Sikka Health Indicators Whitepaper

In April 2022, ExamOne and Sikka.ai announced a collaboration to provide oral healthcare information through HealthPiQture. Sikka recently published a whitepaper on the use of Sikka Health Indicators™ to identify health risks among insurance applicants.

Sikka Health Indicators whitepaper

Identify pre-existing health conditions from dental clinical notes

Sikka.ai is the leading API Platform in the retail healthcare industry that includes opt-in dentistry, veterinary, audiology, optometry, chiropractic, orthodontics, oral surgery, and other medical practices. Sikka.ai API Platform seamlessly connects to 96% of the retail healthcare market throughout the US and is processing billions of transactions a day. Sikka.ai API Platform provides the platform to help practices optimize their business, profitability, patient communication, revenue cycle management, patient satisfaction, and patient medical history analysis, by enabling over 50 marketplace applications on its platform.

Sikka has over 41,000 opt-in dental practices installed in the US and Canada through its market-leading API integration platform. Sikka leverages this rich dataset to determine if life insurance applicants have 1or more of 10 pre-existing conditions or habits with outsized impact on underwriting. These indicators are based on actual clinical notes from the licensed providers in the practices or patient reported conditions on health history forms. Sikka’s oral healthcare indicators can help determine the appropriate risk class or adjustment based on the applicant’s health risk indicators. This can help ensure that “less risky” life insurance policyholders don’t end up subsidizing “risky” ones, regardless of whether or not conditions are mischaracterized accidentally or intentionally.

10 Sikka Health Indicators

Text Classification Model

From Sikka’s vast database, patients with clinical notes that contain specific keywords are identified for each health indicator. These clinical notes were preprocessed using various NLP preprocessing techniques. The Word2vec algorithm was used to generate a distributed representation of words from clinical notes as numerical vectors, capturing the semantics and relationships between words.

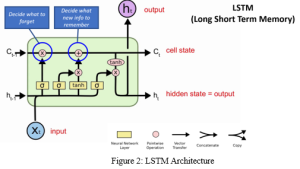

The embedded word was fed into the Long Short Term Memory (LSTM) model Figure 2, which is a type of recurrent neural network capable of learning order dependence in sequence prediction problems. The LSTM model is effective in memorizing important information and, unlike traditional classification algorithms, LSTM can use a multiple word string to find out the class to which it belongs. The LSTM model was trained on a 400,000 balanced dataset with an accuracy of 99%.

As part of enhancing the text categorization, a rules engine was developed to incorporate any incorrect classifications found in the retrospective studies.

Retrospective Studies and Hit rate

Sikka’s data has been validated in studies conducted by 3 major reinsurance companies, 3 leading data providers, several carriers and MGAs in both the US and Canada, and a leading life settlement company. These studies range from a select 2,500 to an expansive 8,000,000 records and have match rates of up to 54%. The tobacco indicator has identified significant numbers of “smoking non-disclosers” that cost carriers as much as $23,0001 per traditional term policyholder in lost premiums due to misclassification, based on the analysis of 1 of the data providers3. Separately Sikka Indicators are now in production with multiple carriers and have been helpful at identifying missing underlying conditions that influence underwriting. Studies of Sikka’s Tobacco indicators have been completed to identify gross protective value of almost 10x the cost.2 In 2019, Munich Re performed a validation of Sikka’s Tobacco Score using insured records. Research confirms that information about dental health can be informative about overall health. Munich Re recommends each carrier perform a retrospective study to best assess the value and application of the Sikka Tobacco Score on its company-specific insured population.3

Upcoming webinar

Join Sikka and ExamOne for a fascinating and timely webinar discussion with top industry panelists on how to leverage oral healthcare data effectively for life underwriting.

Register for our upcoming webinar on March 23, 2023.

1 https://www.verisk.com/siteassets/toprisks/how-audio-analytics-can-detect-undisclosed-tobacco-use-verisk-whitepaper.pdf

2 ExamOne Cost Benefit Analysis, June, 2021, Brian Lanzrath

3 https://www.munichre.com/us-life/en/perspectives/alternatives-for-stratifying-mortality-risk/oral-health-mortality-and-smoker-detection.html