Mindy Diamond: It's the Best Time in Years for Advisors to Switch Firms

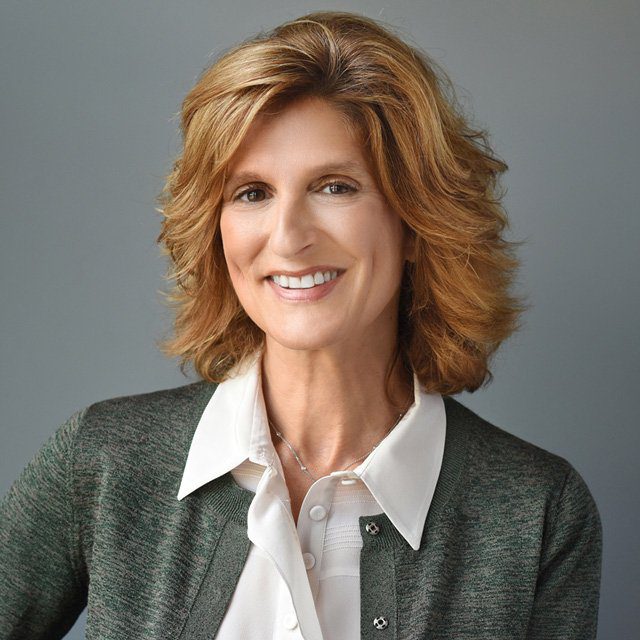

Firms are offering quality advisors transition packages “at real high-water marks. It’s a real seller’s market” in which financial advisors are “more likely [to] find [their] version of utopia versus five or 10 years ago,” Mindy Diamond, a leading financial advisor recruiter, tells ThinkAdvisor in an interview.

Uppermost in the minds of financial advisors seeking to change firms is, apart from the compensation, a strong desire for “freedom and control,” the founder and CEO of Diamond Consultants says.

“They want autonomy,” she stresses. “They want agency over their business lives.”

So are the big firms giving it to them?

“No, not so much,” according to Diamond, who explains why in the interview.

She also discusses the expanded options available to advisors looking to leave large firms, including joining “boutiques” that provide more of that wanted freedom and control, as well as increased opportunities for entrepreneurial types to open their own RIAs.

Though some large firms have started to provide financial advisors with advisor and client services similar to those RIAs offer, the wirehouses, worried about “cannibalizing their wealth management unit[s],” aren’t following suit, Diamond says.

The recruiter also discusses critical questions advisors should ask a firm they’re seriously considering joining, along with her advice on hiring an attorney to represent their interests.

A popular keynote speaker at industry events, such as Pershing’s Insite and Schwab Impact, Diamond blogs weekly and hosts the podcast “Mindy Diamond on Independence.”

In the interview, she singles out two large firms that are going against the grain in their bid to attract advisors and comments on why more women aren’t entering the profession.

Noting that “last year was [her firm’s] best year ever,” she observes that the coronavirus pandemic, which required most advisors to work from home, made many realize “how little they were actually relying on their branch — the office infrastructure — to be successful” and gave those who were already considering moving the privacy to explore options.

ThinkAdvisor recently interviewed Diamond, who was on the phone from her firm’s base in Morristown, New Jersey.

When the conversation pivoted to wirehouses’ retire-in-place programs, she called the trend “a pretty powerful force” — “a blessing and a curse.”

Here are highlights of the interview:

THINKADVISOR: What’s doing in the world of financial advisor recruiting?

MINDY DIAMOND: It’s a real seller’s market. If you’re a quality advisor with a quality book of business, you’ll more likely find your version of utopia versus five or 10 years ago.

The seller’s market is [largely] being fueled by more competition for top talent. It keeps everybody [who’s] bidding on their toes. The deals — the transition packages — being offered are at real high-water marks.

It’s a good time to be an advisor.

What are FAs looking for when they decide to move firms?

One of the things that has really changed in the last number of years is the advisor mindset: What they value is very different from what it once was.

It’s true generally that advisors want freedom and control more than anything. They want autonomy. They want agency over their business lives, including whether they work from home or go to the office two days a week or whatever [the arrangement].

How does this attitude differ from that of the past?

When I started my business [in 1998], every conversation [with an advisor] started with “What’s the deal? How much are they paying?” That was the most important thing.

Of course, the economics are still important. But that’s not what anyone leads with.

What’s most important is “How am I going to best serve my clients, and will I have the freedom, control and agency over my life to get it done?”

So are the firms willing to give them that control?

No, not so much. In fact, if anything, they’re probably giving them less.

Why?

If you’re the senior leader of a publicly traded firm, you’re responsible for margin expansion, keeping the stock price up, keeping costs low, managing the bottom line.

Those don’t necessarily equate with giving advisors more control.

Does that frustrate the advisors?

Yes. When an advisor leaves, nine times out of 10 the number one reason is that they don’t feel they have enough control or freedom or aren’t feeling the love as much.

They don’t have enough of what they want, and they’re frustrated.

How does recruiting in 2022 compare with other years?

The industry landscape has expanded a lot. There are more legitimate options for advisors than ever before.

It’s certainly [a matter of] considering Merrill [Lynch], Morgan [Stanley], UBS and Wells [Fargo].

But it’s also about considering options like Rockefeller [Capital Management] and First Republic [Private Wealth Management], and independence.

So exploration becomes a bigger process, but in a good way.

What are the wirehouses doing to try to stop advisors from leaving and keep their assets under management with the firm?

There’s a pretty powerful force that’s in play to try to keep them in their seats: The big firms are working hard to tie up as many advisors as possible via retire-in-place programs [transferring business to next gen and monetize in place].

In fact, they’re looking to get the advisors tied up as early as possible — sometimes 10 or 20 years before they’re ready to retire. And they’re paying them a premium to do so.

[The programs are] a blessing and a curse.

How so?

They’re a blessing because being able to retire in place without having a disruption [to your business] is a great thing. But one of the downsides is that you lose optionality the more you’re tied up.

How are advisors responding to these programs?

For a senior advisor who was inclined to stay put anyway, who is fairly close to retirement, has no issues with their firm, and most importantly, doesn’t have a family member that’s a next-generation advisor, they’re very likely to embrace it.

What about FAs with next-gen advisors in their family?

They’re questioning the programs. Binding them for the first 20 years [for example] if they’re signing on early, without any sort of escape hatch and making it more expensive or harder for them to leave, probably isn’t the best thing.

What do the next-gen FAs think?

A lot of movement these days is driven by the next generation, who’s looking at these programs and saying, “There’s got to be a better way. I get it that you, Dad — or Mom — have a right to monetize your life’s work, but you’re handcuffing the business. That’s not a good thing.”

Is the trend of advisors becoming RIAs or joining other RIAs as strong as it was?

That’s the breakaway movement, and it’s still a tremendous trend: advisors leaving the traditional firms and going independent. They’re looking for more freedom and control.

There are a number of new entrants [to the industry], which we could call boutique firms, that certainly give advisors more freedom and control than they had at Merrill, Morgan or UBS.

And they don’t have to build something from scratch, because they’re plugging into an already-established infrastructure.

So this is a middle-ground solution. Rockefeller and First Republic are good examples of that.

But it’s easier nowadays for an advisor to build their own firm from scratch. Right?