africa and the Middle East vulnerable to more expensive bread and meat if supplies are disrupted.

That would add to food-commodity costs that are already the highest in a decade.

When Russia annexed Crimea in 2014 wheat prices jumped even though shipments weren’t substantially affected. Russia and Ukraine’s share of world exports has increased since, with nations like Egypt and Turkey reliant on the Black Sea breadbasket.

So far, cargoes are still flowing freely and there’s no indication of significant disruptions. But should that happen, global markets already grappling with shrinking grain stockpiles could see further shortfalls.

Russia is also one of the world’s biggest exporters of all three major groups of fertilizers. Any cuts in supply may result in a surge in already high nutrient prices, affecting crop yields and cause further food inflation.

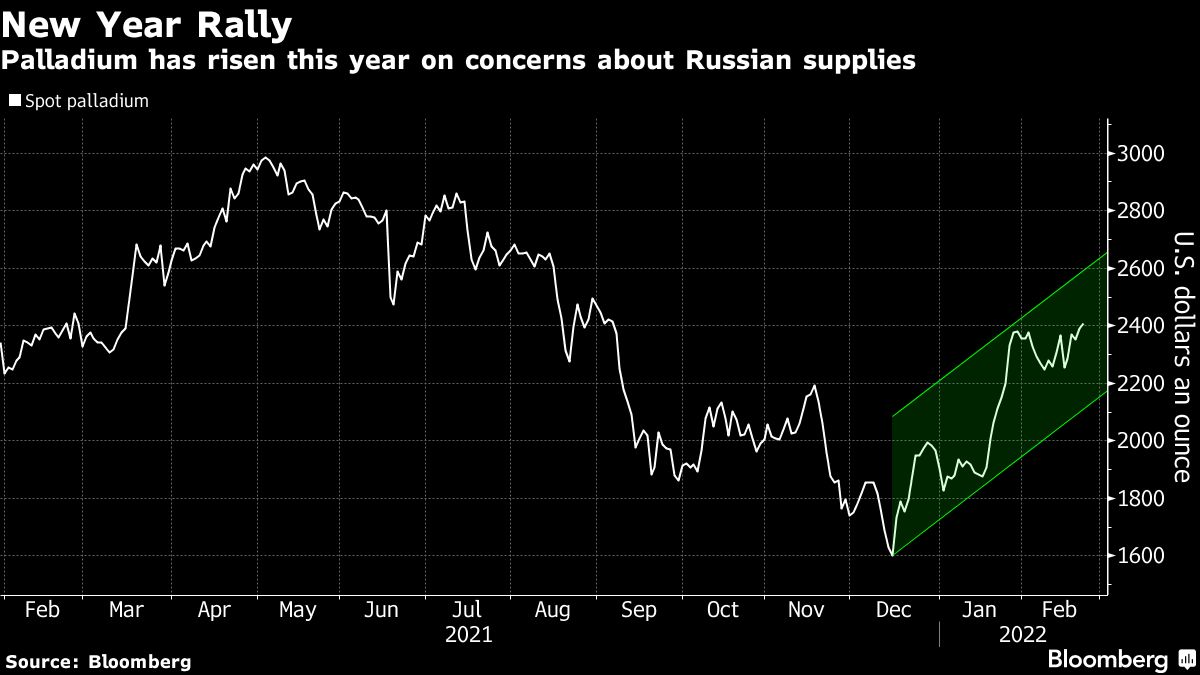

Metals Crunch

Traders are also weighing the risk of disruption to Russian exports of metals including aluminum, nickel, palladium and steel, even as analysts stress that targeting Russian producers directly with sanctions would be a major own-goal for the West. U.S. sanctions against United Co.

Rusal International PJSC sparked turmoil in the aluminum market in 2018, and policymakers may not want to risk a repeat. Rusal’s shares have plunged in Hong Kong in recent days.

But should Russia get cut off from the Swift international payment system as part of any sanctions, it would slow down the flow of funds and hit exports.

Any disruptions to gas flows could also exacerbate problems for metal producers in Europe who’ve been cutting output in response to high energy prices.

Even short-lived disruptions could have an outsized impact at a time when manufacturers are already facing critical shortages of metals from aluminum to zinc.

The fallout could be particularly dramatic in the palladium market, where Russia accounts for about 40% of global supply.

The country is less dominant in base metals, but remains one of the world’s leading suppliers, with JPMorgan estimating that it accounts for about 4%-6% of global refined production of copper, aluminum and nickel.

Oil Spike

Any disruptions to oil flows from Russia, with low spare production capacity in other countries, could easily send prices rallying. JPMorgan’s analysts have even tested the possibility of a spike to $150. Prices in London are approaching $100 a barrel.

Additional sanctions on top of those already affecting Russia’s oil industry could take oil higher much more quickly.

At that price, the impact on the global economy could be debilitating. It’s a reason many don’t expect sanctions to be so severe that oil flows are significantly affected. Besides, Saudi Arabia and some others in the Middle East could potentially fill the gap.

Still, traders remain edgy. Around half of Russia’s oil and condensate exports are directed to Europe. Disruptions could wreak havoc, and force trade routes to change.

–With assistance from Elena Mazneva, Olga Tanas, Dina Khrennikova, Eddie Spence, Yuliya Fedorinova and Grant Smith.

(Image: Shutterstock)

Copyright 2022 Bloomberg. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.