Wait a minute, what is a Waiting Period? [Navigating this crucial clause in your policies]

![Wait a minute, what is a Waiting Period? [Navigating this crucial clause in your policies]](https://www.insurancenewsmag.com/wp-content/uploads/2023/01/1672736439_Wait-a-minute-what-is-a-Waiting-Period-Navigating-this-1024x683.jpg)

We kick off the year by taking a close look at something that everyone should really know about when buying (most) insurance policies.

This knowledge could be the difference between a successful claim – or a disappointing rejection.

Let’s go!

What is a Waiting Period?

A waiting period is the minimum period that an insured must wait before some (or all) of their policy benefits come into effect.

Should there be a claim made before the waiting period is up, the insurers may reject the claim outright.

If this is the first time you have heard of this term, fret not – most people aren’t aware as well. Hence the existence of this article.

Why do they exist?

Believe it or not, it exists to protect your interests.

Ok, probably more so of the insurers’ interests, but you get protected as well. Here’s why.

Waiting periods exist to deter people from buying insurance knowing that they are going to claim in a short amount of time. This process is formally known as adverse selection, and if left unchecked, would drive up premium costs for everyone involved.

When are they usually present?

Typically, they exist for policies that provide health-related claim benefits – like integrated shield plans, critical illness coverage (early or late stage).

This is because things like illnesses can be detected (but not declared at the point of buying insurance).

An example being our protagonist Tom, who visits a doctor overseas who diagnoses him with cancer. He then comes back to Singapore, takes out a hefty term policy covering critical illness without declaring it to the insurer.

Without the existence of the waiting period clause, Tom can then make a claim on the same day that the policy is issued.

Most health insurance policies impose a waiting period of between 30 days and 90 days from the approval of cover. Read more from MoneySense here

What are some examples of Waiting Period clauses?

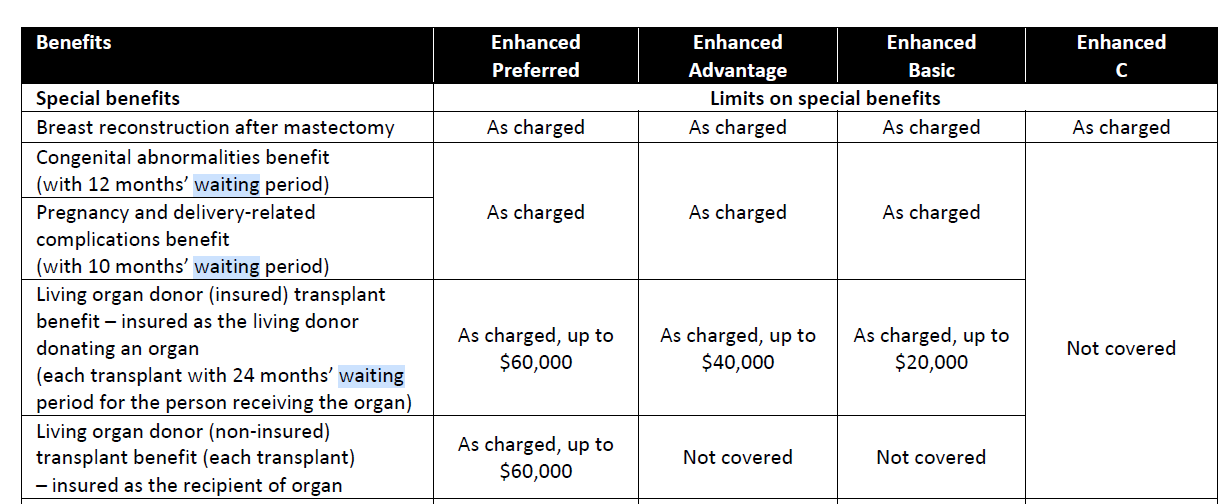

We extract two examples of Waiting Period clauses here

From a Term Plan offering Critical Illness Cover

From an Integrated Shield Plan

Note the separate waiting periods for different benefits

How might they affect me?

This means that to get the full benefit from all policies, the waiting period must be fulfilled prior to making any claims (if you want them to have the highest chance of success)

For new policies, this means waiting it out (hurr hurr) till the relevant waiting periods are over.

For replacement of existing policies (buying new polices to replace older ones), this means that the replacement policies only provide their full benefit after the waiting period are over.

In other words…

What are the best practices to adopt?

This is crux of the whole article, so pay close attention here.

For new policies that you might be considering, buy them ASAP. This is because you never know when or what disaster may strike (check out this unexpected brain bleed while travelling), so the earlier you get covered, the sooner you fulfil the waiting periods, if any.

For replacement of existing policies, check for the waiting period of the replacement policies first, and we recommend buy the replacement policy AND keeping the old policy until the waiting period of the replacement is over.

And finally, just because we want you, our gentle reader, to be morally upright always, we are going to include an unscrupulous practice that should be avoided at all cost.

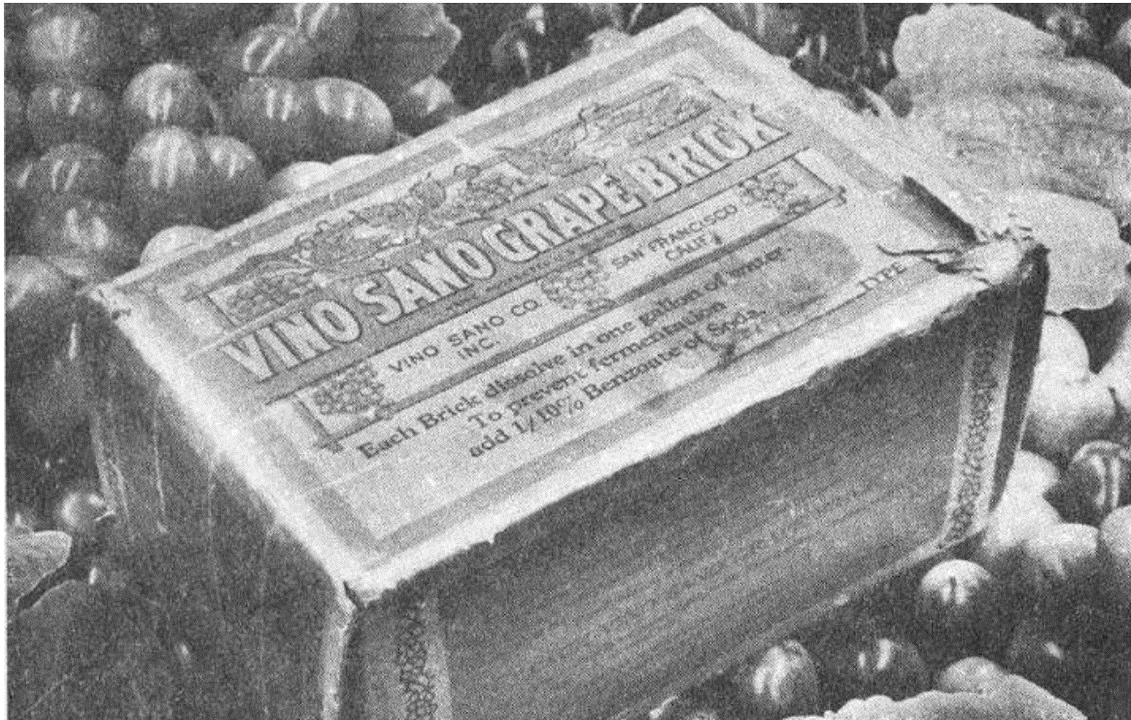

Only make claims on your policy after its waiting period is over. This is similar advice to the grape brick manufacturers who gave specific instructions to their customers on how NOT to make wine during the prohibition in the 1930s.

“After dissolving the brick in a gallon of water, do not place the liquid in a jug away in the cupboard for twenty days, because then it would turn into wine.”

Take Action now

Want to set yourself up for a financially strong 2023?

Let us help.

Whether is it doing policy reviews, exploring options to reduce cost for your existing coverage, or simply getting properly covered, we can link you up to our agent partners.

Simply sign up here and complete your financial discovery journey.

At the end of it all, you get freebies, merch, and most importantly of all – gems that can be converted to cash when you make any purchase via our agent partners.

You can compare across various insurers, get the best policies for yourself, and enjoy any promotions from the insurers AND US.

Cash and Clarity – now that is a great way to start 2023, wouldn’t you agree?

Sign up today