Suze Orman: Even the Wealthy Need Emergency Savings

What You Need to Know

Lawmakers want to allow employers to automatically enroll workers in emergency savings accounts.

Experts say such accounts could help boost both short- and long-term financial stability, especially among those with lower and middle incomes.

Emergency savings accounts can benefit even those with higher incomes by preventing early retirement plan withdrawals.

On Tuesday, the Bipartisan Policy Center hosted a webinar event that featured Sens. Cory Booker, D-N.J., and Todd Young, R-Ind., advocating for the inclusion of the emergency savings legislation they co-sponsored in the broad package of retirement reforms known as the Secure Act 2.0.

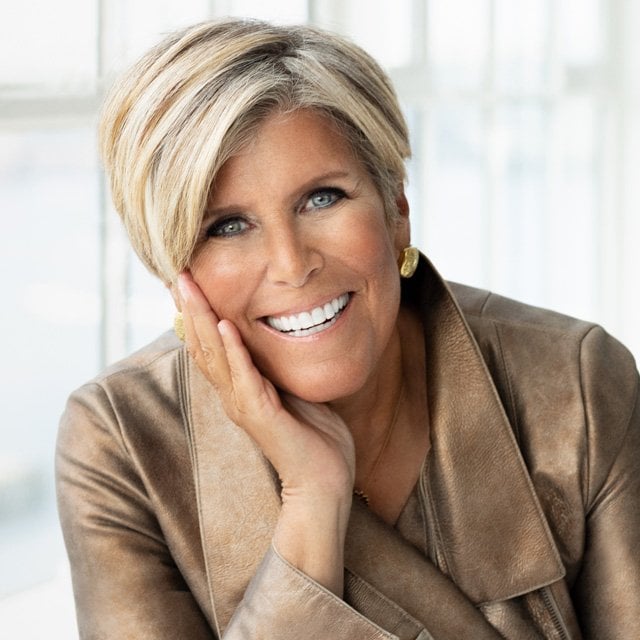

The event also featured an opening interview with personal finance expert Suze Orman, co-founder of SecureSave, an emerging firm that works with employers to offer payroll-linked emergency savings accounts to employees. Like the senators, Orman urged Congress to pass legislation that would allow employers to automatically enroll their workers in “sidecar” emergency savings accounts.

According to Orman, even workers of more than modest means can have trouble balancing their short- and long-term financial needs. Many may have 401(k) plan accounts with sizable balances, she noted, but they can also struggle to meet an unexpected expense stemming from events such as car accidents, major appliance breakdowns, medical emergencies or uncovered damage to a home.

“Far too often, these people end up having to withdraw emergency funds from their 401(k) plans, and this results in significant taxes and penalties being paid,” Orman said. “My view is that automated emergency savings accounts that are situated with the employer are essential to avoid such issues.”

Normal Savings vs. Emergency Savings

According to Orman, many Americans say they are savers, but what they are really focused on is generating enough money to go on a vacation every once in a while or to go out to eat regularly with their friends and family.

“That is all fine, but it is not the same thing as being prepared for financial emergencies and preparing for your retirement,” Orman said. “Normal savings and emergency savings are different.”

It is bad enough, Orman said, when people have to pull assets from 401(k) plans to meet unexpected expenses. Even worse is when a person has to turn to high-interest credit cards or personal loans that can easily trap them in an unending cycle of toxic debt.

“We all know how easy it is for people, even those with substantial earnings, to get trapped in the cycle of debt,” Orman said.