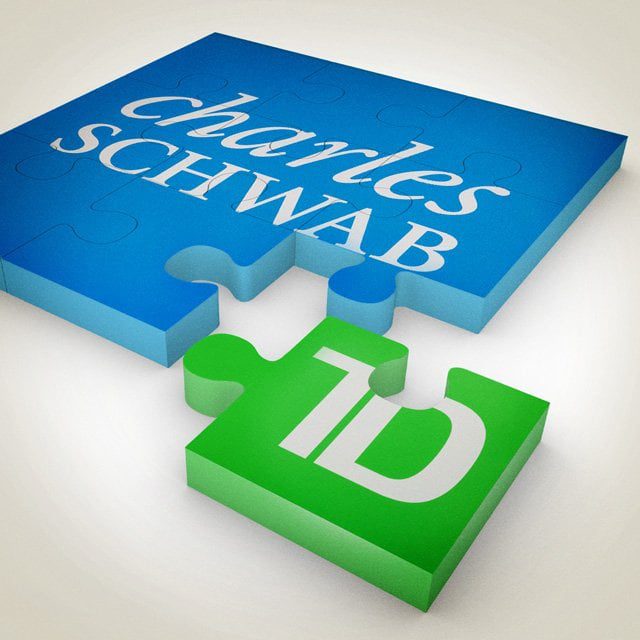

Schwab Defends App Bashed as Clunky by Some Former Ameritrade Clients

The complaints about change don’t tend to be about the thinkorswim trading platform, which came with the Ameritrade acquisition, since there wasn’t a change there, he explained.

“It tends to be about the mobile app, because the mobile app is what many TDA clients use who don’t use thinkorswim, and they’re going from one experience, TDA mobile, to Schwab mobile,” Craig said, comparing the situation to to a BMW driver waking up one day and finding a Mercedes in the garage and having difficulty figuring out where things are at first.

Craig also explained that “what Schwab does is far more significant from a capability standpoint than what Ameritrade did. So as you’d expect, our app, our web experiences are more comprehensive. We’re also a lot larger.”

Some former Ameritrade clients ask why Schwab doesn’t just use the Ameritrade app, Craig noted, saying there are many reasons. If Schwab did that, “we’d have three times as many complaints on the blue (or Schwab) side.”

Prior to conversions, Schwab’s app and mobile experiences were rated highly, either at par with or better than those of TD Ameritrade, he added.

“We’re getting a very, very small number of complaints,” he said. ”They tend to be about change, and yet at the same time, we are trying to take the best of what Ameritrade has and the best of what Schwab has. And we’ll continue to make enhancements as we go.”

Meanwhile, Schwab is seeing strong engagement from Ameritrade clients, attrition rates across all groups have come in well below expectations, and converted clients’ behaviors “are very, very promising,” Craig said. These clients have brought in about $60 billion since conversion, and there’s a 99% retention rate among converted clients assigned to a financial consultant.

In addition, converted clients’ adoption of Schwab’s managed investing services has been “fantastic,” with about $17 billion in asset inflows last year, he said.

After moving the last 1.8 million client accounts this month, Schwab has converted approximately 17 million accounts and about $1.8 trillion to $1.9 trillion in assets from TD Ameritrade over the course of the integration. That includes about 13 million retail accounts, according to statistics Craig presented at the conference.

Image Credit: Chris Nicholls/ALM; Adobe Stock