Wall Street Builds on $3T Stock Rally

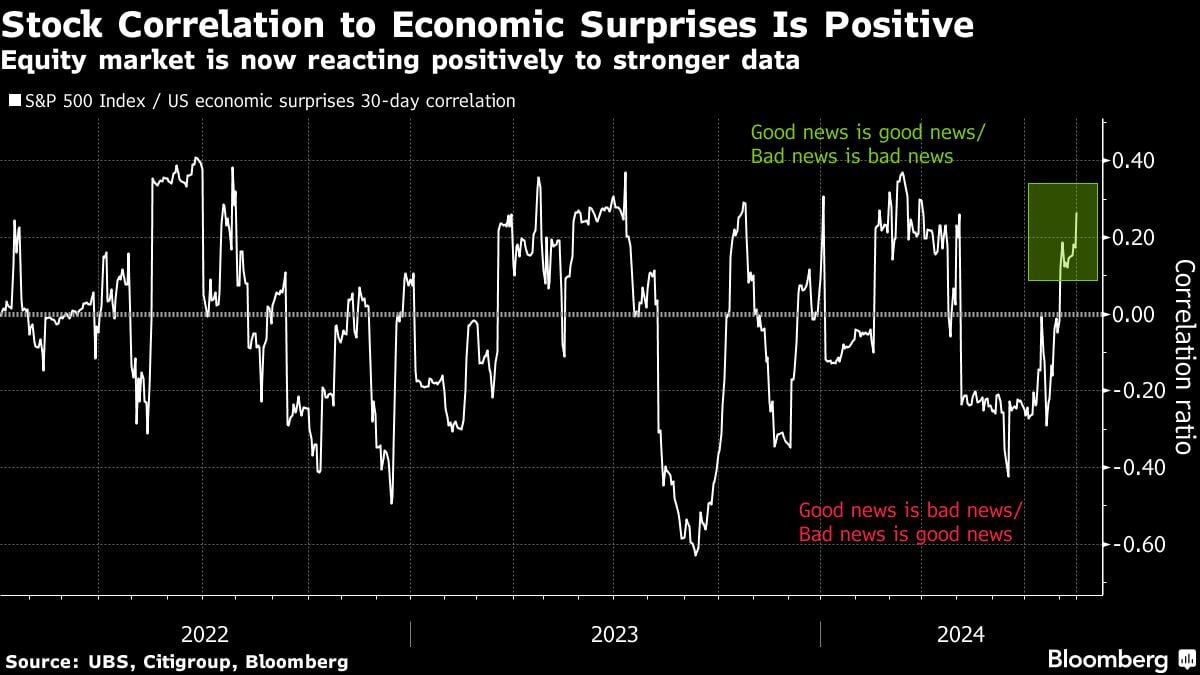

Stocks climbed for an eighth straight day — the longest winning streak in 2024 — with traders hoping the Federal Reserve will signal it’s ready to start cutting interest rates.

With the central bank approaching a crucial pivot point, it’s difficult to overstate how much attention financial markets will be paying.

For starters, they’re looking for confirmation from Jerome Powell Friday that the Fed will lower rates in September.

But more drama surrounds what happens after that and the pace of additional cuts over the next several months as the Fed confronts the dual risks to both inflation and employment.

At Bank of America Corp., Ohsung Kwon says the Fed is unlikely to “out-dove” the market, but as long as growth is OK, equities can withstand a less-dovish Fed.

“Stocks just need a nod that growth is going to be supported,” Kwon said. “While our view is that risk is to the upside, we do not believe that Jackson Hole will spur the large equity moves that it has in the past when the Fed used it as forum to telegraph upcoming policy decisions.”

The S&P 500 extended a rally that’s already added over $3 trillion since the Aug. 5 low.

Advanced Micro Devices Inc. agreed to buy server maker ZT Systems in a deal valued at $4.9 billion. Estée Lauder Cos. gave a disappointing sales forecast. Lowe’s Cos, Target Corp. and TJX Cos are among the major retail names reporting this week.

Treasury 10-year yields fell two basis points to 3.86%. Oil sank 3%. Secretary of State Antony Blinken said Israeli Prime Minister Benjamin Netanyahu has accepted a cease-fire proposal for Gaza and “the next important step is for Hamas to say yes.”

To Neil Dutta at Renaissance Macro Research, the Fed is cutting in September, the only question is by how much.

“I don’t think Powell is going to greenlight a big move, but he won’t torpedo the idea entirely either,” Dutta said. “Powell is likely to acknowledge that the balance of risks has changed, dramatically since the June Summary of Economic Projections. Removing optionality in such a situation is not prudent.”

“So, in this regard, I think the fabled ‘Powell Put’ makes a comeback this week,” Dutta said.

All told, Dutta notes the equity market seems “a bit too enthusiastic” relative to the tone of the incoming economic information. Looking ahead, there is good reason to assume the pace of consumers’ spending slows, he concluded.

A bumpy stretch for traders across financial markets in the dog days of July and August hasn’t tempered their zest for stocks, with allocations to the asset class still robust despite a bout of recent volatility and heightened uncertainty around the economic outlook.

‘A Wall of Worry’

“Investors ‘climbed a wall of worry’ as the stock-market relief rally gained momentum,” said Craig Johnson at Piper Sandler. “Equities will likely consolidate ahead of Fed commentary at Jackson Hole this week.”

Equity positioning is back up to moderately overweight, a week after sliding to underweight, according to Deutsche Bank AG strategists including Parag Thatte and Binky Chadha, who said exposure remains well below the mid-July highs at the top of the historical band.