Why FOMO (fear of missing out) is not a sustainable investment plan

Although it can be tempting to put your investment goals aside to chase these returns, beware of FOMO, which can introduce an unreasonable level of risk in your portfolio.

What is FOMO when it comes to investments?

Many investors will, at some point, experience what is commonly referred to as a Fear of Missing Out (FOMO) when it comes to their investments. There is a common psychological aspect of investing where you may feel as if you are missing out on opportunities each time a new market fad causes a temporary run-up in a stock or investment. Emotional investing is often driven by the ups and downs of the markets rather than key inputs, such as your investment time horizon, your long-term investment goals and your risk tolerance level, and can lead to serious consequences, such as an erosion of wealth. Investors who focus on short-term performance rather than diversification are also more likely to change their investment strategy when their investments are performing poorly.

Although it can be tempting to put your investment goals aside to chase these returns, beware of FOMO, which can introduce an unreasonable level of risk in your portfolio.

Easy come, easy go

With the recent run-up in value of several stocks related to Artificial Intelligence (AI) which have been dubbed the “Magnificent Seven”,1 it can be tempting for anyone without exposure to these stocks to reverse course and join in on the AI hype. However, attempting to join a rally that has already taken off is incredibly risky as market sentiment may start to turn after you have made the investment. Without a solid understanding of what is driving these returns, it will be difficult to predict when this may be the case.

History provides many examples of certain segments of the market that have experienced impressive gains only to later reverse course. The best way to protect your portfolio is to diversify your investments so that it can withstand these fluctuations.

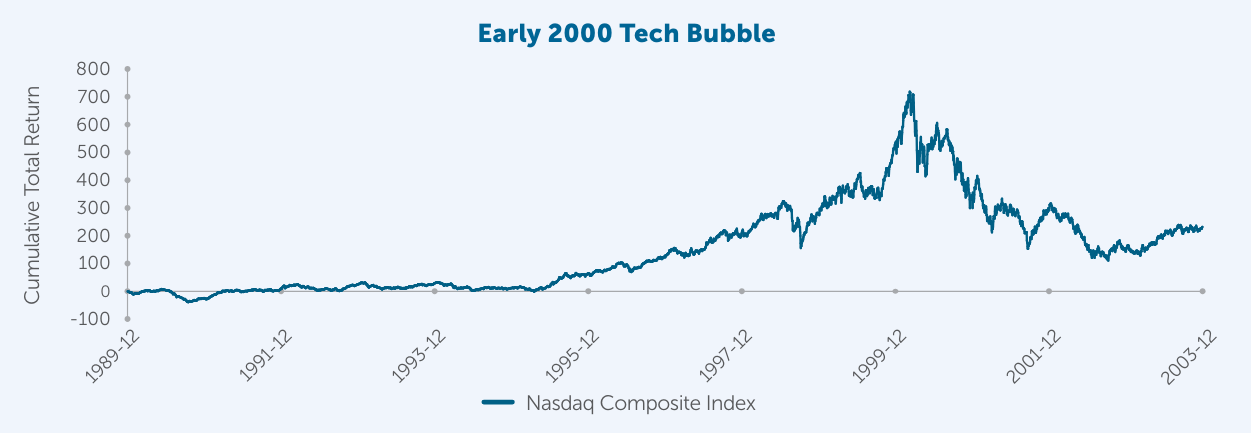

For example, similar to the market enthusiasm we are now experiencing around AI, technology stocks saw a runup in the late 1990s/early 2000’s due to the rapid growth of investment in internet-based companies. As shown in the graph below, an investor who invested in a technology focused portfolio, as represented by the Nasdaq Composite Index, in October 1999 before it reached record highs would have seen their investment soar before plummeting below the value of their initial investment in just 13 months.

Source: Bloomberg. Cumulative returns are presented gross of dividends in USD from January 1, 1990 to December 31, 2003. Indices are unmanaged and cannot be invested in directly.

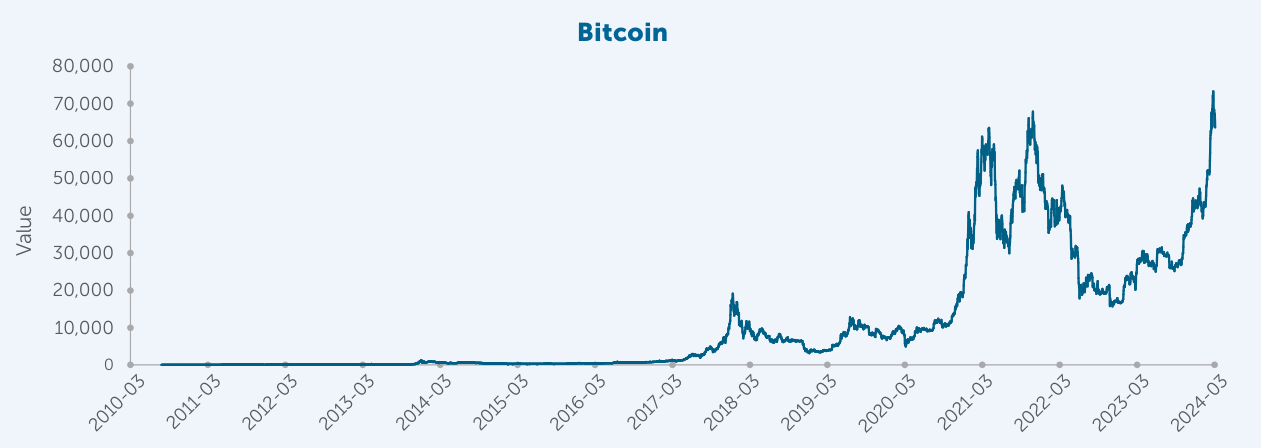

Another recent example can be found in the rise of cryptocurrency, which has had a volatile trading history since it burst onto the mainstream investment scene. If an investor only held Bitcoin in their portfolio, the largest cryptocurrency by market capitalization, they would have experienced a number of large crashes since 2018, as shown by the graph below.

Source: Bloomberg as of March 11, 2024 in USD. Start date is July 19, 2010. Price of one bitcoin (USD).

How to take the emotion out of investing

1. Setting financial goals- and sticking to them

Whether you are saving for your first home, your children’s education or retirement, setting a financial goal is a critical first step. Like most goals that we set, when our investment goals are specific and measurable, we increase the chances of meeting them.

education or retirement, setting a financial goal is a critical first step. Like most goals that we set, when our investment goals are specific and measurable, we increase the chances of meeting them.

Sticking to our goals are equally as important as defining clear goals. Although our objectives may change over time as life events occur, it is important to re-visit them from time to time to ensure that we are either on track to meet them, or that they are updated where needed. Once we have set our goals, it is crucial to have the discipline to stick to them. Markets change constantly, so rather than changing your portfolio each time a new trend emerges, sticking to your financial plan and keeping sight of your goals can help you achieve long term success. A skilled

Advisor can help you create a roadmap to achieving your

goals, and ensure that you are sticking to your plan.

2. Identify your risk tolerance and your investment horizon

Each individual investor will have a unique investment horizon. It will generally be determined by factors such as the investor’s age, their level of income, and the number of dependents they have. Generally, younger investors can take on more risk as they will have a longer investment horizon. The opposite is generally true for an individual who is nearing retirement and may require a more significant monthly cash flow.

3. Diversify your portfolio

It is important to diversify in order to “shock proof” your portfolio. Once your investment objectives are clearly articulated, an Advisor can work with you to ensure that your portfolio has exposure to different sectors, asset classes and/or investment styles. This is part of a sound, long term investment strategy that will protect your investments against market volatility.

Why is diversification so important?

Portfolio diversification is an important investment strategy because it allows investors to include different sources of return in their portfolio while mitigating losses during downturns.

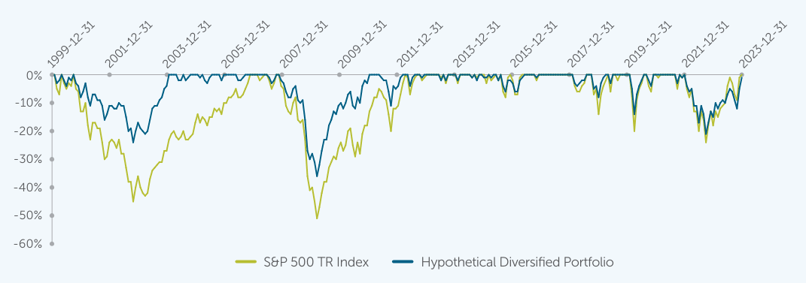

These diversification benefits have proven to hold even during anomalous periods, such as the period preceding 2018 when there was a pronounced correlation among different asset classes. The chart below compares a hypothetical portfolio comprised solely of U.S. equities, represented by the S&P500 Index, and a hypothetical portfolio diversified across asset classes, regions and investment styles. The drawdowns, which measured the decline in the value of the portfolios from a peak, were less pronounced for the diversified portfolio.

Historical portfolio drawdowns

Source: Morningstar using data from December 31, 1999 to December 31, 2023. Index returns represent those of the S&P 500 TR Index in CAD. Drawdown was measured as the decline from a previous peak in performance and remained in effect for the length of time that the performance remained below that peak. The performance of the hypothetical diversified portfolio was constructed using the weights and returns of the following indices in CAD and assumed that the hypothetical portfolio was rebalanced monthly to the noted weights: 40% S&P500 TR Index, 15% MSCI EAFE GR Index, 5% Russell 2000 TR Index, 30% Bloomberg US Aggregate Bond TR Index and 10% Bloomberg US Corporate High Yield TR Index. Indices are unmanaged and cannot be invested in directly.

Learn how your portfolio can benefit from diversification

A trusted Advisor is an excellent resource that can help you ensure that your portfolio is positioned appropriately to meet your short-term and long-term financial goals. They also have the skills and tools in place to ensure that your portfolio is appropriately diversified across asset classes, sectors and investment styles to help you achieve additional sources of return while managing volatility. Talk to your Advisor today to learn about the Empire Life products that are available to help you reach your investment goals.

![]() Download the full Investment Insight: Portfolio Diversification (PDF).

Download the full Investment Insight: Portfolio Diversification (PDF).

1The Magnificent Seven refers to Alphabet, Amazon, Apple, Meta Platforms, NVIDIA and Tesla.

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. All returns are calculated after taking expenses, management and administration fees into account.

Past performance is no guarantee of future performance.

Empire Life Investments Inc., a wholly owned-subsidiary of The Empire Life Insurance Company, is the Portfolio Manager of Empire Life Segregated Funds. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Segregated Fund policies are issued by The Empire Life Insurance Company.

© 2024 Morningstar Research Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

® Registered trademark of The Empire Life Insurance Company. Policies are issued by The Empire Life Insurance Company

May 2024