Manulife: A 5.2% Yielding Blue Chip Too Cheap To Ignore – Seeking Alpha

Riddy/iStock via Getty Images

This article was coproduced with Dividend Sensei.

The correction of 2022 is now 65 days old and could potentially last another eight to 10 weeks, according to Morgan Stanley and JPMorgan.

Why?

Well, there are many bricks in Wall Street’s wall of worry, but one of the biggest is inflation.

Thanks to the supply chain disruptions of the pandemic, combined with record excess savings from trillions in stimulus and a booming economy, inflation has soared to 7.9%.

Even excluding volatile food and fuel costs, core inflation is 6.4%. And thanks to soaring energy prices, largely a result of Russia’s invasion of Ukraine, Goldman Sachs thinks inflation could get a bit worse in the next month.

Goldman estimates that we could see about 8.5% inflation in March, and in a worst-case scenario of $200 crude, about 10.5% in the coming months.

But guess what?

High inflation tends to cause rising interest rates and that’s a boon to financial blue chips like Manulife Financial (MFC).

YCharts

In fact, value tends to do best relative to growth when rates are rising, and you can see that from MFC’s 4% gains this year, which are 20% better than the Nasdaq.

Today I want to share with you the three reasons why Manulife is one of the best high-yield blue chips you can safely buy in these troubled times.

Not only does it offer a very safe 5.2% yield today, but it could help you retire in safety and splendor in the coming years and decades.

In fact, MFC is an anti-bubble Buffett-style “fat pitch” that analysts expect to deliver 32% total returns in the next year and potentially triple over the next half-decade.

Or to put it another way, Manulife Financial is a 5.2% yielding blue-chip set to soar and too cheap to ignore.

Reason One: One Of The World’s Highest Quality Companies

The Dividend Kings’ overall quality scores are based on a 238-point model that includes:

dividend safety

balance sheet strength

credit ratings

credit default swap medium-term bankruptcy risk data

short and long-term bankruptcy risk

accounting and corporate fraud risk

profitability and business model

growth consensus estimates

historical earnings growth rates

historical cash flow growth rates

historical dividend growth rates

historical sales growth rates

cost of capital

long-term risk-management scores from MSCI, Morningstar, FactSet, S&P, Reuters’/Refinitiv and Just Capital

management quality

dividend friendly corporate culture/income dependability

long-term total returns (a Ben Graham sign of quality)

analyst consensus long-term return potential

It actually includes more than 1,000 metrics if you count everything factored in by 12 rating agencies we use to assess fundamental risk.

How do we know that our safety and quality model works well?

During the two worst recessions in 75 years, our safety model predicted 87% of blue-chip dividend cuts during the ultimate baptism by fire for any dividend safety model.

How does MFC score on one of the world’s most comprehensive safety models?

MFC Dividend Safety

Rating

Dividend Kings Safety Score (147 Point Safety Model)

Approximate Dividend Cut Risk (Average Recession)

Approximate Dividend Cut Risk In Pandemic Level Recession

1 – unsafe

0% to 20%

over 4%

16+%

2- below average

21% to 40%

over 2%

8% to 16%

3 – average

41% to 60%

2%

4% to 8%

4 – safe

61% to 80%

1%

2% to 4%

5- very safe

81% to 100%

0.5%

1% to 2%

MFC

91%

0.5%

1.5%

Risk Rating

Low Risk (84th industry percentile consensus)

A stable outlook credit rating 0.66% 30-year bankruptcy risk

15% OR LESS Max Risk Cap Recommendation

Long-Term Dependability

Company

DK Long-Term Dependability Score

Interpretation

Points

Non-Dependable Companies

21% or below

Poor Dependability

1

Low Dependability Companies

22% to 60%

Below-Average Dependability

2

S&P 500/Industry Average

61% (58% to 70% range)

Average Dependability

3

Above-Average

71% to 80%

Very Dependable

4

Very Good

81% or higher

Exceptional Dependability

5

MFC

85%

Exceptional Dependability

5

Overall Quality

MFC

Final Score

Rating

Safety

91%

5/5 very safe

Business Model

80%

2/3 above-average

Dependability

85%

5/5 exceptional

Total

88%

12/13 Super SWAN

Risk Rating

3/3 Low Risk

15% OR LESS Max Risk Cap Rec

10% Margin of Safety For A Potentially Good Buy

MFC: The 81st Highest Quality Master List Company (Out of 509) = 84th Percentile

The DK 500 Master List includes the world’s highest quality companies including:

All dividend champions

All dividend aristocrats

All dividend kings

All global aristocrats (such as BTI, ENB, and NVS)

All 13/13 Ultra Swans (as close to perfect quality as exists on Wall Street)

47 of the world’s best growth stocks (on its way to 100)

MFC’s 88% quality score means its similar in quality to such blue-chips as

Nordson (NDSN) – dividend king

Pepsi (PEP) – dividend king

Altria (MO) – dividend king

Kimberly-Clark (KMB) – dividend king

Ecolab (ECL) – dividend aristocrat

Caterpillar (CAT) – dividend aristocrat

A.O Smith (AOS) – dividend aristocrat

McCormick (MKC) – dividend aristocrat

Even among the most elite companies on earth, MFC is higher quality than 84% of them.

Why?

Manulife was founded in 1999 in Toronto, Canada.

Manulife provides life insurance and wealth management products and services to individuals and group customers in Canada, the United States, and Asia.

Manulife is one of Canada’s Big Three Life Insurance companies (the other two are Sun Life and Great-West Life). As of Dec. 31, 2020, Manulife reported assets under management or administration of about CAD $1.3 trillion.” – Morningstar

It’s the third-largest insurance company in Canada and the seventh-largest publicly-traded insurance company on earth.

But it’s also highly diversified globally.

Investment Thesis: Improving Profitability Fueling Industry-Leading Growth

“Manulife, along with Sun Life and Great-West Life, are the Big Three Canadian life insurers. While Manulife has attempted to reposition itself from the global financial crisis, it is still arguably the worst position of the three as it generally has the lowest returns on equity.

Not only does Manulife pay out the highest percentage of benefits to premiums, but the firm’s asset-management operations don’t generate the pretax margins that Sun Life’s does, while Great-West has a larger retirement record-keeping business via Empower.” – Morningstar

MFC’s growth prospects are the best of the CA big three thanks to its margins having the most room for expansion.

In other words, just like Home Depot (HD) has superior profitability to Lowe’s (LOW) for many years, it’s the ability to boost margins that can deliver superior long-term growth and potentially life-changing long-term returns.

“Asia has been a big focus for Manulife and currently generates around 30% of the firm’s profit. Manulife’s Asia business stretches across the continent as the firm provides insurance and wealth products in Japan, Hong Kong, Singapore, mainland China, and Southeast Asian countries. In addition, Manulife recently entered into a joint venture to provide asset and wealth management solutions in India.” – Morningstar

MFC is investing heavily in Asia, which it sees as the best long-term growth runway in the insurance industry.

“In the fourth quarter, we announced a dividend increase of $0.05 per share resulting in a total quarterly common shareholder dividend of $0.33 per share or an 18% increase. This increase resumed our track record of sustained gradual dividend increases which remains one of our top capital deployment priorities. We also recently launched a Normal Course Issuer Bid to repurchase up to 5% of outstanding common shares.” – CEO, Q4 conference call (emphasis added)

MFC plans to increase the dividend every year going forward and buying back more stock than it historically has.

“On a cumulative basis, we freed up $6.3 billion of capital through various efforts across multiple legacy blocks. And our commitment and focus on optimizing our long-term care and variable annuity businesses are as strong as ever. And we aim to achieve our 2025 supplemental goal of reducing core earnings contributions from these businesses for less than 15% of total core earnings and would like to see this decline further to less than 10% with inorganic actions…

I’m pleased to report that in 2021, we reduced the core earnings contribution from our long-term care and variable annuity businesses to 20%, supported by the increasing contributions from our highest potential businesses. In addition, we entered into an agreement in the fourth quarter to reinsure a significant portion of our legacy US Variable Annuity Block with Venerable Holdings, Inc. ” – CEO, Q4 conference call

Legacy businesses like long-term care (nursing homes) and annuities have bedeviled insurance companies for the last decade. MFC is working on getting those policies down to less than 10% of its business over time.

“I’m pleased to confirm the transaction closed on February 1st and is expected to result in approximately $2 billion of capital released in 2022. This transaction positions us well to achieve our 2025 supplemental goal…

We plan to deploy a significant portion of the capital release to buy back common shares to neutralize the impact of the transaction on core EPS. We remain committed to optimizing our legacy portfolio especially LTC and VA and we’ll continue to seek opportunities to reduce risk and unlock value.” – CEO, Q4 conference call

MFC is executing well on that plan to become a more profitable and financially flexible company in the future.

MFC has a good market share in a highly fragmented global industry.

#1 in Canadian retirement plans

#2 in Canadian group benefit plans

#3 in Canadian insurance

10th largest bank in Canada

#1 in Hong Kong retirement plans

#1 in Vietnam insurance

#2 in Singapore insurance

#5 in HK insurance

#8 in Indonesian insurance

#8 in Malaysian insurance

#9 in US insurance

MFC just signed a 16-year deal with one of Vietnam’s largest banks and acquired a Vietnam insurance company.

Why?

Vietnam’s economy has grown at 9% annually over the last decade (one of the fastest-growing economies on earth)

just 1.6% insurance generation (long growth runway)

Manulife’s Vietnam policies have been growing at 27% CAGR over the last five years

its estimated Vietnam new business value has been growing at 51% CAGR

This is just one example of how MFC is able to deliver some of the best growth rates in the insurance industry.

Management thinks it can grow at 10% to 12% over time while delivering safe dividends via a 30% to 40% payout ratio (50% is safe according to rating agencies).

Conservative Investment Strategies Retirees Can Trust

MFC’s $333 billion investment portfolio is 83% invested in bonds, 97% of which are investment grade.

7% stocks

10% alternatives like real estate, infrastructure, private equity, and timberland and farmland

15% of MFC’s bond portfolio (13% of its portfolio) is AAA-rated sovereign debt

72% is A-rated bonds (59% of its portfolio)

75% of its portfolio is investing in Canada and the US, and another 9% in Japan and Europe.

Its securities debt is 72% AAA, and 92% A-rated or better.

Not a single corporate bond is more than 1% of its portfolio, and it has exposure to every sector.

Its high quality commercial real estate portfolio is diversified globally

42% US

42% Canada

14% Asia

2% Australia and other

MFC owns $11.25 billion in commercial real estate in some of the world’s most important financial centers.

Toronto

LA

San Diego

Boston

Singapore

Vancouver

San Francisco

Hong Kong

Chicago

Washington

New York

Melbourne

Atlanta

Tokyo

Bottom Line: Manulife Is A 5.2% Yield Retirees Can Trust

In fact, no less than Warren Buffett think another financial crisis is all but impossible.

The banks will not get this country in trouble, I guarantee it” – Warren Buffett

New financial regulations post-Great Recession were so strict that even in 2013 Buffett assured the world that another crisis was very unlikely.

MFC Credit Ratings: Very Little Fundamental Risk

Rating Agency

Credit Rating

30-Year Default/Bankruptcy Risk

Chance of Losing 100% Of Your Investment 1 In

S&P

A stable

0.66%

151.5

Fitch

A stable

0.66%

151.5

DBRS

A+ stable

0.60%

166.7

AmBest

A-

2.50%

40.0

Consensus

A stable

1.11%

90.5

(Source: S&P, Fitch, DBRS, AMBest)

MFC’s balance sheet and risk-management look nothing like the company that had to cut its dividend twice during the Great Recession.

And MFC’s subsidiary financial strength ratings are even more impressive.

AM Best: A+ (2nd place out of 13 peers)

DBRS/Morningstar AA (3rd place out of 22 peers)

Fitch AA- (4th place out of 21 peers)

Moody’s A+ (5th place out of 21 peers)

S&P AA- (4th place out of 21 peers)

No less than four credit rating agencies estimate an approximate 1% risk of losing all your money buying this company today.

MFC’s capital reserves are 41% above regulatory minimums.

How do MFC’s credit ratings compare to its two largest peers?

Sun Life Credit Ratings

Rating Agency

Credit Rating

30-Year Default/Bankruptcy Risk

Chance of Losing 100% Of Your Investment 1 In

S&P

A+ stable

0.60%

166.7

DBRS

A+ stable

0.60%

166.7

AmBest

A

0.66%

151.5

Consensus

A stable

0.62%

161.3

(Source: S&P, DBRS, AMBest)

Great-West Credit Ratings

Rating Agency

Credit Rating

30-Year Default/Bankruptcy Risk

Chance of Losing 100% Of Your Investment 1 In

S&P

A+ stable

0.60%

166.7

Fitch

A+ Negative Outlook

0.60%

166.7

DBRS

A+ stable

0.60%

166.7

AmBest

A

0.66%

151.5

Consensus

A stable

0.62%

162.6

(Source: S&P, Fitch, DBRS, AMBest)

MFC’s credit ratings are not quite as good as SLF and GWO’s but rating agencies agree it’s a low-risk balance sheet and with a fundamentally very low risk of default and bankruptcy.

Like with Canadian banks, even the lower quality Canadian insurance company is still one of the world’s safest companies.

MFC Bond Profile

$1.7 billion in liquidity

well-staggered debt maturities (little problem refinancing maturing bonds)

bond investors are so confident in MFC’s new safer business model that they are willing to lend to it for 20 years at 4.1%.

Profitability: Wall Street’s Favorite Quality Proxy

MFC’s profitability has been improving in recent years, as management’s cost-cutting efforts take hold.

MFC”s profitability is relatively stable over the last decade and its free cash flow margins are now nearly 40%.

MFC Profit Margin Consensus Forecast

Year

EBIT (Operating) Margin

Net Margin

2020

7.0%

7.0%

2021

10.6%

10.6%

2022

9.6%

8.9%

2023

11.1%

10.1%

2024

15.1%

12.0%

Annualized Growth

21.20%

14.51%

(Source: FactSet Research Terminal)

MFC’s profitability is expected to significantly improve in the coming years, though some of this is due to the expected short-term decrease in sales.

MFC Dividend Growth Consensus Forecast

Year

Dividend Consensus

EPS/Share Consensus

Payout Ratio

Retained (Post-Dividend) Earnings

Buyback Potential

2021

$0.92

$2.57

35.8%

$3,206

8.36%

2022

$1.03

$2.79

36.9%

$3,420

8.92%

2023

$1.11

$3.00

37.0%

$3,672

9.58%

2024

$1.13

$3.30

34.2%

$4,216

11.00%

Total 2021 Through 2024

$4.19

$11.66

35.9%

$14,514.21

37.85%

Annualized Rate

7.09%

8.69%

-1.47%

9.56%

9.56%

(Source: FactSet Research Terminal)

Rating agencies consider a 50% payout ratio safe for this industry.

MFC is expected to average 36% and allow it to retain $14.5 billion in post-dividend earnings over the next few years.

That’s potentially enough to buy back almost 40% of its shares at current valuations.

MFC isn’t known for aggressive buybacks though it just authorized a 5% buyback program to take advantage of its low valuation.

Basically, MFC offers high-yield income investors everything they could want.

a generous and safe yield

that grows every year including during the worst recession in 75 years

a fortress balance sheet confirmed by no less than five credit rating agencies

But MFC’s 5.2% yield is just the starting point for its incredible long-term investment proposition.

Reason Two: Some Of The Best Growth Prospects In The Industry

MFC has some impressive growth levers to pull, and analysts are optimistic about its medium-term and long-term growth prospects.

MFC Medium-Term Growth Consensus Forecast

Year

Sales

EBIT (Operating Income)

Net Income

2020

$62,211

$4,349

$4,349

2021

$48,845

$5,164

$5,164

2022

$59,517

$5,687

$5,292

2023

$55,938

$6,191

$5,642

2024

$49,142

$7,413

$5,906

Annualized Growth

-5.73%

14.26%

7.95%

(Source: FactSet Research Terminal)

MFC’s efficiency efforts are expected to overcome the medium-term sales headwinds analysts expect.

Metric

2020 Growth Consensus

2021 Growth Consensus

2022 Growth Consensus

2023 Growth Consensus (Bond Market Recession Forecast)

2024 Growth Consensus

Sales

0%

-19%

28%

-6%

-12%

Dividend (Local Currency)

12%

5%

14% (official)

7%

2%

EPS

-3%

18%

9%

9%

9%

Operating Cash Flow

-3%

23%

NA

NA

NA

Book Value

8%

7%

10%

7%

19%

(Source: FAST Graphs, FactSet Research Terminal)

While revenue can be volatile in this industry what matters is that MFC is expected to deliver very consistent earnings and book value growth, as well as dividend increases every single year.

And here’s the reason Dividend Sensei just recommended MFC for DK members and added it to the DK correction watchlist.

MFC Long-Term Growth Outlook

8% to 13% growth consensus range

13% median growth estimate from all 16 analysts

10% to 12% management guidance

Coming out of the financial crisis MFC suffered many years of disappointing earnings growth, missing expectations until it began modestly beating expectations started in 2017.

smoothing for outliers 30% margins of error to the downside and 5% to the upside

5% to 14% CAGR margin-of-error adjusted growth consensus range

70% probability that MFC grows within this range over time

80% probability it grows at least at 5% (and delivers 10.2% long-term returns)

In the modern regulatory and low rate era, MFC’s growth rates have ranged from 7% to 19% CAGR.

Analysts expect growth similar to the last six years (13.4% CAGR), and management says it can deliver long-term growth similar to the last 12 years (10.4%).

What does all this mean for long-term high-yield investors?

Investment Strategy

Yield

LT Consensus Growth

LT Consensus Total Return Potential

Long-Term Risk-Adjusted Expected Return

Long-Term Inflation And Risk-Adjusted Expected Returns

Manulife (Analyst Consensus)

5.20%

13%

18.2%

12.7%

10.6%

Manulife (Management Guidance)

5.2%

11.0%

16.2%

11.3%

9.2%

Dividend Growth

1.6%

12.6%

14.2%

9.9%

7.8%

Value

2.1%

12.1%

14.1%

9.9%

7.7%

High-Yield

2.8%

11.3%

14.1%

9.9%

7.7%

High-Yield + Growth

1.7%

11.0%

12.7%

8.9%

6.7%

Safe Midstream

5.8%

6.3%

12.1%

8.5%

6.3%

Safe Midstream + Growth

3.3%

8.5%

11.8%

8.3%

6.1%

Nasdaq (Growth)

0.8%

10.7%

11.5%

8.1%

5.9%

Dividend Aristocrats

2.2%

8.9%

11.1%

7.8%

5.6%

REITs + Growth

1.8%

8.9%

10.6%

7.4%

5.2%

S&P 500

1.4%

8.5%

9.9%

6.9%

4.8%

REITs

3.0%

6.5%

9.5%

6.6%

4.4%

60/40 Retirement Portfolio

1.9%

5.1%

7.0%

4.9%

2.7%

10-Year US Treasury

1.9%

0.0%

1.9%

1.4%

-0.8%

(Sources: Morningstar, FactSet, Ycharts)

MFC has the potential to deliver a 5.2% very safe and rapidly growing yield today and life-changing 16% to 18% returns in the future.

far more than the S&P, Nasdaq, and aristocrats

or any major investment strategy

MFC Inflation-Adjusted Long-Term Return Potential: $1,000 Initial Investment

Time Frame (Years)

7.8% CAGR Inflation-Adjusted S&P Consensus

8.9% Inflation-Adjusted Aristocrat Consensus

14.0% CAGR MFC Guidance

Difference Between MFC Guidance And S&P

5

$1,453.07

$1,531.58

$1,925.41

$472.34

10

$2,111.43

$2,345.73

$3,707.22

$1,595.80

15

$3,068.06

$3,592.68

$7,137.94

$4,069.88

20

$4,458.12

$5,502.47

$13,743.49

$9,285.37

25

$6,477.98

$8,427.47

$26,461.92

$19,983.94

30

$9,412.99

$12,907.33

$50,950.16

$41,537.17

(Source: DK Research Terminal, FactSet)

Time Frame (Years)

Ratio Aristocrats/S&P

Ratio MFC Guidance and S&P

5

1.05

1.33

10

1.11

1.76

15

1.17

2.33

20

1.23

3.08

25

1.30

4.08

30

1.37

5.41

Is it worth paying 6.9X earnings for a high-quality 5.2% yielding insurance company to potentially earn 5.4X the market’s inflation-adjusted long-term returns?

I think so.

And here’s why MFC is such a potentially amazing investment opportunity today.

MFC Investment Decision Score

DK Investment Tool

DK Investment Tool

In fact, for anyone comfortable with its risk profile, MFC is a close to a perfect high-yield dividend growth blue-chip as you can buy in today’s market.

Reason Three: A Ridiculously Attractive Valuation

In the modern regulatory, low-interest rate era, tens of millions of investors have paid between 10 and 12.5X earnings for MFC.

Metric

Historical Fair Value Multiples (12-year)

2021

2022

2023

2024

12-Month Forward Fair Value

5-Year Average Yield

4.28%

$21.50

$24.05

$24.05

$26.40

13-Year Median Yield

3.72%

$24.73

$27.67

$27.67

$30.38

Earnings

10.99

$28.24

$30.66

$32.97

$36.27

Average

$24.52

$27.19

$27.77

$30.50

$27.30

Current Price

$19.63

Discount To Fair Value

19.93%

27.81%

29.30%

35.63%

28.10%

Upside To Fair Value (NOT Including Dividends)

24.90%

38.52%

41.45%

55.36%

39.08% (44% including dividend)

2022 EPS

2023 EPS

2022 Weighted EPS

2023 Weighted EPS

12-Month Forward EPS

12-Month Average Fair Value Forward PE

Current Forward PE

$2.79

$3.00

$2.25

$0.58

$2.83

9.6

6.9

I conservatively estimate MFC is worth 9.6X earnings, and today it trades at 6.9x.

Analyst Median 12-Month Price Target

Morningstar Fair Value Estimate

$24.89 (8.3 PE)

$22.50 (8 PE)

Discount To Price Target (Not A Fair Value Estimate)

Discount To Fair Value

21.13%

12.76%

Upside To Price Target (Not Including Dividend)

Upside To Fair Value (Not Including Dividend)

26.80%

14.62%

12-Month Median Total Return Price (Including Dividend)

Fair Value + 12-Month Dividend

$25.92

$23.53

Discount To Total Price Target (Not A Fair Value Estimate)

Discount To Fair Value + 12-Month Dividend

24.27%

16.57%

Upside To Price Target ( Including Dividend)

Upside To Fair Value + Dividend

32.04%

19.86%

Morningstar’s 8 PE fair value estimate is 90% likely to be too conservative based on market-determined historical fair values.

But even if Morningstar is right, MFC still has 20% upside potential to fair value.

And analysts expect 32% total returns in the next year alone.

Rating

Margin Of Safety For Low-Risk 13/13 Ultra SWAN Quality Companies

2022 Price

2023 Price

12-Month Forward Fair Value

Potentially Reasonable Buy

0%

$27.19

$27.77

$27.30

Potentially Good Buy

10%

$24.47

$24.99

$24.57

Potentially Strong Buy

20%

$21.75

$22.21

$21.84

Potentially Very Strong Buy

30%

$17.13

$19.44

$19.11

Potentially Ultra-Value Buy

40%

$16.31

$16.66

$16.38

Currently

$19.63

27.81%

29.30%

28.10%

Upside To Fair Value (Not Including Dividends)

38.52%

41.45%

39.08%

For anyone comfortable with MFC’s risk profile, it’s a potentially strong buy and very close to a very strong buy, and here’s why.

Consensus Total Return Potential That Knock Your Socks Off

For context, here’s the return potential of the 12% overvalued S&P 500.

Year

EPS Consensus

YOY Growth

Forward PE

Blended PE

Overvaluation (Forward PE)

Overvaluation (Blended PE)

2021

$206.39

50.44%

20.5

23.1

19%

31%

2022

$223.03

8.06%

19.0

19.7

10%

12%

2023

$245.83

10.22%

17.2

18.1

0%

3%

2024

$272.94

11.03%

15.5

16.4

-10%

-7%

12-Month forward EPS

12-Month Forward PE

Historical Overvaluation

PEG

25-Year Average PEG

S&P 500 Dividend Yield

25-Year Average Dividend Yield

$225.60

18.762

11.48%

2.21

3.62

1.43%

2.01%

(Source: DK S&P 500 Valuation And Total Return Tool) updated weekly

Stocks have already priced in 90% EPS growth from 2020 through 2024 and are trading at 18.5X forward earnings.

S&P 500 2023 Consensus Return Potential

FAST Graphs

Analysts expect the S&P 500 to deliver potentially -4% total returns over the next two years.

Year

Upside Potential By End of That Year

Consensus CAGR Return Potential By End of That Year

Probability-Weighted Return (Annualized)

Inflation And Risk-Adjusted Expected Returns

2027

42.90%

7.40%

5.55%

2.10%

(Source: DK S&P 500 Valuation And Total Return Tool) updated weekly

Adjusted for inflation, the risk-expected returns of the S&P 500 are about 2% for the next five years.

S&P Earnings Yield

10-Year US Treasury Yield

Earning Yield Risk-Premium (3.7% 10 and 20-year average)

5.33%

1.98%

3.35%

Theoretical Interest Rate Justified Market Fair Value Forward PE

Current PE

Theoretically Interest Rate Justified Market Decline

17.62

18.76

6.10%

(Source: DK S&P 500 Valuation And Total Return Tool) updated weekly

Even adjusting for low (and rising) interest rates, stocks still require a 6% correction before they become theoretically fairly valued.

But here’s what investors buying MFC today can reasonably expect (5% to 14% growth and 10 to 12.5X earnings)

MFC 2023 Consensus Total Return Potential

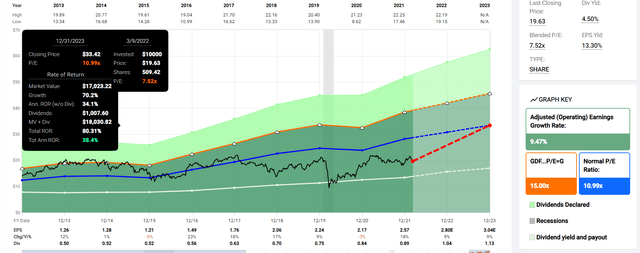

FAST Graphs

If MFC grows as expected and returns to historical fair value by 2023 that’s potentially 80% total returns or 38% annually.

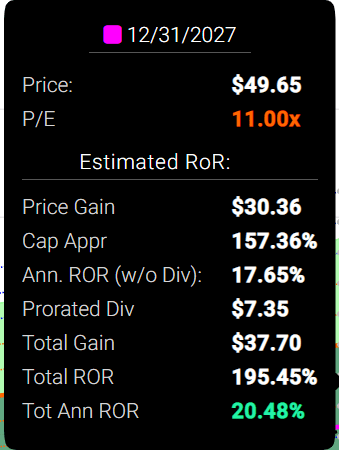

MFC 2027 Consensus Return Potential (Management Guidance)

FAST Graphs

If MFC grows as expected and returns to historical mid-range fair value

But before you get too excited, and start measuring the drapes for your penthouse, don’t forget that even low-risk Super SWANs still have risk profiles you have to be comfortable with before investing.

Risk Profile: Why Manulife Isn’t Right For Everyone

There are no risk-free companies and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

MFC’s Risk Profile Summary

“Because of its balance sheet, Manulife is sensitive to changes in interest rates and equity markets. Manulife discloses that a 50-basis-point decrease in interest rates would reduce net income by about $100 million excluding changes to fair value.

In addition, Manulife’s asset management business is sensitive to changes in equity markets. Over the past several years, the company has taken steps such as adjusting its business mix and implementing hedge activities to decrease earnings sensitivity but hedging can be costly and add additional risks. Manulife does not attempt to fully hedge out all risks of its products.

From an environmental, social, and governance perspective, we view the largest risks as stemming from business ethics and product governance issues. For example, U.S. life insurer MetLife failed to pay thousands of workers’ pension payments and has settled with the SEC related to weak internal controls in its annuity business.

In addition, with CAD 764 billion in assets under management or administration, an operational failure could be costly. Lastly, given the millions of customers, failure to keep personal data secure and private could harm the company. We believe management has adequately managed ESG risks so far.” – Morningstar

economic cyclicality risk: mostly through interest rates and asset management fees

each 1% decrease in interest rates = 4% decline in net profit

each 1% increase = 4% increase in net profit

regulatory risk (domestically and internationally, pertaining to capital buffers)

M&A risk

margin compression risk: SFL and GWO are larger and have better economies of scale

labor retention risk (tightest job market in over 50 years and finance is a high paying industry) – rising wage pressures

currency risk (growing over time as Asian business is the fastest-growing part of the business)

The Asian market is a competitive one with domestic companies often having leading market share and firms are subject to various regulations. As an example, Manulife, along with other insurers, suspended selling company-owned life insurance policies in Japan because of uncertainty regarding the tax treatment of these policies. Revenue growth in Asia has been strong but we’d focus on profits as it has slipped and we believe growth is only accretive if it generates sufficient returns on equity.” – Morningstar

Global expansion is an opportunity, but one that brings its fair share of challenges and risks.

In general, higher interest rates should benefit the firm’s investment income. That said, higher inflation is likely to weigh on expense growth. Core expense growth was 5% in 2021 versus a modest decline in 2020. The expense efficiency ratio improved to 48.9% in 2021 from 52.9% in 2020. Manulife expects to be under 50% for 2022.” – Morningstar

MFC is doing a good job managing its costs but higher inflation around the world could put pressure on its labor costs and make it more difficult to achieve the expected growth that management and analysts are forecasting.

What Would Break/Weaken The Thesis On MFC

Fundamental safety falls to 40% or less (unsafe) – would require MFC’s core business model to fail dramatically

growth consensus falls to less than 4.8% CAGR for 6 years

if growth consensus fell to less than 4.8% CAGR for 6 years then I’d sell my shares

MFC’s role in any portfolio is to generate steadily growing income and 10+% CAGR long-term total returns with minimal fundamental risk

High-yield defensive sectors like midstream, utilities, REITs, healthcare, consumer staples, etc, have 8+% total return requirements

non-defensive sectors have 10+% return requirements to stay on the Phoenix list (and in my portfolio)

How long it takes for a company’s investment thesis to break depends on the quality of the company.

Quality

Years For The Thesis To Break Entirely

Below-Average

1

Average

2

Above-Average

3

Blue-Chip

4

SWAN

5

Super SWAN

6

Ultra SWAN

7

Perfect 100% Quality – only MA at the moment

8

These are my personal rule of thumb for when to sell a stock if the investment thesis has broken.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Material Financial ESG Risk Analysis: How Large Institutions Measure Total Risk

“ESG is just normal risk by another name.” Simon MacMahon, head of ESG and corporate governance research, Sustainalytics” – Morningstar

ESG factors are taken into consideration, alongside all other credit factors, when we consider they are relevant to and have or may have a material influence on creditworthiness.” – S&P

ESG is a measure of risk, not of ethics, political correctness, or personal opinion.

S&P, Fitch, Moody’s, DBRS (Canadian rating agency), AMBest (insurance rating agency), R&I Credit Rating (Japanese rating agency), and the Japan Credit Rating Agency have been using ESG models in their credit ratings for decades.

Dividend Aristocrats: 67th Industry Percentile On Risk Management (Above-Average, Medium Risk)

MFC Long-Term Risk Management Consensus

Rating Agency

Industry Percentile

Rating Agency Classification

MSCI 37 Metric Model

93.0%

AA Industry Leader – positive trend

Morningstar/Sustainalytics 20 Metric Model

87.8%

17.9/100 Low-Risk

Reuters’/Refinitiv 500+ Metric Model

87.1%

Good

S&P 1,000+ Metric Model

61.0%

Above-Average- Stable Trend

FactSet

90.0%

Industry Leader- Positive Trend

Consensus

84%

Very Good

(Sources: Morningstar, Reuters’, S&P, JustCapital, FactSet Research)

MFC’s Long-Term Risk Management Is The 45th Best In The Master List (91st Percentile)

master list average: 62nd percentile

dividend kings: 63rd percentile

aristocrats: 67th percentile

Ultra SWANs: 71st percentile

MFC’s risk-management consensus is in the top 9% of the world’s highest quality companies and similar to that of such other companies as

Merck (MRK)

Mastercard (MA)

Cummins (CMI)

British American Tobacco (BTI) – global aristocrat

AbbVie (ABBV) – dividend king

Equinix (EQIX)

Digital Realty Trust (DLR.PK)

Prologis (PLD)

Applied Materials (AMAT)

W. W. Grainger (GWW) – dividend king

Lowe’s (LOW) – dividend king

Blackrock (BLK)

Pepsi (PEP) – dividend king

The bottom line is that all companies have risks, but MFC is very good at managing theirs.

How We Monitor MFC’s Risk Profile

“When the facts change, I change my mind. What do you do sir?” – John Maynard Keynes

There are no sacred cows. Wherever the fundamentals lead we always follow. That’s the essence of disciplined financial science, the math retiring rich and staying rich in retirement.

Bottom Line: Manulife Is A 5.2% Yielding Blue-Chip Set To Soar And Too Cheap To Ignore

We live in troubled times.

It’s understandable that many investors, spoiled by an incredible bull market, might be scared right now.

After three years in which the market delivered 25% annual returns, it’s easy to forget that corrections like what we’re living through now are normal, healthy, and beneficial.

“Volatility isn’t risk, it’s the source of future returns.” – Joshua Brown, CEO of Ritholtz Wealth Management

But by focusing on the fundamentals that drive 97% of long-term stock returns, you can sleep well at night no matter what is happening with geopolitics, inflation, the economy, or interest rates.

MFC is one of the world’s safest, most dependable, and highest quality companies

a very safe 5.2% yield = 3.5X the S&P 500’s yield

a thriving Asian business has management forecasting 10% to 12% growth

thanks to a 5% buyback authorization analysts expect 13% growth

MFC’s buyback potential is almost 40% of shares at current valuations through 2024

6.9X forward earnings = anti-bubble price pricing in -3.2% long-term growth

28% discount to fair value = potentially good buy

classic Buffett-style “wonderful company at a wonderful price”

195% consensus total return upside over the next five years = 4.5x the S&P consensus

15% CAGR 5-year risk-adjusted expected return is 3X that of the S&P 500

I can’t tell you when the market will stop declining or reach a new record high.

Morgan Stanley and JPMorgan think the bottom is coming in the next eight to 10 weeks

the bond market thinks stocks might not bottom until February or March…of 2023 and not hit a record high until March or April…of 2024

What I can tell you is that the world’s highest quality high-yield blue-chips are always a safe place for your long-term discretionary savings.

That’s especially true when they are trading at anti-bubble valuations of 6.9X earnings.

All of this means that if you’re looking to make your own luck on Wall Street, Manulife Financial is one of the most reasonable and prudent choices you can make today.

In fact, it’s as close to a perfect high-yield blue-chip opportunity as exists on Wall Street today.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.