Stocks Sink as Economic Jitters Fuel Rush to Bonds

“But some indicators, including the unemployment rate may be moving past optimal, toward levels consistent with excessive labor slack. Or, in plain English, these indicators are dangerously close to falling short of being consistent with maximum employment — which is the Fed’s mandate,” Low said.

Source: TD Securities

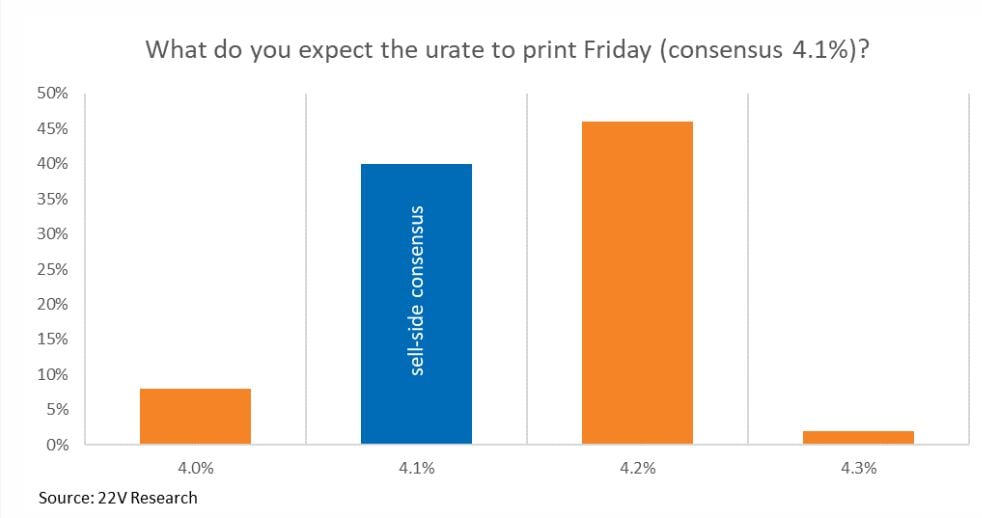

Economists are expecting moderation in job growth in the government’s July employment report due Friday. Forecasters anticipate the unemployment rate remained steady at 4.1%.

A survey conducted by 22V Research shows 42% of investors think the market reaction to Friday’s jobs data will be “risk-off,” 36% said “negligible/mixed” and only 22% “risk-on.”

“Investors are paying the most attention to payrolls,” said Dennis DeBusschere founder of 22V. “However, the unemployment rate is a close second. Our survey consensus for the unemployment rate is 4.2%.”

The cooling economy has raised market speculation that there will be three rate cuts to come before the year is out, according to Fawad Razaqzada at City Index and Forex.com.

“In fact, there is now a greater risk tomorrow’s US non-farm payrolls report missing the mark, if today’s labor market indicators are anything to go by,” he said. “Should NFP disappoint, then the calls for the Fed to act will get louder.”

Source: 22V Research

Source: 22V Research

The Fed has been clear on needing more proof of soft inflation prints to cut, but labor-market slowing could lead the Fed to cut rates more aggressively, putting a November cut into play in addition to September and December, according to Oscar Munoz and Gennadiy Goldberg at TD Securities.

“Rates have moved sharply lower in recent days due to a combination of a more dovish Fed, moderating data, and geopolitical risks,” they said. “As such, a weaker reading could reinforce the move lower in rates, exacerbating the bull-steepening trend.”

Fixed-income ETFs took in a historic amount of cash last month as investors pile into the bond market, positioning for the start of a Fed rate-cutting cycle. Bond funds saw inflows of roughly $39 billion in July, the most on record, according to data from Strategas.

To Vail Hartman at BMO Capital Markets, the data won’t be as relevant to expectations for the timing of the first rate cut as it will be to the perceived likelihood the Fed ultimately needs to deviate from the “fine tuning” 25 basis-point quarterly cuts assumption as implied by its projections.

“Said differently, payrolls won’t lead the market to seriously rethink whether a September rate cut is too soon — but the information could easily skew the market-implied path of policy rates toward a more dramatic cutting campaign,” said Hartman.

The Fed is indeed a hot topic this week for global investors trying to time rate cuts. It’s also — unusually — a prominent feature on Corporate America’s post-earnings conference calls.

The words “Federal Reserve” were on track to be mentioned about 380 times on second-quarter calls with analysts, according to a Bloomberg analysis of transcripts of S&P 500 and Stoxx 600 companies. That would be the highest tally ever in the database’s records going back to 2001, if the current pace holds.

A contrarian stock indicator from Bank of America Corp. rose last month, reflecting Wall Street sentiment at elevated levels. Although the gauge remains in “neutral” territory rather than at outright “buy” or “sell” thresholds, ultra bearish attitudes toward equities are no longer a tailwind for upside like last year.

As a risk-on momentum in US stocks showed signs of easing in July, several computer-based systematic strategy funds trimmed their equity exposure. But they may not be done selling just yet.

Commodity trading advisers, or CTAs, cut their equity positions to a two-month low in July, according to Bank of America Corp. Those funds typically use a combination of price-trend signals and volatility to determine allocation. As the stock-market advance hit a snag, CTAs unwound their positions as well.

But to BofA Securities senior equity derivatives research analyst Chintan Kotecha, those CTAs that remain long U.S. stocks should continue to cut their positions, at least in the near-term, as the rally shows signs of stalling.

(Credit: Adobe Stock)