The Ups and Downs of Going Independent, in 10 Charts: Schwab

Financial advisors considering going out on their own are weighing several paths to independence while facing multiple challenges in doing so, according to a new Charles Schwab study.

“The path to independence is alive and well — and, as the study shows, is evolving in new, interesting ways. There are more choices than ever as financial advisors seek independence,” said Jon Beatty, chief operating officer of Schwab Advisor Services, in an interview with ThinkAdvisor.

“A flourishing ecosystem system has sprung up around advisors over the past 30 years — with custodians playing a crucial role, along with fintech players, outsourcing partners, pay-for-service organizations and enterprise firms that set up platforms for advisors to join,” Beatty explained.

This means there’s “more complexity than ever, so support for advisors with the process [of going independent] is more critical than ever,” he noted.

Advisors must decide what services to offer, the client demographic they want to serve, what technology to use, which custodians to work with, and how they’ll pay for the change, among other choices, the report points out.

The study is based on responses collected in March and April from 200 financial advisors — 158 of whom were then working for a broker-dealer and considering a move to independence over the next three years, and 42 of whom had joined an RIA and gone independent over the past four years.

Here are 10 critical findings from the Schwab Advisor Services Supported Independence Study. Click on the images, which come from Schwab’s report, to enlarge.

1. Advisors take different paths to independence.

Advisors currently considering independence are more likely to join or affiliate with an existing registered investment advisor (44%) than create their own firm (31%), while 24% are unsure which path they’ll take, the study found.

In contrast, recently independent advisors were equally likely to have formed their own RIA firm as they were to have joined or affiliated with an existing RIA.

Among the advisors Schwab interviewed one-on-one, the more risk-averse were more likely to lean toward joining a firm, according to the study, which found advisors considering independence expressed worry about the financial effects of starting their own business.

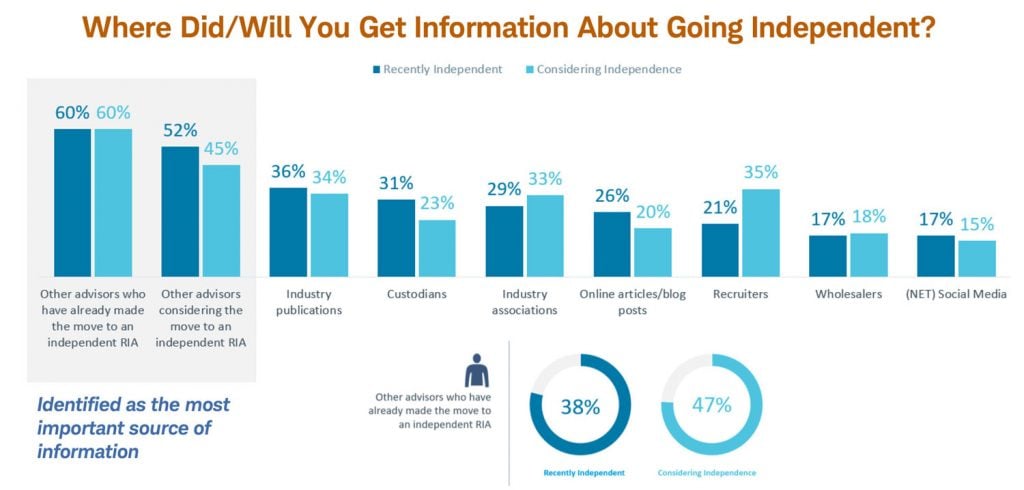

2. They turn to peers for support.

The survey found that 60% of advisors considering independence are most likely to seek advice from peers who previously made the transition, while 45% said they would consult with other advisors weighing independence.

Nearly half, or 47%, cited advisors who have already gone independent as the most helpful information sources.

Findings were similar for newly independent advisors, with 60% saying they turned to those who had already transitioned and 38% indicating these advisors were their best information source.

“These are very very reassuring findings,” said Beatty. “Often, advisors considering this [move] reach out to peers, so there’s a virtuous ecosystem that should bring even more advisors into independence.”

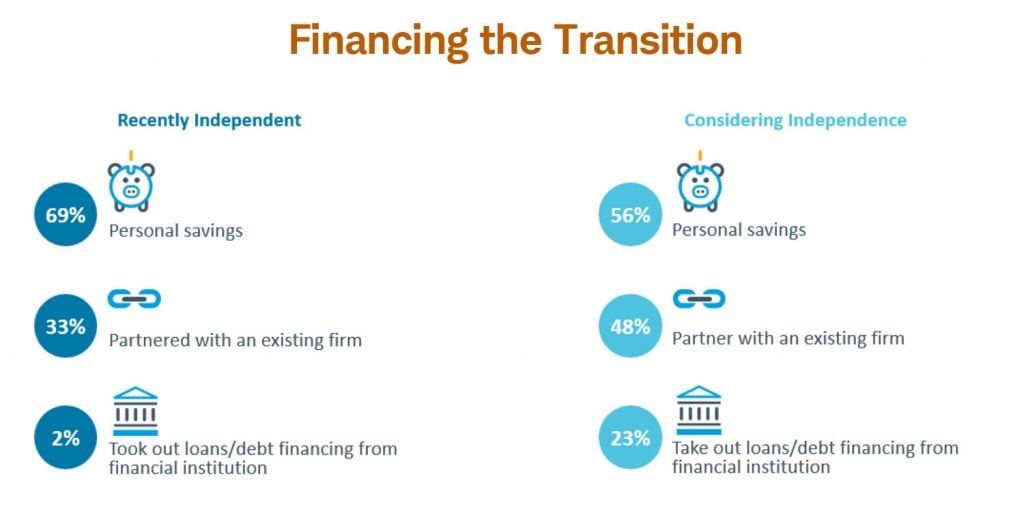

3. They see different ways to pay for it.

Going independent can be costly, whether an advisor establishes their own RIA firm or move their business to an existing RIA, Schwab noted.

The advisors polled indicated they were or are most likely to use their personal savings to support the transition, with 69% of recently independent and 56% of considering advisors citing this method as their preferred route.

Partnering with an existing firm, which 33% of recently independent and 48% of considering advisors cited, is the second most-favored option, which Schwab called unsurprising as this option helps reduce startup costs for those with less financial flexibility.

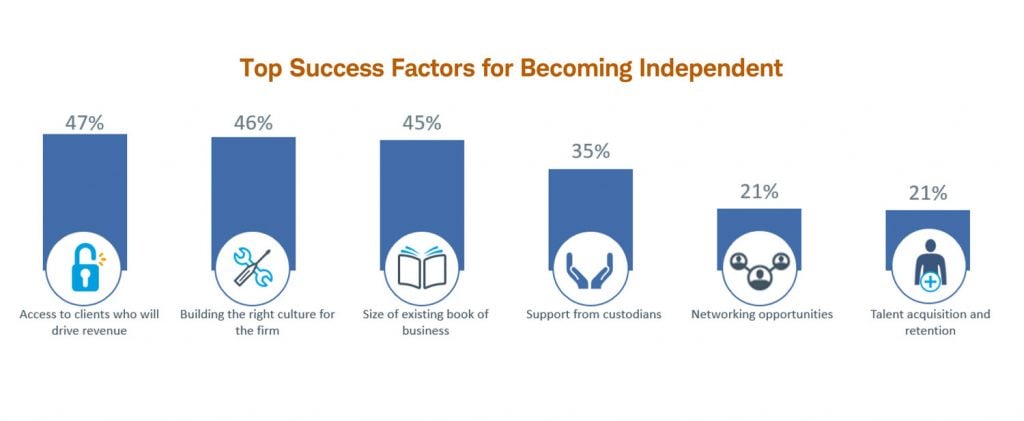

4. The three C’s of success are clients, culture and custodians.

Besides money and advice, advisors need to consider other factors that will help them succeed in going independent.

Forty-seven percent of both advisors who recently became independent and those considering it cited access to clients who will drive revenue as a key factor to achieve that success, the study found.

Building the right culture for the firm also ranked high, as did the advisor’s existing business size. And over a third cited support from custodians as an important success factor.

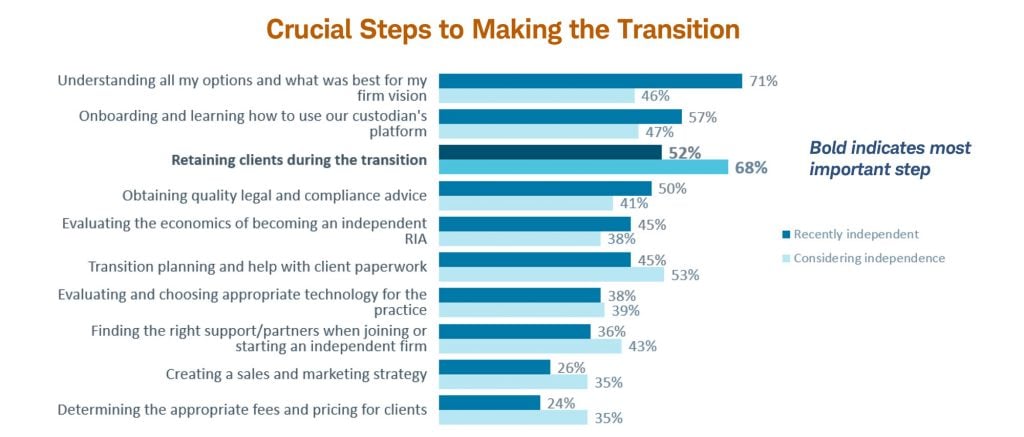

5. The most important steps to independence might not be what advisors expect.

Advisors considering the move and those who’ve made it already differed in the key steps they took, or plan to take, to transition to independence.

Among those thinking about going independent, 68% cited client retention and 53% named transition planning and client paperwork as the most likely steps they will take in becoming an independent advisor.