Wall Street Is Worried Over T+1's Quicker Settlement Time

What You Need to Know

A spike in the number of failed trades, operational glitches and additional costs are among industry fears as the trading process accelerates.

The T+1 regime increases the chance of failures because the compressed timeframe makes it harder for buyers and sellers to ensure their funds and securities are ready.

The U.S. switch also means it’s leaving other jurisdictions behind, which is a headache for many investment vehicles operating across borders.

When U.S. markets reopen next Tuesday after the long weekend, everything will likely seem normal. It’s only after the close and in the following days that any cracks are expected to appear.

A spike in the number of failed trades, operational glitches and additional costs are among industry fears as the trading process for American securities accelerates, with the time allowed to complete every transaction halved to a single day.

Spurred on by the original meme-stock frenzy, the Securities and Exchange Commission is pushing the shift to reduce the chance of something going wrong between when a trade is executed and when it’s settled. But the switch to what’s known as T+1 comes with risks of its own.

International investors — who hold about $27 trillion in American markets — face a system in which the usual method of funding a US trade takes longer than they actually have to execute the deal.

Unheralded parts of the trading process like affirmation (confirming details), fixing errors, and recalling securities out on loan must happen at least twice as fast. Global funds face a mismatch where cash flowing in and out moves at a different speed to the assets they have to buy and sell.

And it all faces an immediate stress test as some of the world’s major indexes rebalance or reveal planned reconstitutions before the end of this month.

“All hands will be on deck,” said Michele Pitts, Citigroup Inc.’s global head of custody data for securities services, noting the likelihood of increased trade fails across the industry. “There will be a significant uptick in settlement risks for the first several weeks.”

‘Lot of Anxiety’

Under current rules, anyone purchasing a U.S. stock has two days between hitting the “buy” button and actually having to deliver money for the trade, while the seller has the same time to supply the share.

This lengthy settlement period in such a large and sophisticated market is what remains from the days when transactions were manual, and investors had up to a week to complete.

That’s been whittled away over the years, and new SEC rules will slash the settlement time again on May 28 to one day. Across Wall Street and beyond, major banks, asset managers and an assortment of specialized service firms are bracing for the fallout.

At JPMorgan Chase & Co., internal modeling shows about a quarter of the currency trades it processes for clients are set to be impacted. Brown Brothers Harriman & Co. is putting clients through a “T+1 simulator” to identify those with potential issues.

Institutions including Societe Generale SA, Citi, HSBC Holdings Plc, UBS Asset Management, Baillie Gifford and more say they’re either moving staff, reorganizing shifts or building new systems — and in some cases all three — in preparation for the switch.

“There’s a lot of anxiety even just around the technology and the actual way by which settlement will take place,” Amy Hong, head of market structure and strategic partnerships for global banking and markets at Goldman Sachs Group, told the Bloomberg Sell-Side Leaders Forum this month.

“There are going to be some mismatches around funding, there are going to be some FX-related issues that we’re going to need to work out,” Hong said.

The world of finance and investment can be famously averse to change, with doomsayers dependably appearing whenever new rules are proposed. Yet in the case of T+1, the concerns go beyond one or two market Cassandras.

Just 9% of sell-side firms polled by Coalition Greenwich in April and May said they expect the T+1 switch to go smoothly, with 38% warning that buy-side managers are unprepared, and 28% believing trading platforms aren’t fully ready. Almost a fifth anticipate a large disruption with “many or severe issues.”

The consensus view is that trade failures — when either a seller doesn’t deliver securities or a buyer fails to produce payment — are about to rise. The question is how large and persistent that uptick will be.

Settlement failures are generally a tiny feature of the modern market, usually stemming from technical issues or human error. They can result in regulatory punishment, loss of capital tied up in the trade, and even — in very rare instances when the transaction is large enough — the collapse of parties in the deal.

The T+1 regime increases the chance of failures because the compressed timeframe risks making errors more likely, while at the same time reducing the opportunity to correct them. Most crucially, it makes it harder for buyers and sellers to ensure their funds and securities are ready.

The $7.5 trillion-a-day foreign-exchange market is a flashpoint of the shift, because currency trades typically settle on a T+2 basis. An overseas investor buying a US stock will soon need to either have dollars ready or find them within a day in an arena where it can take two.

Friday Fears

From its Edinburgh headquarters over 3,200 miles from Wall Street, the £225 billion ($285 billion) investment house Baillie Gifford has relocated two traders to New York and beefed up its settlement desk to help the firm stay active after the 4 p.m. US stock close.

Thanks to the T+1 shift and a 6 p.m. deadline at CLS Group (a platform at the center of the market that settles over $6 trillion of currency transactions every day), that will become a crucial period for asset managers seeking dollars to fund their U.S. trades.

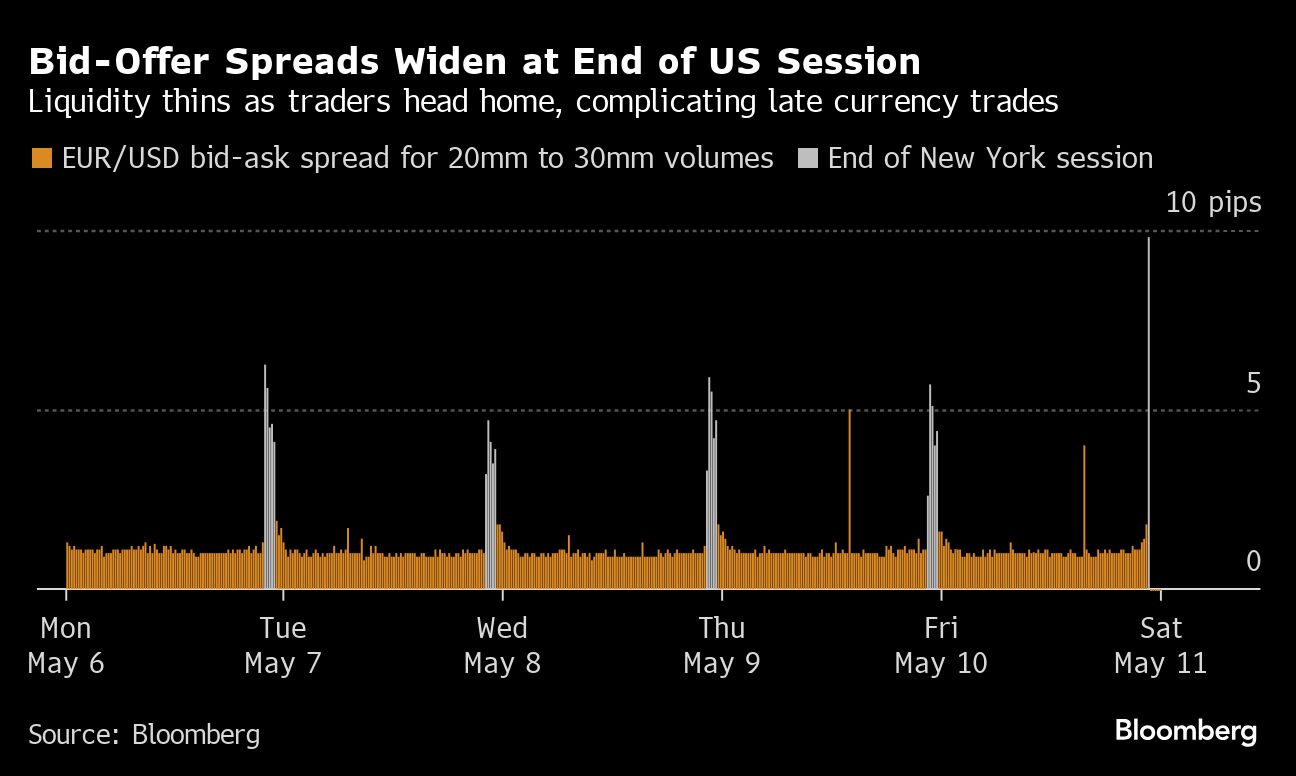

But it also falls around the start of what are known as the witching hours in foreign-exchange circles because of the famous lack of liquidity.

“If you look at the bid-offer spreads, they’re generally tight throughout the day and when you get to the 5 p.m. to about 8 p.m. Eastern, they just widen out,” said Brendan Burke, a managing director at BBH. “It’s as simple as there’s less liquidity in the market because the banks aren’t staffed.”

Baillie Gifford has lobbied US regulators to get banks to extend their foreign-exchange trading hours and to continue providing liquidity until at least 6 p.m. in New York, five days a week. Since moving its staff in January, the firm has been trading as if T+1 was already in force to ensure everything goes smoothly, according to Adam Conn, head of trading.

“It’s about trying to mitigate the additional operating risk which is falling on asset managers,” said Conn. There will only be a “very short window” after the US market close to resolve problems, he said.

Friday afternoon is emerging as a particular area of concern, because currency markets close on weekends, meaning liquidity is typically at its lowest just before the US joins Europe and Asia in clocking off. JPMorgan’s Brijen Puri, head of global FX services, said “neither the buyside or sellside really knows what will happen” in those periods following the switch.

“Once there is more data about what’s happening in that time zone, that’s when banks as well as asset managers may decide on providing more coverage,” Puri said. “Like you have a night desk, you may have a Friday evening desk.”