What are the new Mortgage Lending Rules in Ireland?

Getting a mortgage was a cinch in olden times (the noughties).

Deposit? Pah – 100% mortgages were the norm.

3.5 times income? Pfff – Borrowing 8 times income was a breeze

You could even self-certify your earnings!

Yeah, I know, it didn’t end well, and this laxer lending made the Central Bank more cautious when laying down Ireland’s current mortgage lending rules.

But are things changing?

What are the new Mortgage Lending Rules?

Posting the keys of your new home on social is the ultimate “I’ve succeeded at adulting” humblebrag.

But with inflation, increases in interest rates, and a pretty shitty-looking housing market, owning a home has become a pipe dream for many.

But fear not!

It looks like the Central Bank has heard our cries of desperate disappointment and is throwing us a bone.

The good news is fourfold.

Increase in borrowing limits

Borrowing limits are raised for second-time buyers.

More people can be considered as first-time buyers

Smaller deposit requirement

Let’s break down these rules so you know exactly what the changes are and how they might help you in your quest for home ownership.

Onward!

What has the Mortgage Borrowing Limit Increased to?

As alluded to above, the Central Bank imposed some serious income-based rules to control the housing market after the crash.

It’s gone OK, and those measures have done their job, but, let’s be honest, it’s made it a right pain in the arse to purchase a home because prices have only gone one way.

Ask Yazz.

Adding investment funds, cash buyers, and non-cash buyers with big cash deposits to the mix have made it impossible for some people to buy a home under the previous lending rules.

So, for some, these new rules are a godsend.

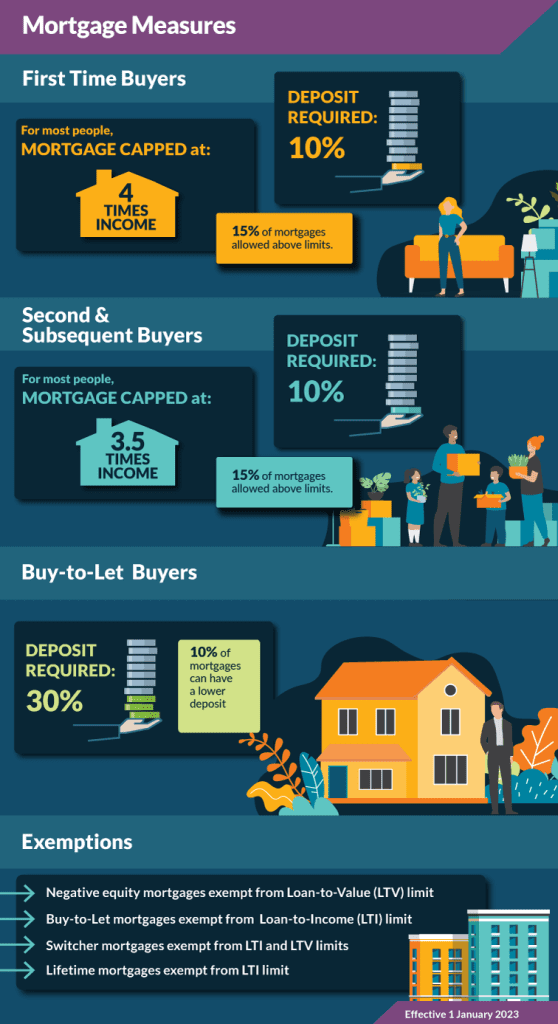

Instead of your mortgage lender being unable to lend you any more than 3.5 times your annual income, they can now lend up to 4 times your annual income.

Is it a panacea to all the ills of the housing market? Eh, no, but it will help many first-time buyers get a bigger mortgage.

Will this just cause house prices to increase further because the government refuse to build enough houses? Probably. Anyway, not the place for a rant Nick, let’s get back to it.

Yes, you heard that right; the new 4x income rule is only available to first-time buyers.

Second home purchasers, you are shit out of luck, compadre.

There is also some wiggle room baked into the new rules.

If the four times borrowing limit still doesn’t give you what you need, lenders can now give up to 15% of all mortgage applications a little more mortgage borrowing flexibility.

In layman’s terms, if you’re lucky, punk, your mortgage lender may even offer you more than four times your annual income.

Yep, it won’t be long until we’re back at 8 times income and 100% mortgages because bless us and save us, above all else, we have to stop the bubble bursting again. Defo last rant, sorry.

However, to force you to live in the box room at your Ma’s for the foreseeable, first-time buyers will still need to pony up a 10% deposit.

Can Second Time Buyers Borrow More?

Second-time buyers haven’t been left entirely in the cold regarding the new mortgage lending rules.

No longer will you have to stump up for a whopping 20% deposit!

Second-time buyers will only need a 10% deposit for their next home as the maximum LTV (loan to value) mortgage moves from 80% to 90%.

However, your borrowings are still capped at 3.5 times your income for unless you’re a member of the 15% cozy cartel that can get a bit more.

It’s not a massive change, but it will make it easier if you want to upgrade your home to something a little roomier.

That said, buy-to-let buyers are still in the same boat as before, with their LTV limit still set at 70. In simpler language, (if you’re buying a property to rent out, you need to bring a tasty 30% deposit to the table).

Here’s a pretty picture explaining things.

Can You be a First-Time Buyer if You Already Owned a Property?

This is a doozy.

Before the rules changed, you could only achieve First-Time Buyer (FTB) status if you never owned a property before.

But the Central Bank has widened the criteria for FTBS meaning waaaaay more people will now be able to avail of the FTB benefits outlined above (smaller deposit, 4x earnings for those who have already forgotten!)

It’s called the ‘fresh start’ or F-ART.

Now, borrowers who are divorced, separated, or have gone through bankruptcy or insolvency could be considered a first-time buyer if they no longer own property.

Pretty sweet, right?

But wait! There’s more.

If you are a first-time buyer and you need additional borrowings, you may be considered a first-time buyer.

How will this help?

Let’s say you earned 100k and got a mortgage for 350k (as per the previous 3.5x income rule)

You still earn 100k, so you now qualify for €400k (4 times your income), so according to the new rules, you can get a top-up of 50k.

Not from me, though, I have no money.

You will have to go to a bank.

Have fun.

So, What Does This Mean For You?

Lookit.

Some first-time buyers will be happy; others will be bashing their heads against a wall or their fingers against a keyboard.

Personally, I think it’s all fur coat and no knickers.

Housing prices are still skyrocketing, and the number of houses on the market is still well below actual demand.

So, take it from me, these new rules will not put an end to the mile-long house viewing queues or bidding wars.

Yes, you can borrow more but so can the people you are bidding against, so actually scoring that elusive home house will still prove to be a battle of wills and determination.

Right, that’s enough doom and gloom from me.

I really hope the changes help you (YES, YOU THERE) buy a home!

Call that a plug?

This is a plug!

If the new rules mean you’re successful in getting a whopper mortgage to buy your dream gaff, you’ll need mortgage protection….ya see where this is going.

Have a gander at this blog First Time Buyers Guide to Mortgage Protection – it explains all you need to know.

Get in touch if you need some help.

Need it now, immediately, asap? Complete this questionnaire, and I’ll be right back.

Thanks for reading (and sharing)

Nick