Majority of Large P&C Insurers Have Deployed Cloud Computing and Unstructured Data

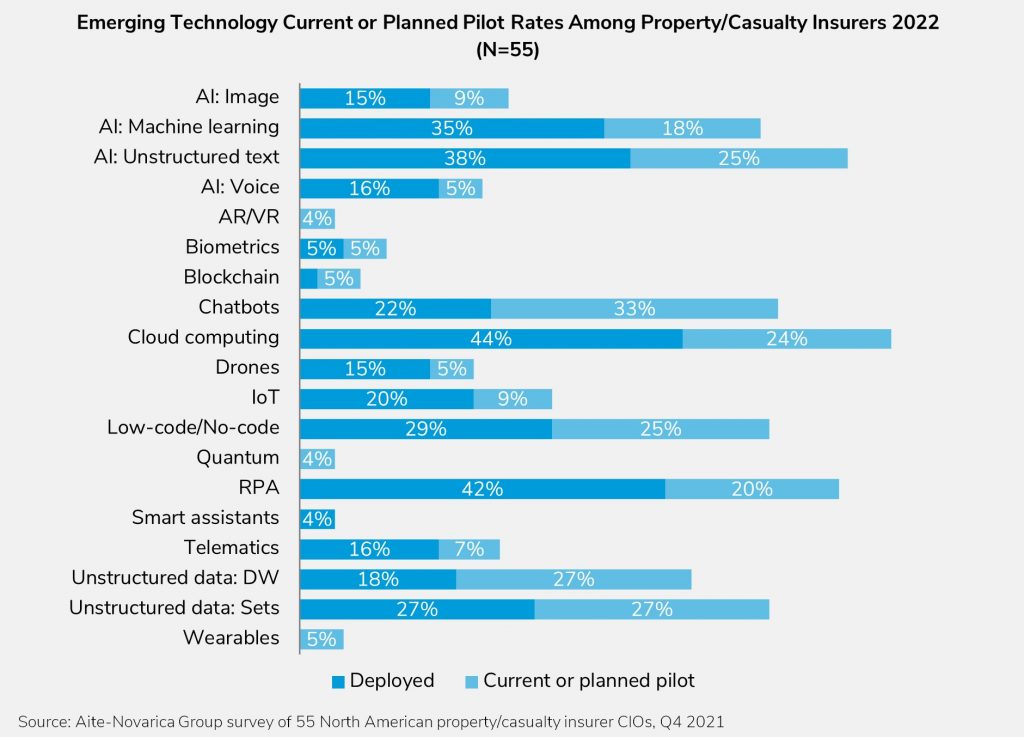

More than half of large Property/Casualty insurers have deployed cloud computing, unstructured data, and another 20% are piloting: Aite-Novarica Group

Annual report on emerging tech adoption analyzes a survey of 55 insurer CIOs across nearly a dozen relatively new technology areas

Boston, MA (Apr. 7, 2022) – Emerging technologies can allow property & casualty insurers to sell more, manage risk better, or improve efficiency, but they can also threaten disaggregation or create new ways of doing business insurers must address. In a new Impact Report, Emerging Technology for P/C Insurers 2022: Artificial Intelligence, Chatbots, Cloud Computing, Unstructured Data, and More, research and advisory firm Aite-Novarica Group analyzes a survey of 55 insurer CIO members of the Aite-Novarica Insurance Technology Research Council to help P&C insurers track adoption rates, planned pilot activity, and use cases across nearly a dozen relatively new technology areas.

“Insurers regularly experiment with emerging technologies to find more efficient and more effective ways of managing information, workflow, and risk,” said Harry Huberty, Head of CIO Research at Aite-Novarica Group. “Carriers should broadly keep in mind that technology can only create value in proportion to how it’s actually used. Workflows, processes, or even products may need to be reconsidered for a new tool to have maximum impact.”

“Solution providers should focus on helping insurer partners rework processes, where necessary, to get the greatest value from a new capability,” adds Martina Conlon, Head of Property and Casualty Insurance at Aite-Novarica Group and contributing author to the new report. “Solution providers must articulate the value of products in terms of the impact they can have, helping insurers to focus on concrete metrics that measure greater sales, productivity, or risk evaluation.”

Click here to access the report.

Report Preview

Emerging Technology for P/C Insurers 2022: Artificial Intelligence, Chatbots, Cloud Computing, Unstructured Data, and More

It’s crucial for insurers to understand the potential applications of innovative technology and have a sense of where their competitors are exploring and investing

Technology is both an enabler and a disruptor in the insurance vertical. Emerging technologies can help insurers to sell more, manage risk better, or improve efficiency, but they can also threaten disaggregation or create new ways of doing business insurers must address.

This Impact Report is designed to help insurers track adoption rates, planned pilot activity, and use cases across nearly a dozen relatively new technology areas. This report is based on a survey of 55 insurer CIO members of the Aite-Novarica Group Insurance Technology Research Council conducted in Q4 2021, representing a broad cross-section of property/casualty insurers. Eighteen participants represented larger insurers with annual written premium greater than US$1 billion, while 37 represented midsize insurers with annual written premium less than US$1 billion.

This 30-page Impact Report contains 19 figures. Clients of Aite-Novarica Group’s Property & Casualty service can download this report and the corresponding charts.

Click here to access the report.

This report mentions Allianz, AXA, and Progressive.

About Aite-Novarica Group

Aite-Novarica Group is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms—as well as the technology and service providers that support them. Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts. For more information, visit aite-novarica.com.

Source: Aite-Novarica Group

Tags: Aite-Novarica Group, Allianz, AXA, Big Data, carriers, Cloud, data, disruption, emerging technologies, natural language processing (NLP), pilot program, Progressive Insurance, Property/Casualty (P&C) insurance