Research Points to a Better Way to Market Annuities

The research also showed that more than a third of retirees with more than $500,000 in non-housing wealth had increased their assets during this period. Other studies have also reported very little change in asset levels during retirement years.

So, with no earnings from work and a reluctance to spend down their savings, how are retirees funding their spending needs?

The simple answer is that retirees cut down their spending. But how do they decide how much to cut down? This is where annuities enter the picture.

On average, essential or nondiscretionary items such as mortgage or rent, groceries, gas and health care account for 75% to 80% of total spending throughout retirement. And retirees determine how much to spend on these items by matching these expenses to their guaranteed income, such as Social Security payments or pensions.

So, rather than dipping into their savings for their day-to-day spending needs, retirees anchor their lifestyle to the level of their guaranteed income.

The Case for Annuities

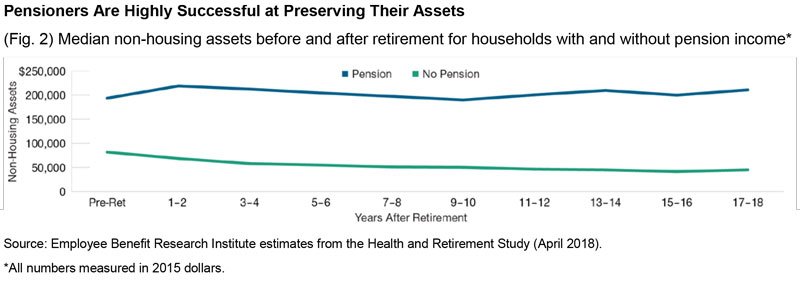

Is this a successful strategy to help preserve assets? The data seem to indicate so. The EBRI study showed that after 18 years of retirement, non-housing assets of pensioners dropped by only 4% compared with a drop of 34% for those without pensions (Figure 2). So more guaranteed income can lead to better preservation of assets.

These results are somewhat counterintuitive. If the fear of running out of money is the primary driver of asset preservation, then pensioners with higher levels of guaranteed lifetime income should spend down their savings more freely. Instead, we find the opposite, and this implies that:

In addition to consumption, households have a strong preference for asset preservation and derive satisfaction from the level of assets they hold.

Higher levels of guaranteed income help households preserve assets more successfully.

The Need for Positive Marketing

Annuities are often marketed using fear. They are projected as the best hedge against running out of money. But this type of messaging could make people think that they will not benefit from annuities if they don’t live long enough.

Further, annuitization requires giving up control of one’s funds and most people are reluctant to do so. With these concerns, it is therefore not surprising that people are generally hesitant to purchase annuities.

However, a more positive framing of annuities — as potential solutions to help achieve present financial goals like asset preservation, rather than a failsafe in the event of an extreme outcome in some distant future — could help retirees rethink their utility as a tool to pursue their current financial goals.

Sudipto Banerjee, Ph.D.. is vice president of retirement thought leadership at T. Rowe Price.