Older Workers and Periodic Coverage Reviews: A Medicare Customer Question

What You Need to Know

Many people ages 65 and older still have jobs.

The employer plan might be the best coverage option.

Sometimes, a Medicare plan might be a better choice.

Whether it’s a result of high inflation or a desire to bulk up retirement funds, older Americans are now working later in life than before.

The number of people ages 65 through 74 in the workforce has been rising for years, and the U.S.

Bureau of Labor Statistics projects that this segment will reach nearly 30.2% in 2026.

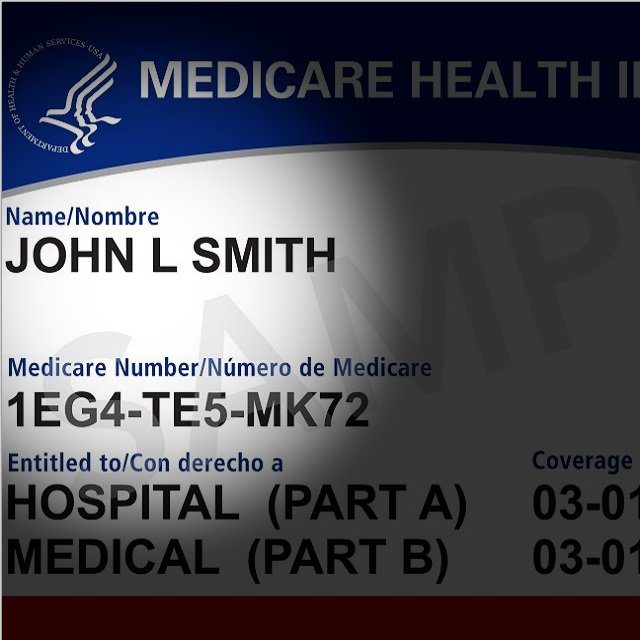

With the growing number of older adults in the workforce, it’s essential that they learn about the opportunity for cost savings when choosing their Medicare plan.

It can be a critical decision, especially as they continue to work beyond Medicare eligibility at age 65 and also plan for eventual retirement.

It’s an important decision to appropriately align their Medicare coverage with their health care needs.

As they consider their options and try to find the best fit for their financial situation and health needs, agents can play a vital role for their clients.

Agents need to understand the Medicare landscape so they can be the helping hand their client needs.

The Question

What are the benefits of comparing Medicare plan options regularly?

The Answer

Today’s economic landscape has many Americans feeling rightfully a little shaky about their financial future and how prepared they are to handle cost-of-living increases and inflation.

This is especially the case for older Americans, some of whom are living on a fixed income, including Medicare beneficiaries who must factor their health and health care into their financial planning as well.

Although people’s health and medical needs change over time, a survey by the U.S.

Centers for Medicare and Medicaid Services found that 71% of Medicare beneficiaries do not compare plans each year.

This means that the majority of beneficiaries are missing out on the opportunity to evaluate their current plan against other options.

Factors such as provider access, out-of-pocket and premium costs, and the overall quality of coverage vary from plan to plan.

Comparing plans is the only way to ensure beneficiaries are getting the best and most affordable health care coverage available.

Individuals still in the workforce have even more to consider because they have the option to remain on their employer health care plan.

However, many people working past retirement age don’t fully understand their options — meaning that even though they have more avenues to explore, they are often still missing out on the chance to maximize their coverage.

For instance, many older Americans aren’t aware they can enroll in Medicare while still working, which could be more cost-effective.