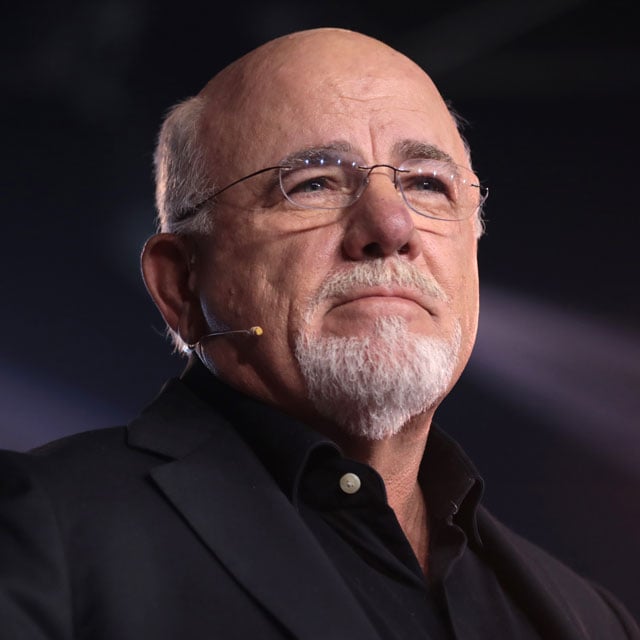

Supernerds Unite Against Dave Ramsey's 8% Safe Withdrawal Rate Guidance

Dave Ramsey is not a fan of safe withdrawal rate researchers. In a recent podcast episode, he blasted them for being “supernerds” who “live in their mother’s basement with a calculator.”

When told about these quotes, one of our spouses (who knows all three of us well) replied “well, you don’t live in your mother’s basement.”

Ramsey’s math is simple. “If you’re making 12 [percent] in good mutual funds and the S&P is averaging 11.8, and if inflation for the last 80 years is 4%, if you make 12 and you need to leave 4% in there for average inflation raises, that leaves you eight. So, I’m perfectly comfortable drawing eight. But if you want to be a little bit conservative, seven. But, sure, not five or three.” Unfortunately, this math is wrong.

Ramsey doesn’t appear to grasp the differences between geometric returns (what you earn in an investment) and arithmetic returns (the simple average). He also doesn’t appreciate how a 100% stock portfolio increases sequence of return risk. A retiree who listened to Ramsey and followed an 8% withdrawal rule while holding a four-fund stock portfolio in the 2000s would have run out of money in as little as 13 years.

A Primer on Retirement Income Math

This logic of earning 12% and withdrawing 8% seems perfectly reasonable. Or would be if stocks always provided a 12% return. Unfortunately, stock returns bounce around a bit. In fact, the “theory” that supernerds use to explain the higher historical return of stocks is that people prefer investments that bounce around less. If investors are going to be rewarded with higher returns for taking risk, then there must be some risk.

Volatility does two things to safe withdrawal rates. First, it means that retirement portfolios can fall in value. When retirees withdraw a fixed amount from an investment portfolio that has fallen in value, it chips away at a nest egg that has already suffered a beating. The portfolio is now smaller. Less savings means less money that can rise in value when returns go back up.

Second, an average 12% return doesn’t mean that a retiree’s portfolio grows by 12% per year. If $1 million invested in stocks falls by 20%, you now have $800,000. If it rises by 25% the next year, you’re back up to $1 million. The average return of -20% and positive 25% is 2.5%. But you still only have a million bucks. Your actual return was zero.

This is the difference between arithmetic returns (2.5%) and geometric returns (0%). This higher order math is the kind of stuff that we all teach at The American College of Financial Services Supernerds, for those who wish to learn more. An investor can’t spend arithmetic returns. They are subject to the tyranny of lower geometric returns. The more volatile the investment, the bigger the difference between arithmetic and geometric returns.

It’s also one of the reasons that bond returns often get a bad rap. Although arithmetic returns of bonds have been lower than stocks, the 20-year growth of money invested in bonds hasn’t been that much lower than stocks since the late 1980s.

Ramsey suggests that retirees hold a 100% stock portfolio to safely produce $80,000 of spending from a $1 million nest egg. This sounds reasonable because bonds just don’t provide enough return to generate this kind of lifestyle. However, because stocks are more bouncy they can lose more money early in retirement. Supernerds refer to this as “sequence of return risk,” and we discuss it often which makes us lots of fun at parties.

Consider a retiree who follows the Ramsey principle. She invests $1 million in the recommended Ramsey portfolio of a growth fund, a growth and income fund, an international fund, and an aggressive growth fund. It has been suggested that Dave prefers the American Funds, which makes sense because they are less likely to be managed by communists and are therefore “good” funds. We can divide our savings equally among four American Funds that match Dave’s allocation: the AMCAP Fund (AMCPX), The Growth Fund of America (AGTHX), Investment Company of America (AIVSX) and the New Perspective Fund (ANWPX).

How well have these funds performed since their inception? On the aggregate, they’ve provided investors with a 14.3% arithmetic and a 12.6% geometric return! This is great news for investors hoping to create a more generous retirement lifestyle.

Imagine it is December 2000. Stocks have had a great run. Between 1995 and 2000, your four-fund portfolio rose between 16% and 31% every year, and 2000 was a slow year where returns only rose by 2.9%. You figure that the funds will continue to grow by a conservative 12% or so in the future, just as they have in the past (on average). The healthy growth pushed your nest egg to $1 million and you figure it’ll be easy to take out $80,000 each year and still have money left over to reinvest to keep up with inflation.

How long could you have withdrawn $80,000 plus inflation? In 2001, your investments slip by 7.5% and you withdraw the $80,000. You now have $850,592. The second year the portfolio falls by 17.8%. Inflation is modest, but you need to withdraw $81,362 to maintain the same standard of living. The balance at the end of 2002 is now $632,286.

In year 3, the funds rebound by 31.4%. You breathe a sigh of relief. Your average return is now a positive 2% per year. Unfortunately, you have less capital to grow so your ending balance at the end of 2003 is $722,202. The next 4 years see an average return around the 12% you’d been hoping for, but by 2007 you’re taking out $91,248 each year.

When you get a bad sequence of returns early in retirement, even good returns in subsequent years can’t bail you out because 12% of a $650,000 balance is just $78,000 and you’re withdrawing over $90,000.