Why Are You Still Selling Life Insurance With Lifetime Guarantees?

What You Need to Know

Some clients may need coverage to stay in force at age 90.

Some may have tight budgets and more flexible coverage duration needs.

The author suggests helping clients weigh the costs and the benefits carefully.

Permanent life insurance comes in many forms. Too often, however, clients are presented as if only two types exist: “guaranteed” and “non-guaranteed.”

Whether intentional or not, framing the choice this way creates a false dichotomy and too often leads clients toward solutions that don’t best meet their needs. In my experience, the most successful producers take a different approach.

The first thing they acknowledge is that all products have guarantees, and all products have risks. It does not serve anyone to pretend otherwise.

For example, a product presented as the “guaranteed” option may come with the risk of limiting a client’s ability to adjust their premium funding in the future, or with the risk that the cost is substantially higher than alternatives. On the other hand, a product presented as “non-guaranteed” might actually guarantee coverage for decades while providing compelling cash value growth potential relative to the “guaranteed” alternative.

The second thing successful producers do is keep it simple, but not too simple. While “guaranteed” vs. “non-guaranteed” is certainly catchy, it oversimplifies the conversation. An alternate approach is acknowledging that tradeoffs are required in life insurance product selection, just as in any other financial decision. Advisors can do this by asking a more impartial and open-ended question: “What’s the best use of your money?”

When the need is permanent death benefit protection, there are typically four different priorities that need to be balanced: maximizing the death benefit, enabling future flexibility, activating living benefits, and finally, what I call “extending the warranty.” This last one gets at the “guaranteed” question in more neutral terms that a client can easily understand. Just as with a car or a TV set, a life insurance buyer has the option to take a “manufacturer’s warranty” — i.e., the basic no-lapse guarantee — or they can “extend the warranty” and purchase a longer no-lapse guarantee. Presenting it this way helps the client understand that this approach has both a cost and a benefit — one that should be balanced against other needs.

At this point, the advisor has a much better understanding of what is truly important to the client, and this can lead to presenting two choices that have different no-lapse guarantees. For example, option A might offer a 20% lower premium with a no-lapse guarantee to age 90, while option B has a lifetime no-lapse guarantee but is more expensive. In this situation, the advisor must address a very real client concern: “What if the policy underperforms the illustration and I outlive life expectancy?”

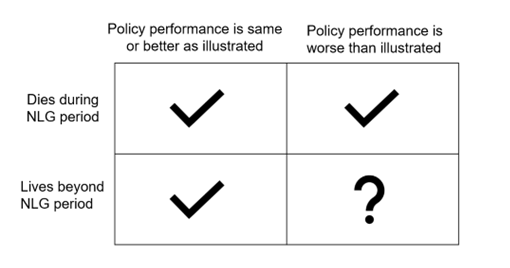

This leads to the third thing successful advisors do: they show how “guarantee” duration does not necessarily mean “coverage” duration. The easiest way to do this is to draw a simple two-by-two grid to map out four possible outcomes. In three of the four, “Option A” will be the clear favorite. In the other one, the better solution will depend on how long the client lives and how much worse the illustrated performance is.

Showing a grid like this has three benefits. First, it eliminates a false assumption that life insurance coverage doesn’t necessarily disappear after the no-lapse guarantee period. Second, it helps the client see that the adverse outcome is not the only possible outcome. And, finally, it helps show that there may be adverse scenarios that will still keep coverage in force well beyond the manufacturer’s warranty. Advisors can then get creative in addressing adverse scenarios through different illustration designs.