S&P 500 Set for Worst CPI Day Since September 2022

Wall Street got a reality check on Tuesday, with hotter-than-estimated inflation data triggering a slide in both stocks and bonds.

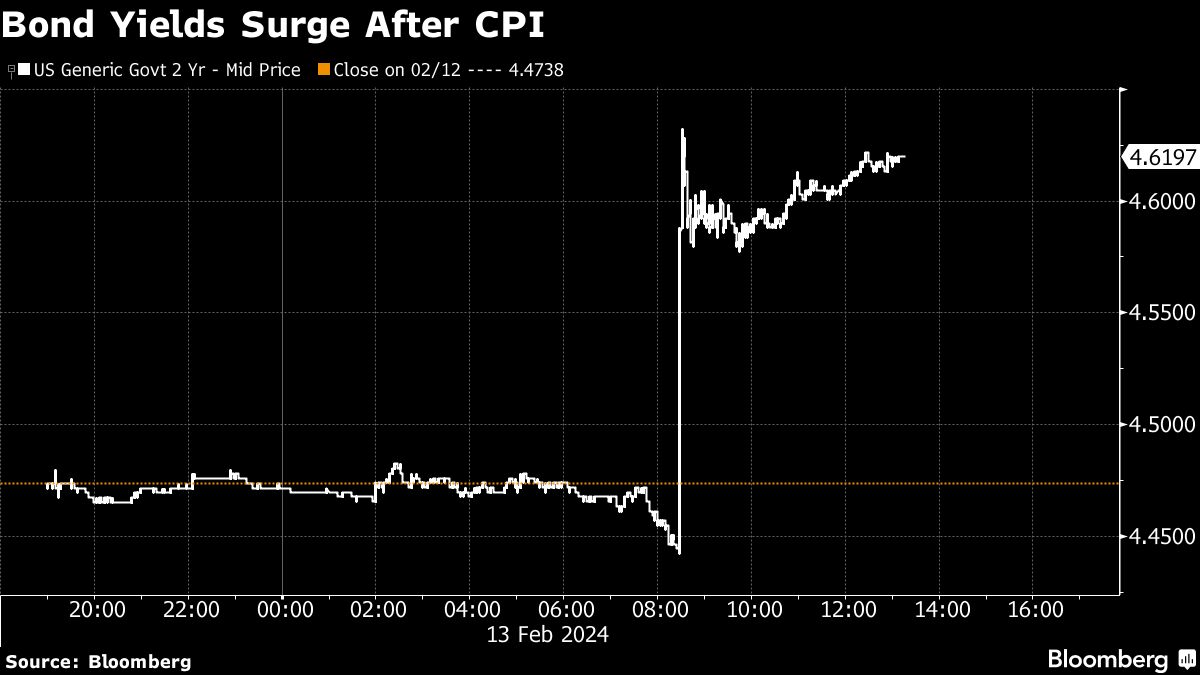

Equities moved away from their all-time highs after the core consumer price index topped estimates and climbed the most in eight months. Treasuries sold off, with two-year yields hitting the highest since before the December central bank “pivot.”

Swap traders all but abandoned expectations for a Fed cut before July. And a measure of perceived risk in the U.S. investment-grade corporate bond market soared — with three issuers getting sidelined.

The CPI data came as a disappointment for investors after a recent downdraft in price pressures that helped build expectations for rate cuts this year. The numbers also gave credence to the wait-and-see approach highlighted by Jerome Powell and a chorus of Fed speakers.

“If Powell and other Fed members hadn’t already thrown cold water on the prospects for a March rate cut a few weeks ago, today’s CPI report might have done that,” said Jason Pride at Glenmede. “Evidence of still-sticky services inflation is likely to give the Fed pause before cutting rates too quickly.”

Pride says rate cuts are likely still on the table for this year, but they may begin later than the market may be anticipating.

The S&P 500 fell below 5,000, heading for its worst CPI day since September 2022. Rate-sensitive shares like homebuilders and banks sank, while Microsoft Corp. led losses in megacaps.

U.S. 10-year yields climbed 10 basis points to 4.28% — set for the highest since November. The dollar rose and gold fell below $2,000.

“While the door for a March cut had already been effectively shut given the recent Fed commentary and the jobs reports, the Fed has now locked the door and lost the key,” said Greg Wilensky at Janus Henderson Investors.

Much of the unanticipated increase in CPI was concentrated in what looks like a “noisy jump” in Owners’ Equivalent Rent (OER) — a shelter price indicator, according to Tiffany Wilding at Pacific Investment Management Co. While that will likely revert, the details were consistent with the Fed having a “last mile problem” — and not cutting rates until midyear or later, she added.

Swap contracts referencing Fed policy meetings — which as recently as mid-January fully priced in a rate cut in May and 175 basis points of easing by the end of the year — were roiled. The odds of a May cut dropped to about 36% from about 64% before the inflation data, with fewer than 100 basis points anticipated this year.

Fed officials are being proven right in their “take it slow” approach, according to Russell Price at Ameriprise. He says the first rate cut could come as early as June — but it could easily be July without a material improvement in near-term inflation trends.

The January CPI report is a reminder that inflation is a difficult, not-well-understood problem that doesn’t move in a straight line, according to Chris Zaccarelli at Independent Advisor Alliance.

“Bonds are too expensive if inflation is still a problem and the stock market can’t keep rallying if rates are going to be higher-for-longer — especially if the assumption that the Fed is completely done raising rates is incorrect,” he added.

Prior to Tuesday’s data, strategists at Citigroup Inc. noted that what was missing was traders hedging the risk of a very brief easing cycle followed by rate increases shortly thereafter.

If inflation proves to be sticky, the debate about the Fed’s so-called neutral rate — which balances supply and demand — could resurface and spark the Treasury yield curve to steepen, they said.