Tax update: What physicians need to know about the current state of tax reform – Healio

Choose a Section

Tax Planning

March 11, 2022

4 min read

Source/Disclosures

Published by:

Disclosures:

Foos reports no relevant financial disclosures.

ADD TOPIC TO EMAIL ALERTS

Receive an email when new articles are posted on

Please provide your email address to receive an email when new articles are posted on .

“

data-action=”subscribe”>

Subscribe

We were unable to process your request. Please try again later. If you continue to have this issue please contact customerservice@slackinc.com.

Back to Healio

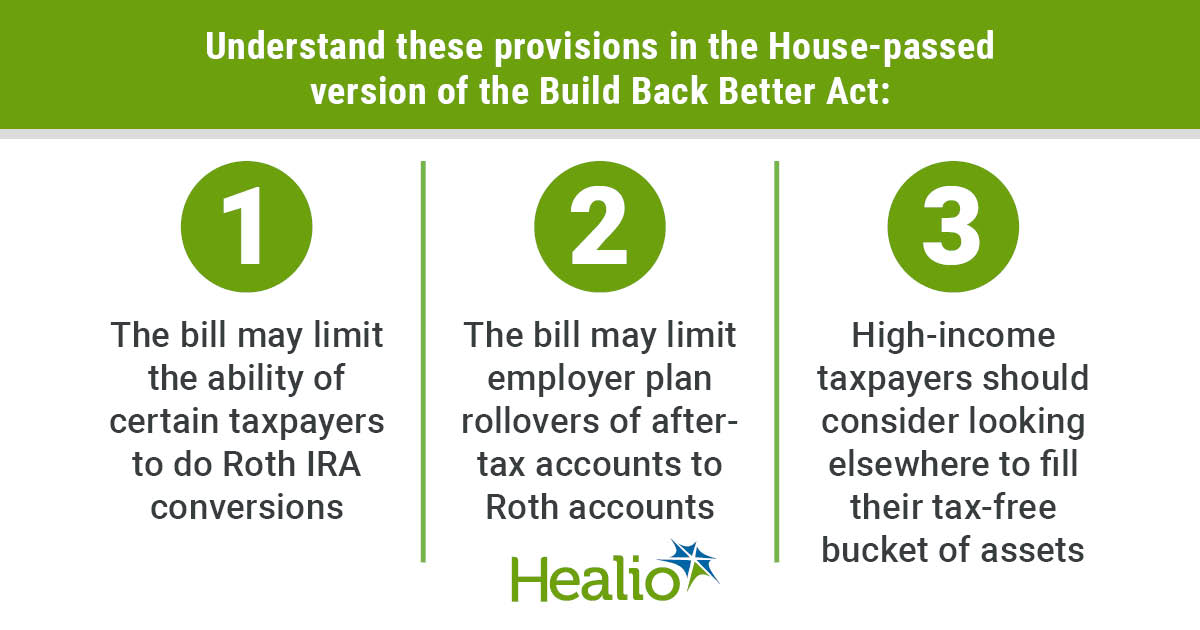

The passage of the Build Back Better Act by the Senate has been put on the back burner. But it makes sense for high-income earners and those with large retirement account balances to understand the provisions in the version of the bill passed by the U.S. House of Representatives in November 2021.

Provisions in the House-passed version of the bill would limit the ability of certain taxpayers to do Roth IRA conversions. It would also limit employer plan rollovers of after-tax accounts to Roth accounts, the so called “mega back door Roths.” Should these provisions remain in a Senate-passed version of the bill, high-income taxpayers would need to look elsewhere for ways to fill their tax-free bucket of assets.

Source: Carole C. Foos, CPA

Tax diversification

The concept of tax diversification is an important one for individuals with high net worth. Many physicians have placed a heavy concentration of retirement assets into their qualified retirement plans — both defined contribution (401k and 403b) and defined benefit plans such as cash balance plans. While these plans have provided a deductible contribution during the physician’s working years along with tax-deferred growth, distributions from traditional qualified retirement plans will be taxed at ordinary income tax rates as the doctor withdraws funds from the plans in retirement. No one knows what future ordinary income tax rates will be. What we do know is that many physician retirees often remain in a higher tax bracket in retirement, so qualified plan distributions may be subject to high ordinary income tax rates.

Because of this, it makes sense to also have assets that will be subject to lower long-term capital gains rates and some that will be tax free. Having assets in each of these buckets can act as a tax hedge in years of higher tax rates. One means of adding assets to the tax-free bucket has been the back door Roth conversion, which has allowed physicians and their spouses to make nondeductible contributions to a traditional IRA annually and then convert the traditional IRA balance to a Roth IRA in a tax-free conversion. Even if the taxpayer had other existing IRA assets that had not been taxed, a pro rata portion of the conversion was tax free.

House version

The House version of the Build Back Better (BBB) Act would eliminate back door Roth contributions effective Jan. 1, 2022, for single taxpayers with modified AGI (MAGI) over $400,000 and joint filers with MAGI over $450,000. The threshold for heads of household would be $425,000. In-plan rollovers of after-tax accounts to Roth accounts would also be eliminated for these taxpayers. In addition, beginning in 2029, taxpayers with combined IRA and defined contribution plan balances exceeding $10 million would be prohibited from making further IRA contributions. Certain contributions would still be allowed such as SEP and SIMPLE contributions and rollovers from eligible plans as well as assets received as a beneficiary or through a divorce or separation agreement. Individuals with combined IRA and defined contribution account balances that exceed the $10 million limit would need to distribute the excess amount as a required minimum distribution even if they are under the age of 72.

If the Senate passes a similar version of the BBB Act, high-income taxpayers will need to find alternative ways to fill their tax-free income bucket to have a hedge against future tax rate increases. One such option will be permanent life insurance policies as a supplement to traditional retirement income. Permanent (or cash value) life insurance policies come in many shapes and sizes. A properly designed policy can provide tax-free retirement income to physicians.

Cash value life insurance

Utilizing a permanent life insurance policy to supplement retirement income involves making premium payments with after-tax dollars. These premium payments serve two purposes: to cover the cost of the policy’s death benefit and to build up cash value in the policy. The policy’s cash value can be invested in various types of investments, depending on the type of product. One popular product invests the cash value into index options, such as the S&P 500 stock index. Typically, the investment options will include a floor so that if the index falls below the floor, the crediting rate remains at the floor (0% or even 1% or 2%). They also generally contain a cap. To the extent the index grows beyond the cap, only the amount up to the cap will be credited.

After allowing the cash value to grow for a number of years, the owner of the policy can borrow against the cash value to supplement retirement income. Such a withdrawal, since it is a loan, is tax free so long as certain rules are met and the policy is not a modified endowment contract. Upon the owner’s death, policy loans will be repaid, reducing the death benefit payable to policy beneficiaries. Life insurance policies meant to provide supplemental retirement income should have contractually low interest rates on borrowed funds.

Next steps

While the passage of a Senate version of the BBB Act remains to be seen, exploring options to increase tax-free retirement income makes sense for those of you who believe that tax rates in the future may be higher than today’s rates. Physicians concerned about their continued ability to contribute to a tax-free retirement income vehicle should consider a permanent life insurance policy. In looking at this option, make sure that the policy is written with a reputable life insurance company, the interest rate is low and the cost of insurance is reasonable. A trusted advisor who compares and contrasts various insurance policies and companies can help in this endeavor.

For more information:

Wealth Planning for the Modern Physician and Wealth Management Made Simple are available free in print or by ebook download by texting HEALIO to 844-418-1212 or at www.ojmbookstore.com. Enter code HEALIO at checkout.

Carole C. Foos, CPA, is a tax consultant and partner in the wealth management firm OJM Group www.ojmgroup.com. You should seek professional tax and legal advice before implementing any strategy discussed herein. Foos can be reached at carole@ojmgroup.com or 877-656-4362.

ADD TOPIC TO EMAIL ALERTS

Receive an email when new articles are posted on

Please provide your email address to receive an email when new articles are posted on .

“

data-action=”subscribe”>

Subscribe

We were unable to process your request. Please try again later. If you continue to have this issue please contact customerservice@slackinc.com.

Back to Healio

Residency to Retirement