What If a Client Asks ChatGPT About the Elections?

What You Need to Know

A veteran advisor asked ChatGPT to emulate a financial advisor.

The AI program gave a pretty good answer.

Part of the advice: The users should talk to someone like you.

With it being an election year, many clients want to know how markets will react.

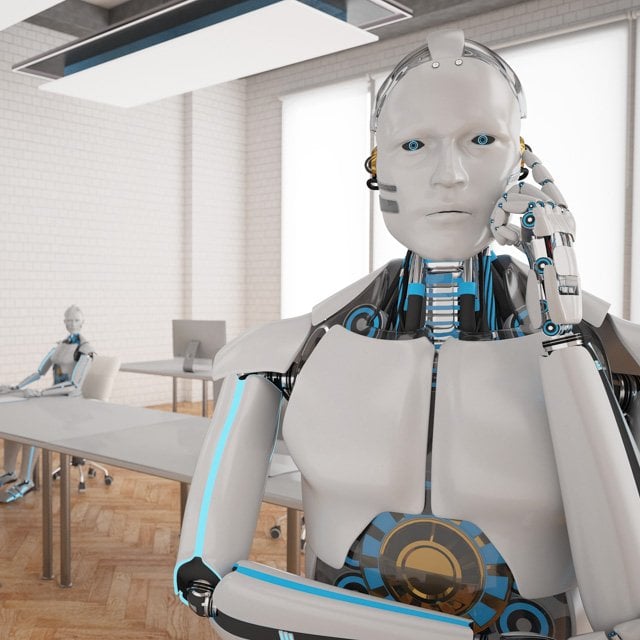

I decided to give a question about the elections to ChatGPT, a popular artificial intelligence program, to see what type of advice it would provide consumers.

ChatGPT was prompted to act as a financial advisor and to provide a response geared toward consumers.

Here’s what happened.

The Conversation

The question: How do markets normally react in an election year?

The answer: Market reactions during election years can vary based on a range of factors, and past performance does not guarantee future results. However, there are some general trends and considerations:

#1. Market volatility: Election years can introduce uncertainty, and markets often don’t like uncertainty. This can lead to increased volatility in the short term.

#2. Policy impact: Market reactions can be influenced by perceived changes in economic and fiscal policies associated with different candidates or parties. For example, proposed tax changes, regulatory policies, or economic stimulus plans can impact specific sectors.

#3. Historical patterns: While there is no consistent pattern, some historical trends suggest that markets might experience increased volatility leading up to the election, with a potential relief rally once the election is over and uncertainty diminishes.

#4. Sector rotation: Investors may adjust their portfolios based on expectations of how different sectors will perform under different political scenarios. Certain industries may benefit from specific policy proposals.

#5. Global factors: Economic and geopolitical events outside the election can also influence market behavior. Global economic conditions, trade tensions, or other international events can impact markets concurrently.

#6. It’s crucial to note that individual circumstances, investment goals, and risk tolerance should guide investment decisions. Diversification and a long-term perspective are often key components of a well-constructed investment strategy. Additionally, consulting with a financial advisor who can provide personalized advice based on your specific situation is recommended.

An Assessment

The information ChatGPT provided is fairly accurate and in line with what I’ve been telling my clients.

It presented a quick and concise summary of the top factors that could impact the market in any election year.