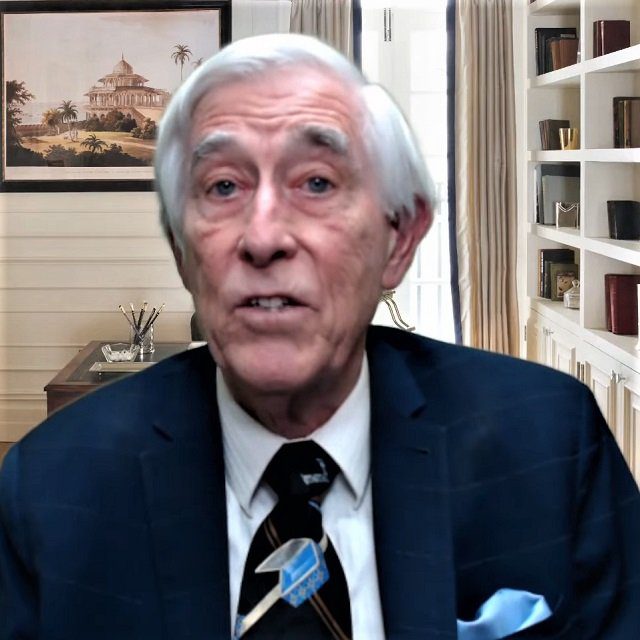

Private Placement Life Insurance Will Get Through This: Michael Malloy

Michael Malloy is predicting that the private placement life insurance players will have good answers to policymakers’ questions.

Malloy is the founder and director of Expanded Worldwide Planning, a firm that helps wealthy clients with PPLI policies and other life insurance arrangements.

Wealthy people can use PPLI to set up customized cash-value life insurance policies backed by a wide range of assets.

Sen. Ron Wyden, the chairman of the Senate Finance Committee, recently asked PPLI issuers whether they are marketing PPLI mainly as a tool for ultra-wealthy families to cut their taxes, and not to provide life insurance.

Malloy argued, in a defense of PPLI, that clients use the product mainly to pay estate taxes.

“Senator Wyden is doing his job by trying to ferret out bad actors connected to PPLI, but, in my experience, they are few and far between,” Malloy said. “All the players I know who work with PPLI structures for U.S.-connected clients play by the rules.”

Malloy earned a bachelor’s degree from the University of California at Riverside, then entered the financial services industry as a risk management consultant at Perkins, Carden & Minahen in Vallejo, California, in 1978.

In 1984, he set out on his own as the founder and principal at Malloy Insurance Services, an insurance agency that helps high-net-worth clients use life insurance-based planning strategies. He continues to own that firm, which has operations in New York; Oregon House, California; and the British Virgin Islands.

He formed Advanced Financial Solutions, a private-placement life and private-placement annuity advisory firm, in 2007.

In recent years, he has adopted the Expanded Worldwide Planning and EWP Financial brands to reflect his planning philosophy, which involves a focus on six principles: privacy, asset protection, tax shielding, succession planning, compliance simplification and trust substitute.

He reached out to ThinkAdvisor and other publications after news of the Wyden investigation broke, in an effort to clear up what he believes to be misconceptions about PPLI.

He answered questions via email about the PPLI market, the Wyden investigation, and what he thinks insurers, advisors and clients associated with PPLI arrangements should do now.

The answers to the questions in this interview have been edited.

THINKADVISOR: What kinds of clients would set up PPLI arrangements, and why?

MICHAEL MALLOY: For our firm, EWP Financial, it is generally clients with a net worth of $50 million or more.

Clients are looking for a more comprehensive solution that brings together all their advisors working to construct the best possible structure. Usually the advisors include asset managers, tax advisors and attorneys.

PPLI asset structures can enhance a family’s financial goals. They can also bring valuable enhancements to the contributions that each of these advisors brings to the client’s overall financial well-being.

For example, when the assets that the asset manager works with are placed inside a PPLI asset structure, they continue to grow tax-free, thus the asset manager gains what is termed alpha with no extra effort on his/her part.

For the tax advisor, the reporting of the client’s assets is simplified, as the assets are now part of a cash value inside a life insurance policy.

For the estate planning attorney, there is greater asset protection and, in some cases, a simpler estate plan for the client, by having assets inside a life insurance policy.

Why don’t clients buy $50 million in life insurance through ordinary channels?

The PPLI solution is more comprehensive than just the need for life insurance. PPLI asset structuring addresses elements of estate planning, tax planning and asset protection.

Why do you think Wyden is focusing on PPLI now?

I think that the 2021 fines leveled against Swiss Life for its abusive PPLI policies are fresh in Senator Wyden’s mind.

Swiss Life funded its PPLI with undeclared assets, thus avoiding both Foreign Bank Account Report and Financial Crimes Enforcement Network reporting requirements.

The policies also flaunted what has been termed the “investor control doctrine,” which says that the policy owner can give an investment mandate to the asset manager, but the client is not permitted to choose individual assets in his portfolio.

The day-to-day investment decisions about the buying and selling of the assets are to be made by the asset manager and not the policy owner.

In recent years, the IRS has been investigating abuses in the areas of captive insurance and conservation easements.

As with PPLI asset structures, Sen Wyden is rightly looking at abusive tax schemes.

PPLI asset structures have been in place since the 1970s in various forms and have been previously under scrutiny by various government bodies, which has resulted in no major changes to these structures.