Postponed for Life Insurance: What it means and how to get around it

You may think that insurers don’t turn people down and are always happy to take your money.

In actuality, they can and do turn people down – sometimes you’re postponed for life insurance (basically a ‘try again later’), but other times it’s an outright no.

Examples of being turned down / postponed for Life Insurance

This article was inspired by an email from Annie, who wrote:

Hi. My Life Insurance has been postponed, and I need it for a mortgage and am wondering if there is Life Insurance out there that I can get?

Obviously, for Annie, this is not good.

She’s done the hard part, saved the deposit, and found a house to buy. However, to buy a home in Ireland, you have to get Mortgage Protection, which pays off your mortgage to the bank if you die.

As we all know, we love the banks here very much, which is why we look after them so well. They get the title deeds of your house and a life insurance policy.

Anyway, Annie can’t actually buy the house until she gets Mortgage Protection, so you can see why she’s in a pickle.

In Annie’s case, her postponement isn’t a hard no – it’s because something made the insurer pause and consider that her current risk is too high, so they may ask her to change some things or do some things and then reapply.

There may be several reasons the insurer postponed her application:

Annie might have a pre-existing condition which means she’s too “high-risk” for the insurer.

Remember: insurers don’t want you to die!

They want you to pay your premiums for however long your policy is so they can scoop up all your money without paying out a big lump sum. A pre-existing condition could be any number of things – from cancer to obesity or diabetes.

In a similar vein, Annie may have recently overcome an illness or have upcoming tests/scans/new medication/something medical that the insurer wants to see.

Only after a certain amount of time has passed or once the tests have taken place, the insurer will give a ‘yes’ or ‘no’.

Why would an insurer postpone an application for Mortgage Protection?

All of the insurers ask the following question on their application form:

Are you awaiting the results of any tests/investigations or referral to any hospital, clinic or doctor?

Answer yes to this question and the insurer is likely to postpone your application for mortgage protection until the test or investigation that you have been referred for is complete.

If you’re due to close on a mortgage soon and this has come as a massive shock, then I am sorry. Every day we take calls from people in the same situation and unfortunately there is not much we can do.

You see it’s not the insurers being arsey or difficult. They are led by your medical professional. So if your doctor, due to an abundance of caution, refers you for a scan on something harmless like a nasal polyp, the insurer will also be abundantly cautious and wait for the scan results.

After all, it’s the insurer who is stumping up the hundreds of thousands of mortgage protection cover.

What can you do if you have been referred for a test that holds up your mortgage?

Sometimes, people are on the public waiting list for so long that the insurers are happy to overlook the referral if the GP is happy to sign off that you no longer need it.

Apart from that situation, in all other cases, you will have to have the test.

I know that might mean going private and paying through the nose but there is no other way.

If your GP believes a test is necessary, the insurer is going to agree.

What do you do if you’ve been postponed for Life Insurance?

Just a note here in case you’re confused: we’re using the term Life Insurance and Mortgage Protection interchangeably. Mortgage Protection is a type of Life Insurance.

The big difference is that if you’re trying to get Life Insurance to protect your family, and you’re postponed, it’s not the end of the world if there is a 6-month delay.

However, if you’re getting a mortgage, you’re under pressure because you may lose the house without mortgage protection!

First, you should find out why you were postponed for Life Insurance. Ask the insurance company’s chief medical officer (CMO) that postponed you to write to your GP with their reasons why letter.

Once the GP receives the letter, have a chat with them to see how they feel. Usually, you can tell by their reaction whether it’s worth appealing.

Your options if postponed:

1. You can accept the postponement

In the case of Mortgage Protection, you’re going to lose the house unless your bank allows you to sign a waiver. See below.

(BTW, If you have any medical issues, apply for Mortgage Protection BEFORE handing over a non-refundable deposit.)

2. You can apply to a different insurer

Each insurer handles each case differently. This is especially true if you’ve been postponed because of a medical thing. Every insurance company has an underwriting department that do the maths and consider the risk on each application.

Some insurers treat specific illnesses or medical issues more sympathetically than others. I’m saying that just because one says no, another may not.

Just be prepared to pay a little more for the luxury of the insurance.

Basically, it’s a bit like Tinder for insurance. The more insurers you apply to, the more likely you are to get a match.

Tindred spirits.

3. Go to a good broker for help

Swiping right on all those insurers and their different policies can get time-consuming fast, so consider working with a broker who works with all the insurance companies. If you have a medical issue, be sure to work with a broker who has ample experience in that field. And make sure they deal with all the insurers.

Also, make sure you know the ins and outs of your medical condition, even better if you can share medical reports. The more information you have for your broker, the better set you’ll be.

They’ll use their nous to present your case to the most sympathetic insurer to increase your chances of nabbing mortgage protection and buying your dream home.

4. If all else fails, beg and plead for a waiver…

Can the insurer tell me why they have postponed offering cover?

That’s firm no.

Doctors provide the insurer with your medical records on the strict understanding that the insurer will keep them between the insurer and your doctor.

Your GP is in the best position to explain the medical reason for the insurer’s decision.

The insurer is unable to speak with you directly because of this.

They have to go through your GP.

What’s a mortgage protection waiver?

If you can’t get cover, and you can prove this by showing the bank your postponement/decline letter, the bank may allow a waiver.

A waiver is a piece of paper you sign confirming you understand the consequence of getting a mortgage without life insurance.

i.e. if you die, your partner will have to continue to pay it from their income.

Usually, the banks will only allow waivers in the following scenario:

joint application

one applicant can get cover

that applicant’s income is strong enough to support the mortgage repayments on their own.

Are there exceptions to mortgage protection?

From Citizens Information

Exceptions to the legal requirement

You do not have to take out mortgage protection insurance if:

You are aged over 50 or

The mortgage is not on your principal private residence (your home) or

You cannot get the insurance or can only get it at a much higher premium than normal or

You already have enough life insurance to pay off the home loan if you die

However, AND THIS IS THE KICKER, some lenders may insist that you take out mortgage protection insurance to give you a mortgage, even if there is no legal requirement.

Basically, waivers are at the discretion of the lender.

Some things to know about applying for Life Insurance with a medical issue/hiccup

Most postponements will be because of medical issues.

Undoubtedly, this is a bit shit.

You’re the exact person who needs Life Insurance, not yer man up the road who is 33 and runs marathons for the craic.

Of course, Runner Man is just as likely to be hit by a bus and wiped out – but you get my point. The insurers are awful sneaks when it comes to illnesses and pre-existing conditions.

The extent to which your health will affect your insurance comes down to the following:

If it’s a mild condition, you’ll probably have no kickback.

If it’s moderate, you’ll have to pay more, or the insurer may postpone.

If it’s a severe case (all the bad stuff no one wants to think about), the insurer may refuse to offer cover, or you’ll have to trade-off with a seeeeeeriouus premium increase.

Your GP will probably also have to complete a PMAR (Private Medical Attendants Report) – which is a medical questionnaire asking things like:

When were you diagnosed?

What are the symptoms?

How have you been treated?

How have you responded to treatment? Or how will you respond?

What’s the outlook?

From there, you can see how an insurer would reassess your case.

If you are trying to apply for Mortgage Protection and you’re hit with a postponement, it doesn’t mean you definitely won’t get the house you’ve fallen in love with. Or at least the home that’s not entirely falling apart based on the catastrophic housing situation in Ireland right now. Still, I’d be lying if I said it wouldn’t affect your chances.

Your best bet is to follow the steps I outlined above and see how it works.

You’ll have to roll the dice again down the line if all else fails.

There will be other houses, and probably a better one.

I promise it’s not all doom and gloom!

I have an appointment pending – will I be postponed?

More than likely, yes.

The most common reasons for a postponement are:

Awaiting a regular smear after an abnormal smear or an LLETZ or colposcopy

Referred for a heart check, e.g. cardiac MRI, ECG, or EKG

Breast check screen/mammogram

The above is only a sample.

If your medical report contains a referral for further investigation by a specialist, there will be an issue even if this referral is years old. Before applying, you should check with your GP; if the referral is no longer required, make sure they note this on your medical report. Otherwise, the insurer will postpone until the appointment has taken place.

Over to you…

Annie isn’t alone. And neither are you.

We’ve helped many people get cover where an insurer had previously postponed.

I’m not saying it’s easy, but it is possible.

If you don’t have a broker, I’ll be glad to help.

Call me on to discuss your application in confidence or schedule a call back here.

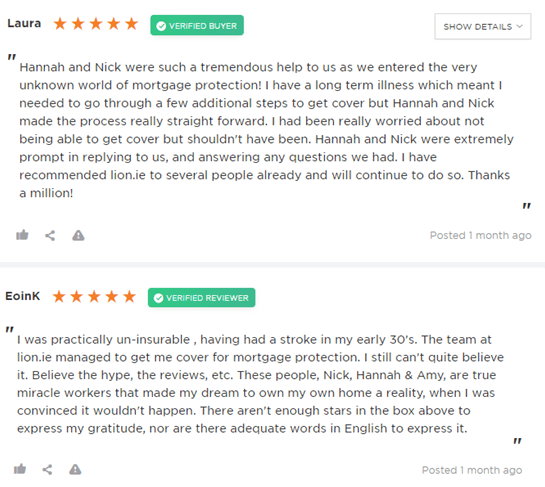

Don’t worry: we deal with the more difficult Life Insurance cases every day, so we know what we’re talking about. Just take a look at our testimonials.

Here are two to save you a click:

We can do that for YOU too.

If an insurer has postponed you, please complete this short medical questionnaire, and I’ll be right back to discuss your options.

Chat soon,

Nick