What Powell's Comments Mean for Stocks: Siegel

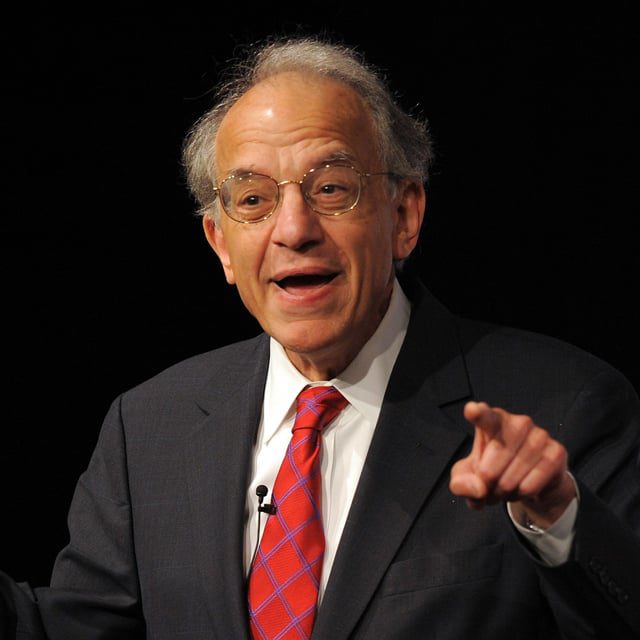

Federal Reserve Chairman Jerome Powell’s comments after the central bank raised its benchmark interest rate yesterday contained a positive signal for the stock market, Wharton School and WisdomTree economist Jeremy Siegel said Thursday.

The Fed, seeking to further reduce high inflation, raised the rate by 25 basis points to a 5.25% to 5.5% range, as anticipated, Wednesday after pausing its aggressive hiking cycle in June.

At a press conference after the move, Powell indicated the Fed would closely monitor upcoming economic data and consider interest rate decisions on a meeting-by-meeting basis, implying the central bank could hike or potentially pause again at its next meeting.

Siegel, speaking on CNBC’s “Squawk Box,” said Powell seemed to acknowledge that the economy faces downside risks.

“This was the best news conference I heard from Jay Powell in over a year,” Siegel said. “He virtually came close to saying there’s balanced risks out there.”

Three key sensitive economic indicators — money supply, commodities and housing prices — have stopped falling, Siegel noted, adding that very high interest rates aren’t having as negative an effect as he had feared.

That, combined with Powell now saying, “‘I’m going to look at both sides of the equation,’ I think is very positive for the market,” Siegel said.

While Siegel expected stocks to rise this year, “I certainly am surprised at the upside. Again, I thought maybe 15% this year, now we’re closer to 20 and going up,” he said.