The Baby Boomers and Medicare

What You Need to Know

Soon, more than one-fifth of Americans will be over retirement age.

The percentage who have at least one chronic condition might shock you.

If ever there was a situation that called out for a thoughtful needs analysis, well…

Baby boomers made a significant impact on many aspects of American life as young and middle-aged adults, and now they are continuing to shape our country in new ways as they age into Medicare and alter demographics in the United States.

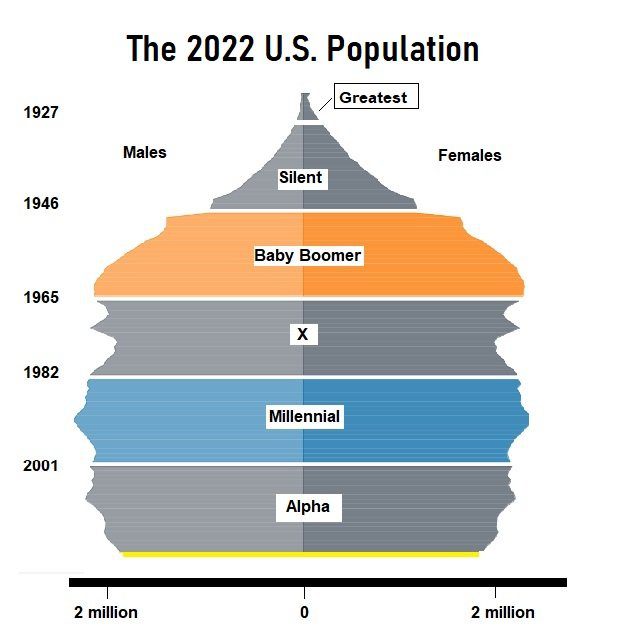

In less than eight years, those born between 1946 and 1964 (also known as the baby boomers) will all be over the age of 65. People ages 65 and older will make up 21% of the American population, up from 15% today.

This means that one in every five U.S. residents will be at retirement age.

The number of chronic conditions that may affect people as they turn 65 and older presents growing challenges.

The Challenges

According to the National Council on Aging, 80% of people 65 and older suffer from at least one chronic condition and 68% have two or more conditions, with hypertension, diabetes, and arthritis leading the pack.

Adding another layer of challenge to the health mix is the increasing prevalence of Alzheimer’s disease.

Currently, 6.5 million Americans suffer from this disease, and that number is expected to double in less than 30 years.

As the baby boomer population ages and they are impacted by increasing chronic conditions, financial challenges may impact them as well.

Based on health care industry averages, those 65 years and older spend more than $5,000 out of pocket annually and more than $400 per month on average on Medicare costs.

The Solutions

Health care insurance plans and brokers can provide solutions that address both the health care challenges and the financial challenges.

This is a particularly interesting time to think about Medicare, because the annual enrollment period for Medicare Advantage and Medicare Part D prescription drug plans begins Saturday.

Brokers are working to streamline the transition for individuals moving from individual or family plans with commercial insurance to the most appropriate, cost-effective, and beneficial Medicare Advantage plans, or into Medicare supplement insurance plans, which are also known as Medigap plans.

Both Medicare Advantage plans and Medicare supplement insurance policies, or Medigap plans, help cover costs not paid for by Original Medicare.

Providing Medicare plan options for aging-in adults that transition from their insurance to Medicare is essential to meeting their medical and budget needs.

In most states, after Medicare beneficiaries are outside a onetime Medigap open enrollment window, Medigap issuers can consider applicants’ health status when underwriting the applications.

One specific health care coverage solution that has met member needs at Blue Shield of California, for example, is a limited-time underwriting holiday that enables Medicare beneficiaries to sign up for select plans within our Medicare supplement portfolio without a medical examination.