Survey Shows What Advisors Really Think of Secure 2.0 Act

Positive Expected Impact on Financial Advisor Practices

Not only do financial advisors expect Secure 2.0 to result in better retirement outcomes for clients, they also expect the legislation to have a moderate to large positive impact on their practices over the next 12 months, as demonstrated below.

Financial advisors surveyed were overwhelmingly positive about the potential impact, with 62% being moderately or largely positive, while only 5% where moderately or largely negative. Financial advisors clearly perceive the Secure 2.0 Act as a way to engage with clients and help them create better outcomes and demonstrate the value of financial planning

Mixed Perspective on the Growth of Annuities in 401(k) Plans

There are a number of provisions in the Secure 2.0 Act targeted toward 401(k) plans. While the original Secure Act was more focused on annuities, e.g., introducing the fiduciary safe harbor, there are updates in the 2.0 version, such as increasing the cap for qualified longevity annuity contracts (QLACs) as well as combining payouts from an annuity and the 401(k) plan for the purpose of calculating RMDs.

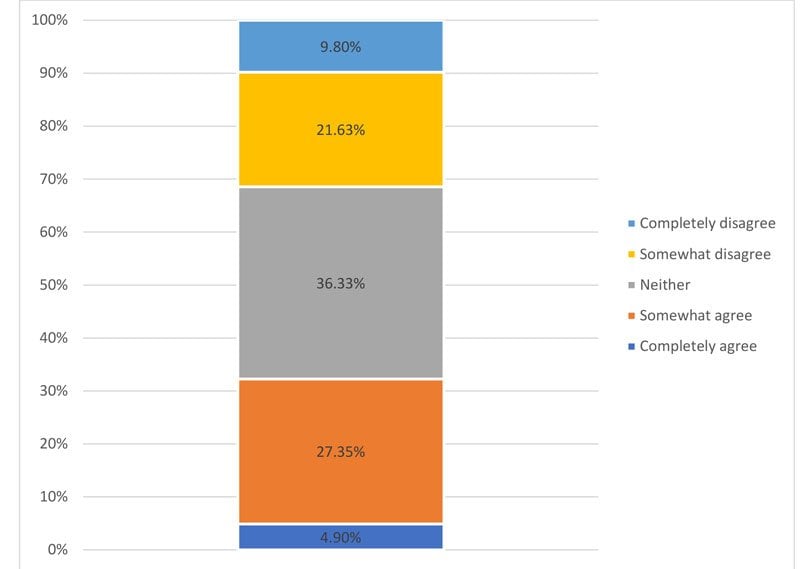

Financial advisors have a mixed perspective on the extent Secure 2.0 will drive higher availability and utilization of annuities in U.S. retirement plans in the near future. The exhibit below contains responses to a question asking whether advisors agree that Secure 2.0 will drive 20% of U.S. retirement plan assets into annuities in the next 12 months.

We can see that the distribution is very mixed, with approximately the same number of responses agreeing and disagreeing with the perspective of growth around annuities.

Perhaps what’s most interesting about these responses is that there is no relationship between the perceived impact on annuity utilization in DC plans and whether the financial advisor uses annuities. In other words, it’s not like the responses agreeing and disagreeing with the expectations are being biased by whether the financial advisor uses annuities; the responses are all over the map.

Conclusions

Financial advisors have somewhat mixed perspectives on the Secure 2.0 Act but generally see opportunity for clients as well as themselves. Therefore, familiarizing yourself with provisions of the Secure 2.0 Act is likely a smart move!

David Blanchett is managing director and head of retirement research for PGIM DC solutions.