What the RIA Industry Looks Like Now, in 4 Charts

The number of investment advisors registered with the Securities and Exchange Commission continues to grow, with the number of firms hitting 15,396 in 2023, up from 15,114 in 2022, according to data from the Investment Adviser Industry Snapshot, a joint effort by the Investment Adviser Association and COMPLY.

The just-released report showed continued growth in the number of asset management clients to 56.7 million in 2023, a 4.4% increase over 2022. The number of total clients also increased by 3.5% from a year earlier.

“The past year again illustrates the important role that the investment adviser industry plays, both by providing crucial advice to investors and as an essential contributor to the markets and the economy,” said IAA President & CEO Karen Barr in a statement. “Individual investors increasingly recognize the value of fiduciary advice as they seek to save and invest for retirement, home ownership, education, and other goals.”

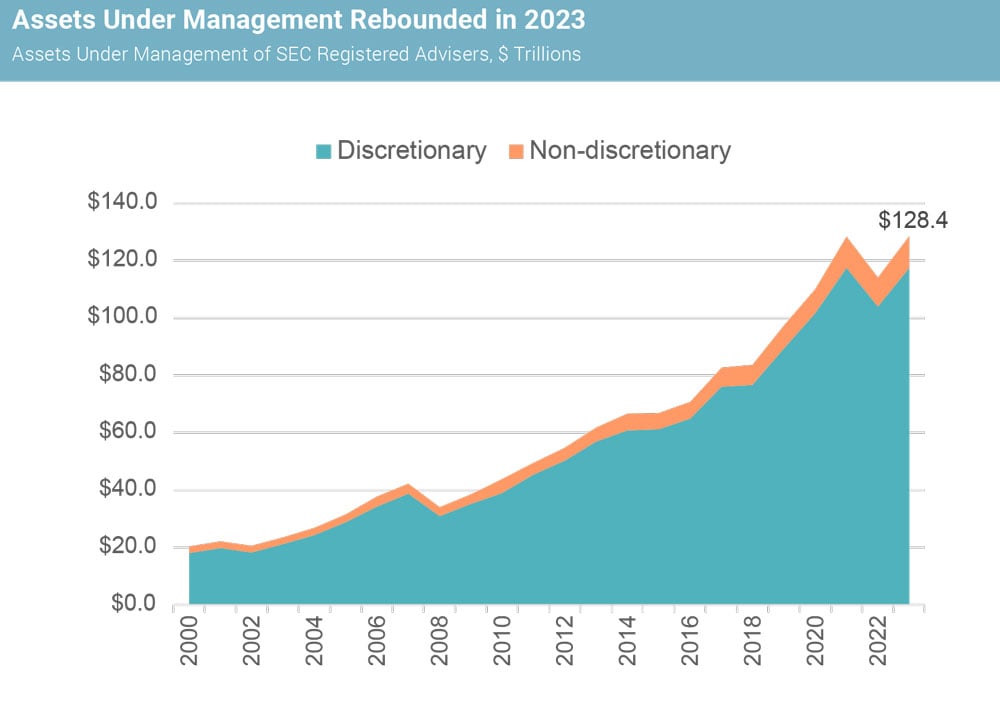

In 2023, assets managed by SEC-registered investment advisors rose by 12.6%, rebounding from difficult market conditions the previous year and returning to the record high of $128.4 trillion set in 2021, the report notes.

The number of RIAs grew by 1.9%.

Charts: IAA

Many RIAs are small businesses. The report states that in 2023:

92.7% of RIAs had 100 or fewer employees;

Over two-thirds of advisors managed less than $1 billion in assets, and nearly 90% managed less than $5 billion;

Advisors focused on individuals as clients were likely to be small, with an average of just nine employees, two offices, and $365 million in assets under management; and

Advisors with less than $1 billion in assets accounted for almost all of the new SEC registrations, with new registrants accounting for nearly 10% of firms in this size range.

RIAs range in size from local Main Street businesses to multinational corporations.

In 2023, 88% of RIAs had less than $5 billion in assets under management, with more than half managing between $100 million and $1 billion, according to the report.

“By contrast, in 2023, 92.4% of industry assets were managed by firms with more than $5 billion in assets under management, with 66.1% of assets managed by the 207 largest firms,” the report said.

In 2023, assets managed by RIAs rebounded from the prior year’s decline, returning to 2021 levels.

Over the past 23 years, assets have increased by 8.4% per year on average, the report states.

“This rate of growth exceeds the 7.8% average annual return for large stocks, an indicator of the increasing importance of the investment advisory industry,” according to the report. ”As in prior years, in 2023, almost all assets were managed on a discretionary basis (91.4%).”