S&P 500 Rally Hits a Wall at End of Banner Quarter

What You Need to Know

Stocks are heading into the second half having gained about 15% this year.

The S&P 500 has followed up a positive first-half return with an average second-half gain of 6%.

Softening in the measure of inflation favored by the Fed highlights a slowing economy that’s upping the risk of a policy error by the central bank, Mohamed El-Erian said.

Wall Street’s enthusiasm faded in the final stretch of a solid quarter for stocks that saw the market hitting multiple all-time highs.

The S&P 500 was little changed after gaining almost 1% earlier Friday. The Nasdaq 100 also lost steam after briefly surpassing 20,000 amid volatility in big techs.

Treasury yields pushed higher, reversing a drop in the immediate aftermath of inflation data that bolstered bets on Federal Reserve rate cuts.

Traders kept a close eye on news regarding the U.S. presidential race, while remaining cautious ahead of Sunday’s elections in France.

JPMorgan Chase & Co.’s Marko Kolanovic says the S&P 500 will falter in coming months in the face of mounting headwinds, from a slowing economy to downward earnings revisions. The gauge is poised to plunge to 4,200 by year-end, a roughly 23% drop from Thursday’s close, he said.

“There is a clear disconnect in the huge run-up in U.S. equity valuations and the business cycle,” the strategist wrote, adding that the S&P 500’s 15% year-to-date gain isn’t justified, given waning growth projections.

The S&P 500 fluctuated after briefly topping 5,500 earlier Friday. Nvidia Corp. swung between gains and losses. Nike Inc. tumbled 20% on a disappointing outlook. Treasury 10-year yields rose six basis points to 4.35%.

Stocks are heading into the second half having gained about 15% this year. Historically, a strong first half tends to be followed by above-average second-half returns, according to Adam Turnquist at LPL Financial.

“While elevated valuations, overbought conditions, and underwhelming market breadth point to a potential pause ahead, seasonal trends suggest momentum could continue in the second half,” he noted.

The S&P 500 has followed up a positive first-half return with an average second-half gain of 6%, Turnquist added. Furthermore, when first-half gains were 10% or higher, the index posted average gains of 7.7% in the second half, with 83% of occurrences producing positive results.

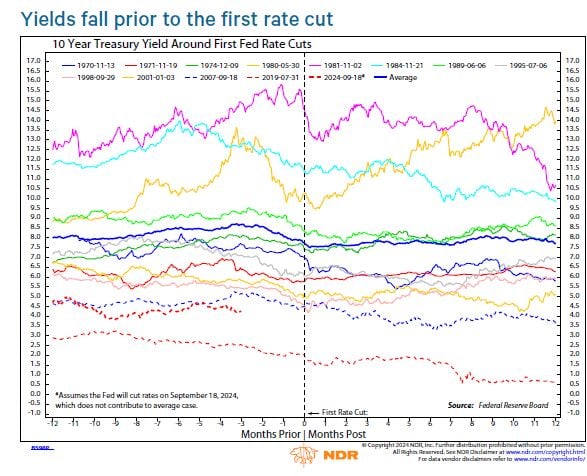

Source: Ned Davis Research

Source: Ned Davis Research

The U.S. presidential election and its aftermath promises investors big market swings in the second half of the year, says Goldman Sachs Group Inc.’s Scott Rubner.

The global markets division managing director and tactical specialist has been correctly bullish on US stocks in May and June, but after July 17 he is modeling a correction in the stock market — this usually means about a 10% drop for equities.

“I would be looking to trim exposure up here post July 4th,” Rubner wrote in a note to clients Friday.

Earlier in the session, traders kept a close eye on economic data.