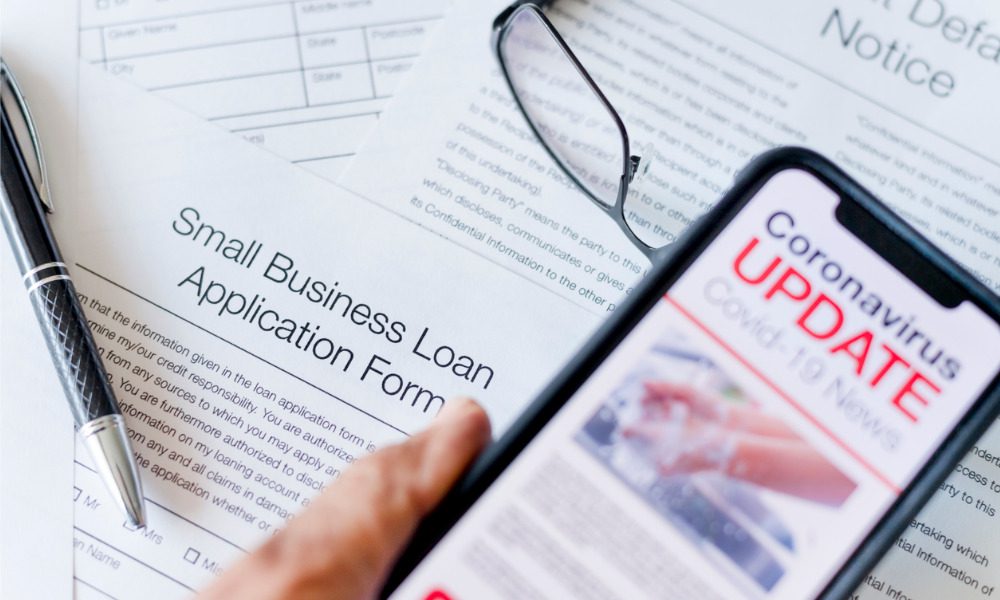

Spare business owners who took out COVID loans in good faith, urges CFIB

Read more: Digging into CEBA’s tax implications

But now, thousands of small businesses are now receiving calls from their financial institutions. According to Pohlmann, those business owners are now deemed ineligible for the loans in the first place, and are being asked to repay their CEBA loan in full by the end of 2023.

“While businesses were given some time to provide more information to qualify, it feels like government has forgotten that many were fighting every day for the very survival of their businesses during lockdowns and restrictions,” said CFIB President Dan Kelly. “Making businesses who applied and received funds repay the full amount will push some over the edge given the massive debt load many accumulated due to the pandemic,”

The CFIB is urging the government to permit any business that got a CEBA loan to keep the forgiving portion upon repayment of the balance, excluding instances of flagrant fraud.

Government must, at the very least, make sure that there is a new procedure for enterprises to requalify and to handle situations of exceptional difficulty.