The Bancassurance Market Size to grow by USD 354.08 billion | Market Insights highlights the Increased Need for Insurance as key driver | Technavio – Yahoo Finance

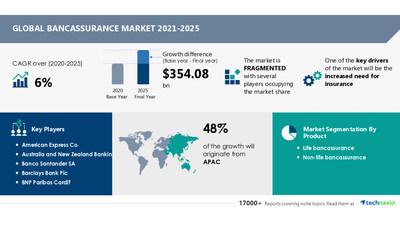

NEW YORK, Jan. 13, 2022 /PRNewswire/ — According to the research report “Bancassurance Market by Product and Geography – Forecast and Analysis 2021-2025”, the market will witness a YOY growth of 3.45% in 2021 at a CAGR of over 6% during the forecast period. Furthermore, this report extensively covers market segmentation by product (Life bancassurance and Non-life bancassurance) and geography (APAC, Europe, South America, North America, and MEA).

Attractive Opportunities in Bancassurance Market by Product and Geography – Forecast and Analysis 2021-2025

For more insights on YOY and CAGR, Read our FREE Sample Report

Vendor Insights

The bancassurance market is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market. Most bancassurers have begun focusing on characteristics like as product features, innovative solutions, pricing, brand awareness, and product portfolio as value-added services help fuel the market’s growth in the future. To boost their profit margins and market share, they also focus on extending their enterprises and geographical presence.

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

Find additional highlights on the growth strategies adopted by vendors and their product offerings, Read Free Sample Report.

Geographical Market Analysis

APAC will provide maximum growth opportunities in the bancassurance market during the forecast period. According to our research report, the region will contribute 48% of the global market growth and is expected to dominate the market through 2025.

China, France, Germany, Spain, and Japan are the key markets for the bancassurance market in the region. In China, about one-fourth of the population buys insurance plans on the internet. Millennials, often known as Generation Y, make up the bulk of this population. These are the people who insurance companies might want to target. These tech-savvy buyers want providers to supply solutions that eliminate the need for physical branch visits and allow them to do chores online using their preferred gadgets. This is expected to lead to increased investments in digital bancassurance, thus driving the growth of the focus market.

Story continues

Furthermore, countries such as the APAC, Europe, South America, North America, and MEA are expected to emerge as prominent markets for the bancassurance market during the forecast period.

Know more about this market’s geographical distribution along with the detailed analysis of the top regions. https://www.technavio.com/report/bancassurance-market-industry-analysis

Key Segment Analysis

The bancassurance market share growth by the life bancassurance segment will be significant during the forecast period. A life bancassurance policy provides financial protection against any financial loss that may occur as a result of the insured person’s untimely or premature death. This aids the beneficiaries in dealing with financial concerns in the event of the insured person’s death. For insurance clients, purchasing life insurance has become a critical financial decision. As people become more aware, demand for life insurance coverage is skyrocketing, according to bancassurance companies.

The advantages of availing of life bancassurance include the following:

Protection of immediate family members

High-risk life cover

Death benefits

Improved cash value offered by permanent life insurance schemes

High return on investments

Tax benefits

In emerging economies, the growth of the high-net-worth population and the middle class is likely to fuel the demand for life insurance products.

View FREE Sample: to know additional highlights and key points on various market segments and their impact in coming years.

Key Market Drivers & Trends:

The rising requirement for insurance is notably driving the bancassurance market growth. Droughts, floods, hurricanes, tsunamis, earthquakes, diseases, and volcanic activity have all increased the number of natural disasters, resulting in massive human and material losses. It resulted in a worldwide health crisis. The occurrence of such natural disasters and health crises prompted an increase in insurance demand.

Another factor driving the bancassurance market is Industry consolidation through partnerships. The number of strategic collaborations and M&A operations in the bancassurance business has increased significantly. Market participants can benefit from such activities by expanding their product portfolio, regional presence, and distribution network. Furthermore, strategic partnership projects allow businesses to obtain access to new technology and resources while also increasing their market share, which can help them grow their businesses during the forecasted period.

Download free sample for highlights on market Drivers & Trends affecting the bancassurance market.

Customize Your Report

Don’t miss out on the opportunity to speak to our analyst and know more insights about this market report. Our analysts can also help you customize this report according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time.

We offer USD 1,000 worth of FREE customization at the time of purchase. Speak to our Analyst now!

Related Reports:

Real-Time Bidding Market by Auction Type and Geography – Forecast and Analysis 2022-2026

Digital Payment Market by Component and Geography – Forecast and Analysis 2022-2026

Bancassurance Market Scope

Report Coverage

Details

Page number

120

Base year

2020

Forecast period

2021-2025

Growth momentum & CAGR

Accelerate at a CAGR of 6%

Market growth 2021-2025

$ 354.08 billion

Market structure

Fragmented

YoY growth (%)

3.45

Regional analysis

APAC, Europe, South America, North America, and MEA

Performing market contribution

APAC at 48%

Key consumer countries

China, France, Germany, Spain, and Japan

Competitive landscape

Leading companies, competitive strategies, consumer engagement scope

Companies profiled

American Express Co., Australia, and New Zealand Banking Group Ltd., Banco Santander SA, Barclays Bank Plc, BNP Paribas Cardif, Citigroup Inc., Credit Agricole SA, HSBC Holdings Plc, ING Groep NV, and Wells Fargo and Co.

Market Dynamics

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and future consumer dynamics, market condition analysis for forecast period,

Customization purview

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized.

About Us:

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

Technavio (PRNewsfoto/Technavio)

![]()

Cision

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-bancassurance-market-size-to-grow-by-usd-354-08-billion–market-insights-highlights-the-increased-need-for-insurance-as-key-driver–technavio-301459490.html

SOURCE Technavio