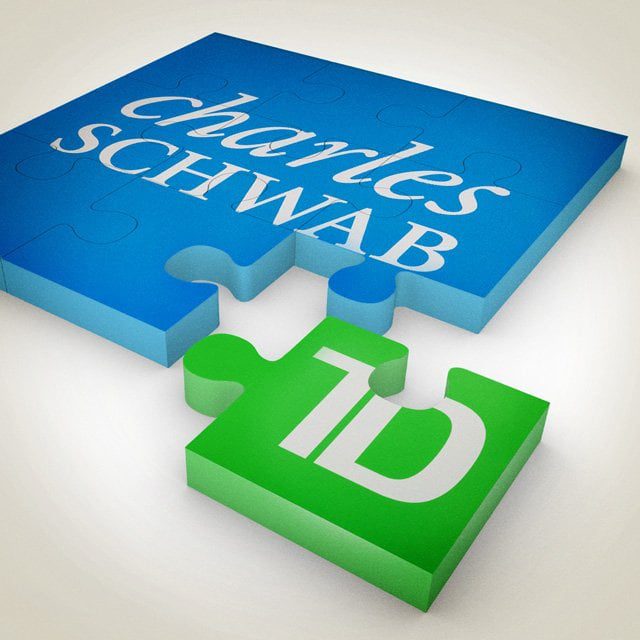

Schwab Call Center Woes Plague RIAs After TD Ameritrade Move

What You Need to Know

The final transition of TD Ameritrade accounts to Schwab was broadly successful but not without hiccups.

RIAs complained of undertrained call center workers and long wait times.

Schwab is helping firms navigate the changes, Tom Bradley said.

Mark Wolter’s client, newly diagnosed with Stage 3 lung cancer, needed money to pay his bills. But, after the transition of TD Ameritrade accounts to the Schwab custodial platform over Labor Day weekend, a long-standing authorization to transfer funds from his retirement account to his checking account was no longer in place.

“All of a sudden,” after the conversion, “they’re like, ‘you don’t have the proper authorizations to transfer funds for this client,’” said Wolter, a partner at RIA firm Beacon Wealth Advisors in McHenry, Illinois. “Now I’ve got to put him through the ringer of, ‘OK, now you’re going to have to go online and fill out these forms so that we can do this.’”

As a result of this and other problems he experienced since his firm made the move from TD Ameritrade, Wolter said: “I can tell you the company line from Schwab is very misleading.”

Schwab executives recently declared the final TD Ameritrade integration weekend — in which 7,000 advisors with 3.6 million client accounts, plus 3.6 million retail client accounts, with a total of $1.3 trillion in assets — a success. Indeed, industry observers said the move went smoothly overall.

But the transition is not without its frustrations, advisors said.

“The service team members are very undertrained and essentially read scripts,” Wolter said.

Wolter said he realized that the number of service center calls had likely “exploded” after the transition and that the service center people his firm’s four advisors spoke to seemed to have “great personalities” and were “trying to be helpful.”

“However,” he said, “when you call them, it seems like all they’re doing is essentially, I’ll use the term Googling … by searching the Schwab system for information because they don’t know what to give you [as an answer].”

Another problem was his firm was told it did not have the authority to access its fee account, “which has money in it that we use for our operations … paying our staff and whatnot … [But] we keep money in a bank locally, too, fortunately.”

It ended up taking two weeks to get access to those funds, he told ThinkAdvisor.