Market timing and missing the worst performance days

In my last article, I wrote about the benefits of a buy and hold strategy where an investor stayed in the market through the ups and downs of a particular investment.

Let’s consider the same four friends, James, Stacey, Jasmine and Vincent and their investment behaviour under a different scenario. Each person invests $10,000 in the same investment, the S&P/TSX Total Return Index. This time, everyone except James, enters and leaves the market over the same 10 year period, missing some of the worst performing days of that investment.

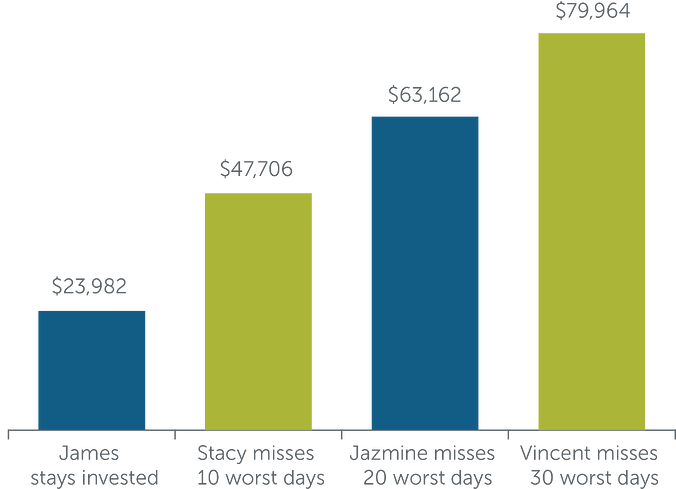

James experiences the same result as under scenario 1. His “buy and hold” strategy resulted in a gain of $23,982. Let’s look at what happened to his three friends.

Timing the market

$10,000 investment in S&P/TSX Total Return Index over 10 years

(2012-2021)

Illustration only, not intended to project future performance of any particular investment.

This scenario shows the merits of timing the market so as to avoid the worst days of performance of a particular investment.1 Here’s the problem. The math works but putting the strategy into practice so that the results match this scenario is virtually impossible. You only know what the worst days have been after the fact. The same holds true for knowing when the best performing days are going to be. Again, seasoned professionals are unable to boast this kind of performance despite being focused on doing this for a living. They hold professional accreditation, have years of education, training and experience and have resources most investors do not.

Nobody likes to lose money. Loss aversion can lead investors to take a loss on paper and turn it into a realized loss by selling equities after a market downturn. Why? They want to avoid more losses. Unfortunately, this behavior can result in missing some of the best days of market returns. The best days tend to follow the worst days within very short timelines. The tough thing to do is staying invested through the dips and drops of the market. Benefiting from those best days that follow can be key to the recovery of an investment portfolio and to optimize returns over time. Consider the previous article which focused on missing the best times of the year to be invested. It shows the risk created by letting emotions take charge when markets go up and down dramatically. Timing the market to your advantage is impossible when considering the small gap between the best and worst days. Given that the worst days frequently precede the best, stay invested.

Investors who do not adopt a long term discipline of a buy and hold strategy tend not to outperform the markets let alone professional fund managers. That said, the two scenarios I have described in this and my previous article may be optimized when investors adopt a dollar cost averaging approach. This strategy does not rely on timing the market. Investors buy in at regular intervals during the accumulation phase of their lives and sell off at regular intervals during the decumulation phases of their lives. They view the worst performance days of the market as times to buy, because investments are on sale. They hold on to those investments during times when those investments experience exceptional growth. The average cost of buying the investment over time may be lower.

Many investors do well and feel less stressed when they rely on professionals to manage the timing of purchases and sales of investments forming a portfolio.2 A key consideration is selecting the right combination of investments that will help investors meet their goals. Another one is the cost associated with having investments managed actively and the value received for the advice and planning investors get from accredited financial advisors in exchange for those investment expenses. This is another example of doing this for yourselves, not by yourselves. Seek out a professional accredited advisor to help you out.

1 Source: Morningstar Research Inc., January 1, 2012 to December 31, 2021.

2 Source: Ivey Business School report, “The costs and benefits of financial advice,” 2013. CIRANO, The Value of Advice Report 2012

Related article(s)

Staying invested in the market